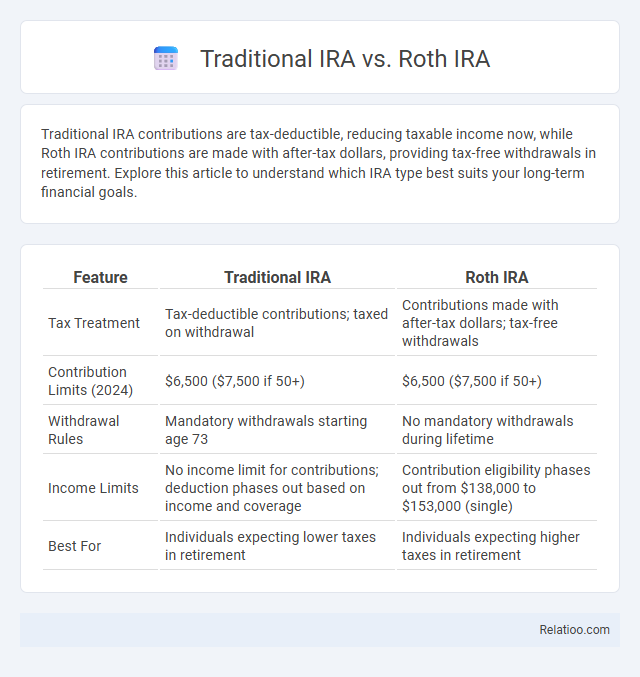

Traditional IRA contributions are tax-deductible, reducing taxable income now, while Roth IRA contributions are made with after-tax dollars, providing tax-free withdrawals in retirement. Explore this article to understand which IRA type best suits your long-term financial goals.

Table of Comparison

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax Treatment | Tax-deductible contributions; taxed on withdrawal | Contributions made with after-tax dollars; tax-free withdrawals |

| Contribution Limits (2024) | $6,500 ($7,500 if 50+) | $6,500 ($7,500 if 50+) |

| Withdrawal Rules | Mandatory withdrawals starting age 73 | No mandatory withdrawals during lifetime |

| Income Limits | No income limit for contributions; deduction phases out based on income and coverage | Contribution eligibility phases out from $138,000 to $153,000 (single) |

| Best For | Individuals expecting lower taxes in retirement | Individuals expecting higher taxes in retirement |

Introduction to Traditional IRA and Roth IRA

Traditional IRA and Roth IRA are two popular retirement savings options with distinct tax advantages and eligibility requirements. A Traditional IRA offers tax-deductible contributions and tax-deferred growth, meaning you pay taxes upon withdrawal, typically during retirement. Your choice between these accounts depends on your current income, tax bracket, and long-term financial goals within the framework of effective financial management.

Key Differences Between Traditional IRA and Roth IRA

Traditional IRA contributions are tax-deductible, reducing your taxable income now, while Roth IRA contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement. Traditional IRAs require minimum distributions starting at age 73, whereas Roth IRAs have no required minimum distributions, providing more flexibility for your retirement planning. Understanding these key differences helps you optimize your financial management strategy based on your current tax situation and future income expectations.

Eligibility Requirements

Traditional IRA eligibility requires you to have earned income and be under age 73 to make contributions, with tax-deductible options depending on your participation in an employer-sponsored retirement plan. Roth IRA eligibility mandates earned income below specified limits, with contributions made post-tax and no age restriction, allowing for tax-free withdrawals under qualifying conditions. Effective financial management involves assessing your income, tax bracket, and retirement goals to determine which IRA type aligns best with your eligibility and long-term savings strategy.

Contribution Limits and Rules

Traditional IRA and Roth IRA both have contribution limits set by the IRS, currently $6,500 annually for individuals under 50, and $7,500 for those 50 and older. Traditional IRA contributions may be tax-deductible depending on your income and participation in a workplace retirement plan, while Roth IRA contributions are made with after-tax dollars but offer tax-free withdrawals in retirement. Effective financial management requires understanding these rules to optimize your retirement savings and maximize tax advantages.

Tax Benefits and Implications

Traditional IRAs offer tax-deferred growth with contributions often tax-deductible, reducing taxable income in the contribution year, but withdrawals during retirement are taxed as ordinary income. Roth IRAs provide tax-free growth and tax-exempt withdrawals in retirement, with contributions made after-tax, offering long-term tax advantages especially for those expecting higher future tax rates. Effective financial management involves balancing current tax deductions from Traditional IRAs against the tax-free income potential of Roth IRAs, optimizing retirement savings based on individual tax brackets and projected income.

Withdrawal Rules and Penalties

Traditional IRAs require withdrawals to begin at age 73 with required minimum distributions, and early withdrawals before age 59 1/2 typically incur a 10% penalty plus income tax. Roth IRAs allow tax-free withdrawals of contributions at any time, but earnings withdrawn before age 59 1/2 and before the account is five years old face a 10% penalty and taxes. Effective financial management involves selecting the IRA type aligned with your tax situation and retirement timeline to minimize withdrawal penalties and maximize tax advantages.

Required Minimum Distributions (RMDs)

Traditional IRAs require you to take Required Minimum Distributions (RMDs) starting at age 73, ensuring taxable income is recognized during retirement. Roth IRAs do not mandate RMDs during your lifetime, allowing your investments to grow tax-free and providing greater control over your retirement funds. Effective financial management involves balancing RMD obligations with tax planning to optimize your retirement savings and income strategy.

Choosing the Right IRA for Your Financial Goals

Selecting the right IRA--Traditional or Roth--depends on your current tax bracket, retirement timeline, and expected future income. Traditional IRAs offer tax-deductible contributions and tax-deferred growth, ideal for those seeking immediate tax relief and anticipating lower taxes in retirement. Roth IRAs provide tax-free withdrawals and no required minimum distributions, benefiting individuals who expect higher future tax rates and desire more flexible financial management in retirement.

Pros and Cons of Traditional IRA vs Roth IRA

Traditional IRAs offer tax-deductible contributions and tax-deferred growth, making them ideal for individuals seeking immediate tax relief and expecting lower income during retirement. Roth IRAs provide tax-free growth and tax-free withdrawals, advantageous for younger investors or those anticipating higher tax rates in retirement, but contributions are made with after-tax dollars and are not tax-deductible. Effective financial management involves balancing contribution limits, withdrawal rules, and tax implications to optimize retirement savings based on individual income, tax brackets, and future cash flow needs.

Common Mistakes to Avoid When Choosing an IRA

Choosing between a Traditional IRA and a Roth IRA requires careful evaluation of tax implications and future income expectations to avoid costly mistakes. Many investors overlook contribution limits and withdrawal rules, which can lead to penalties and reduced growth potential in Your retirement savings. Proper financial management involves understanding these nuances and aligning Your IRA choice with long-term goals and current tax brackets for optimal benefits.

Infographic: Traditional IRA vs Roth IRA

relatioo.com

relatioo.com