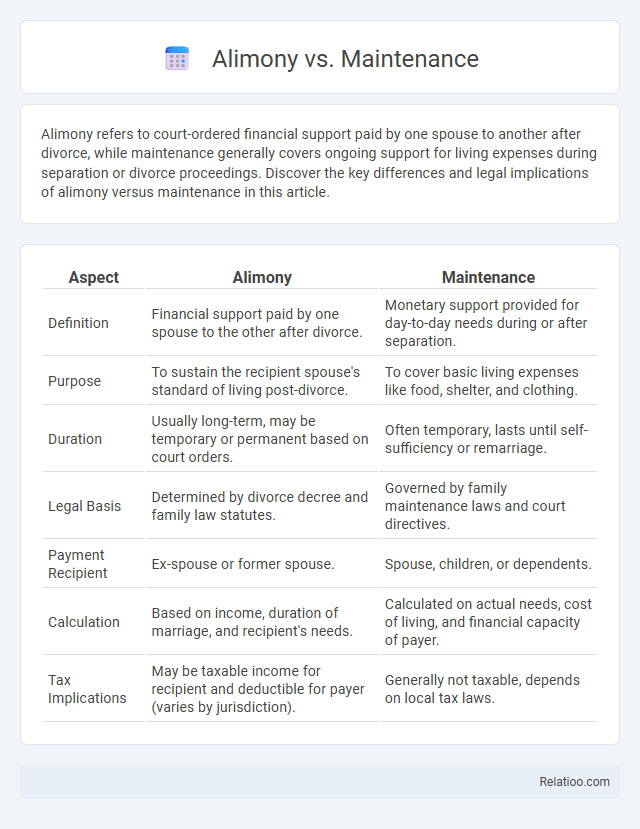

Alimony refers to court-ordered financial support paid by one spouse to another after divorce, while maintenance generally covers ongoing support for living expenses during separation or divorce proceedings. Discover the key differences and legal implications of alimony versus maintenance in this article.

Table of Comparison

| Aspect | Alimony | Maintenance |

|---|---|---|

| Definition | Financial support paid by one spouse to the other after divorce. | Monetary support provided for day-to-day needs during or after separation. |

| Purpose | To sustain the recipient spouse's standard of living post-divorce. | To cover basic living expenses like food, shelter, and clothing. |

| Duration | Usually long-term, may be temporary or permanent based on court orders. | Often temporary, lasts until self-sufficiency or remarriage. |

| Legal Basis | Determined by divorce decree and family law statutes. | Governed by family maintenance laws and court directives. |

| Payment Recipient | Ex-spouse or former spouse. | Spouse, children, or dependents. |

| Calculation | Based on income, duration of marriage, and recipient's needs. | Calculated on actual needs, cost of living, and financial capacity of payer. |

| Tax Implications | May be taxable income for recipient and deductible for payer (varies by jurisdiction). | Generally not taxable, depends on local tax laws. |

Understanding Alimony and Maintenance

Alimony and maintenance both refer to financial support paid from one spouse to another after separation or divorce, but the terms vary by jurisdiction, with "alimony" commonly used in the United States and "maintenance" more frequent in countries like the UK and India. Alimony typically covers long-term or permanent support intended to help the receiving spouse maintain a lifestyle similar to that during the marriage, while maintenance can sometimes indicate temporary financial aid during the divorce process or until remarriage. Understanding the legal definitions, eligibility criteria, and duration in your specific jurisdiction is crucial for navigating alimony and maintenance effectively.

Legal Definitions: Alimony vs Maintenance

Alimony and maintenance both refer to financial support paid to a spouse after separation or divorce, but their legal definitions vary by jurisdiction. Alimony typically denotes court-ordered payments to a former spouse for living expenses, whereas maintenance may include broader support obligations such as temporary or rehabilitative assistance. Understanding the specific legal framework in your area ensures you know your rights and obligations regarding alimony versus maintenance.

