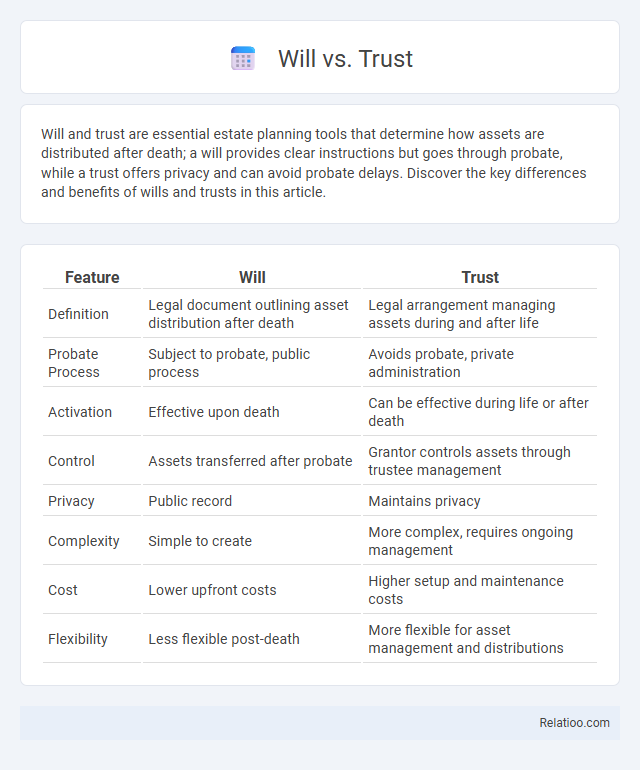

Will and trust are essential estate planning tools that determine how assets are distributed after death; a will provides clear instructions but goes through probate, while a trust offers privacy and can avoid probate delays. Discover the key differences and benefits of wills and trusts in this article.

Table of Comparison

| Feature | Will | Trust |

|---|---|---|

| Definition | Legal document outlining asset distribution after death | Legal arrangement managing assets during and after life |

| Probate Process | Subject to probate, public process | Avoids probate, private administration |

| Activation | Effective upon death | Can be effective during life or after death |

| Control | Assets transferred after probate | Grantor controls assets through trustee management |

| Privacy | Public record | Maintains privacy |

| Complexity | Simple to create | More complex, requires ongoing management |

| Cost | Lower upfront costs | Higher setup and maintenance costs |

| Flexibility | Less flexible post-death | More flexible for asset management and distributions |

Understanding Wills and Trusts: Key Differences

A will outlines how your assets will be distributed after your death and requires probate, while a trust can manage your assets both during your lifetime and after, avoiding probate. Trusts offer more privacy and flexibility in handling your estate, whereas wills are public documents subject to court approval. Understanding these key differences helps you choose the right tool to protect your legacy and ensure your wishes are honored.

What Is a Will?

A will is a legal document that outlines how Your assets and property will be distributed after your death, providing clarity and direction to your beneficiaries. It allows you to appoint guardians for minor children and specify instructions for debt repayment, making it a crucial element in estate planning. Unlike trusts, a will goes into effect only after probate, which can impact the speed and privacy of asset distribution.

What Is a Trust?

A trust is a legal arrangement where one party, the trustee, holds and manages assets on behalf of another, the beneficiary, according to the terms set by the grantor. Trusts offer greater control over asset distribution, often avoiding probate and providing privacy compared to wills. Understanding how a trust can protect your legacy ensures your estate is managed efficiently and aligned with your financial goals.

Benefits of Having a Will

A will provides clear instructions on how your assets will be distributed, ensuring your wishes are honored and reducing potential family disputes. It allows you to appoint guardians for minor children and specify funeral arrangements, offering peace of mind. By creating a will, you protect your legacy and give your loved ones a smoother transition during difficult times.

Advantages of Setting Up a Trust

Setting up a trust provides advantages such as avoiding probate, which speeds up asset distribution and maintains privacy compared to a will. Trusts offer greater control over when and how beneficiaries receive assets, allowing for specific conditions and protections against creditors. They can also reduce estate taxes and provide long-term financial management, ensuring the legacy is preserved according to precise wishes.

Will vs Trust: Which One Do You Need?

A will outlines how your assets will be distributed after death and is simple to create but requires probate, which can be time-consuming and public. A trust offers greater control over asset distribution, avoids probate, and provides privacy, making it ideal for managing assets during your lifetime and after death. Choosing between a will and a trust depends on factors like estate size, privacy concerns, and the complexity of your financial situation.

Common Misconceptions About Wills and Trusts

Many people mistakenly believe that wills and trusts serve the same purpose, but wills only take effect after death and require probate, whereas trusts can avoid probate and provide ongoing asset management. Another common misconception is that trusts are exclusively for the wealthy, while in reality, they can benefit individuals regardless of net worth by offering greater control and privacy. Understanding these differences is crucial for effective estate planning and ensuring a clear legacy is established.

How to Choose Between a Will and a Trust

Choosing between a will and a trust depends on factors such as asset complexity, privacy concerns, and probate avoidance. Trusts provide greater control over asset distribution, help bypass probate, and offer privacy since they do not become public record. Wills are simpler to create but must go through probate, which can be time-consuming and public, making trusts preferable for protecting inheritance and managing estates efficiently.

Steps to Create a Will or Trust

Creating a will or trust involves clearly identifying your assets and beneficiaries to ensure your wishes are honored. You should consult with an estate planning attorney to draft documents that comply with state laws and reflect your specific goals. After drafting, your documents must be signed and witnessed properly, followed by securely storing them and informing trusted individuals of their location.

Frequently Asked Questions: Will vs Trust

A will is a legal document that distributes assets after death, going through probate court, while a trust allows assets to transfer directly to beneficiaries without probate, offering privacy and faster access. Trusts can be revocable or irrevocable, providing varying degrees of control, asset protection, and tax planning advantages compared to a will. Choosing between a will and a trust depends on individual estate size, complexity, and goals for privacy, probate avoidance, and ongoing management of assets.

Infographic: Will vs Trust

relatioo.com

relatioo.com