Key Differences Between Alimony and Maintenance

Alimony and maintenance both refer to financial support payments made after divorce, but alimony typically denotes spousal support aimed at helping a lower-earning spouse maintain a similar lifestyle, while maintenance can include broader support obligations like child maintenance or temporary funds during separation. Key differences between alimony and maintenance involve duration, purpose, and legal terminology, where alimony tends to be long-term or permanent, and maintenance often covers short-term or specific needs. Understanding these distinctions can help you navigate legal responsibilities and ensure compliance with court-ordered payments.

Eligibility Criteria for Alimony and Maintenance

Eligibility criteria for alimony typically require proof of marriage and financial dependence on the spouse, while maintenance eligibility involves demonstrating the inability to support oneself financially after separation or divorce. You must provide evidence of income disparity, duration of the marriage, and contributions to the household to qualify for alimony, whereas maintenance criteria may focus more on immediate financial need and living expenses. Courts assess factors like age, health, earning capacity, and standard of living to determine the appropriate support type and amount.

Types of Alimony and Maintenance

Types of alimony generally include temporary, rehabilitative, permanent, and reimbursement alimony, each serving distinct purposes such as supporting a spouse during divorce proceedings or enabling financial independence. Maintenance, often used interchangeably with alimony in some jurisdictions, typically refers to periodic payments mandated by the court to support a lower-earning spouse post-divorce or separation. Understanding the specific legal definitions and types within a given jurisdiction is essential, as alimony and maintenance laws vary significantly in terms of duration, amount, and eligibility criteria.

Duration and Termination of Payments

Alimony, maintenance, and spousal support differ primarily in duration and termination conditions based on jurisdiction-specific statutes. Alimony payments often continue until remarriage or death of the recipient, whereas maintenance may have a fixed term subject to review depending on the recipient's financial independence goals. Understanding these distinctions helps you anticipate how long your financial obligations or entitlements might persist after separation or divorce.

Factors Influencing the Court’s Decision

Courts assess factors such as the duration of the marriage, each party's financial resources, earning capacity, and contributions to the household when determining alimony, maintenance, or spousal support. The standard of living established during the marriage, age, health, and the needs of dependent children also significantly influence the court's decision. Jurisdiction-specific laws and precedents further guide the calculation and duration of these monetary awards.

Tax Implications of Alimony and Maintenance

Alimony payments are generally tax-deductible for the payer and considered taxable income for the recipient under U.S. tax law if the divorce or separation agreement was finalized before 2019, while maintenance payments, often used interchangeably with alimony in some jurisdictions, can vary widely in tax treatment depending on the local tax codes. Recent changes in tax legislation, such as the Tax Cuts and Jobs Act of 2017, have eliminated the deductibility of alimony payments for agreements executed after December 31, 2018, causing payers to lose this tax benefit and recipients not to report such payments as income. Understanding the specific legal definitions and tax treatments of alimony and maintenance in your jurisdiction is crucial for accurate tax planning and compliance.

Rights and Obligations of Both Parties

Alimony, maintenance, and spousal support each refer to financial obligations imposed after separation or divorce, ensuring fair economic treatment between parties. Your rights include receiving reasonable support based on income, earning capacity, and duration of the marriage, while your obligations involve timely payments and transparency about financial status. Courts evaluate both parties' needs and abilities, balancing protection for the financially dependent spouse with fairness to the paying party's financial capacity.

Frequently Asked Questions: Alimony vs Maintenance

Alimony and maintenance both refer to financial support paid after divorce, but their terms and legal implications vary by jurisdiction. Alimony typically refers to spousal support aimed at helping the lower-earning spouse maintain a reasonable standard of living, while maintenance can encompass broader aspects including temporary financial assistance during separation. Understanding your rights and obligations under either alimony or maintenance is crucial for ensuring fair and legally compliant support arrangements.

Infographic: Alimony vs Maintenance

relatioo.com

relatioo.com