Probate assets are those that require court supervision for transfer after death, including properties solely in the decedent's name, while non-probate assets bypass probate through mechanisms like joint ownership, life insurance, and trusts. Understanding the distinctions between probate and non-probate assets is crucial for effective estate planning; explore this article to learn more.

Table of Comparison

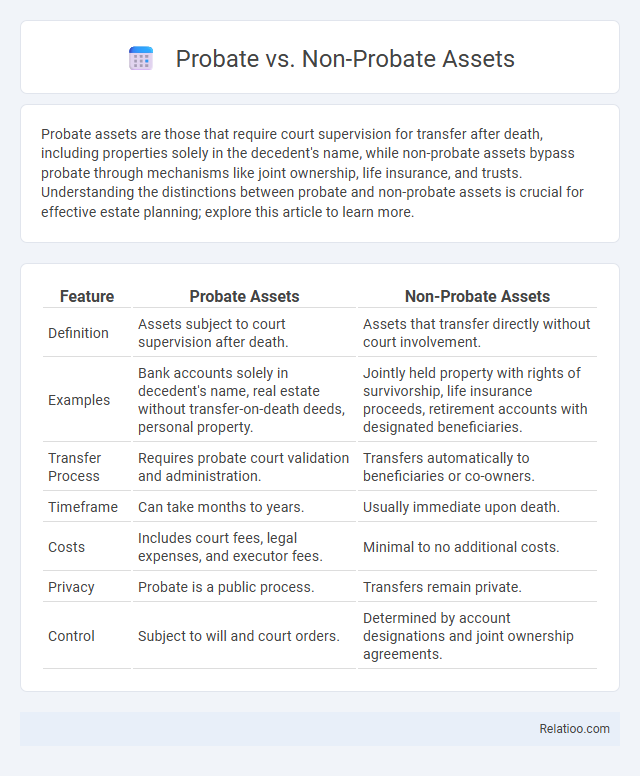

| Feature | Probate Assets | Non-Probate Assets |

|---|---|---|

| Definition | Assets subject to court supervision after death. | Assets that transfer directly without court involvement. |

| Examples | Bank accounts solely in decedent's name, real estate without transfer-on-death deeds, personal property. | Jointly held property with rights of survivorship, life insurance proceeds, retirement accounts with designated beneficiaries. |

| Transfer Process | Requires probate court validation and administration. | Transfers automatically to beneficiaries or co-owners. |

| Timeframe | Can take months to years. | Usually immediate upon death. |

| Costs | Includes court fees, legal expenses, and executor fees. | Minimal to no additional costs. |

| Privacy | Probate is a public process. | Transfers remain private. |

| Control | Subject to will and court orders. | Determined by account designations and joint ownership agreements. |

Understanding Probate vs Non-Probate Assets

Probate assets include property solely owned by you that must go through the legal process of probate to transfer ownership after your death, ensuring debts and taxes are settled. Non-probate assets bypass this process and transfer directly to beneficiaries via mechanisms like joint ownership, beneficiary designations, or trusts, providing quicker access and privacy. Understanding the distinction between probate and non-probate assets helps you plan your legacy efficiently, minimizing delays and legal complexities for your heirs.

Defining Probate Assets: What’s Included

Probate assets include property solely owned by you at the time of your death that requires court supervision to transfer ownership, such as real estate, personal possessions, and bank accounts without designated beneficiaries. These assets differ from non-probate assets, which pass directly to heirs via beneficiary designations or joint ownership and avoid the probate process. Understanding probate assets is crucial for efficient estate planning and ensuring your legacy is preserved according to your wishes.

What Qualifies as Non-Probate Assets

Non-probate assets qualify by passing directly to beneficiaries without court intervention upon death, including jointly held property with right of survivorship, payable-on-death bank accounts, life insurance policies with designated beneficiaries, and retirement accounts like IRAs or 401(k)s. These assets bypass the probate process, enabling faster access and distribution to heirs. Understanding non-probate assets is essential for estate planning to minimize probate delays and costs, ensuring a smoother transfer aligned with the decedent's wishes.

The Probate Process Explained

The probate process involves the legal validation and administration of a deceased person's will, ensuring debts and taxes are paid before distributing probate assets under court supervision. Non-probate assets, such as jointly held property, life insurance, or retirement accounts with designated beneficiaries, bypass probate, allowing direct transfer to heirs without court intervention. Understanding the distinction between probate and non-probate assets is critical when planning a legacy, as probate assets face potential delays and costs, while non-probate assets offer a quicker, private transfer to beneficiaries.

How Non-Probate Assets Bypass Probate

Non-probate assets, including jointly held property, life insurance policies, retirement accounts, and payable-on-death accounts, bypass probate because they transfer directly to named beneficiaries or co-owners upon death. Probate assets, conversely, must go through court administration to validate the will and distribute the estate. Understanding the role of non-probate assets can help you efficiently manage your legacy and reduce probate time and costs.

Common Examples of Probate Assets

Common examples of probate assets include real estate solely owned by the deceased, bank accounts without designated beneficiaries, personal property, and vehicles titled in the deceased's name. Non-probate assets bypass the probate process and often consist of jointly owned property, assets held in a trust, retirement accounts, and payable-on-death (POD) or transfer-on-death (TOD) accounts. Understanding the distinction helps you plan your estate effectively by clarifying which assets will go through probate and which will transfer directly to your heirs as part of your legacy.

Typical Non-Probate Asset Types

Typical non-probate asset types include jointly owned property with rights of survivorship, payable-on-death (POD) and transfer-on-death (TOD) accounts, life insurance policies with named beneficiaries, and retirement accounts like IRAs and 401(k)s. These assets bypass the probate process, allowing for direct transfer to beneficiaries upon the owner's death. Understanding non-probate asset types helps in effective estate planning and legacy preservation, ensuring assets are distributed according to the owner's wishes without court intervention.

Impact on Estate Distribution

Probate assets go through a court-supervised process that can delay estate distribution, affecting how quickly Your heirs receive their inheritance. Non-probate assets bypass probate, allowing for a faster and often more private transfer directly to beneficiaries, which can reduce administrative costs and minimize disputes. Legacy planning involves strategically managing both probate and non-probate assets to ensure Your estate is distributed according to Your wishes while maximizing benefits for future generations.

Avoiding Common Probate Pitfalls

Understanding the differences between probate and non-probate assets is crucial for avoiding common probate pitfalls that can delay your estate distribution. Non-probate assets, such as jointly held property and accounts with designated beneficiaries, bypass probate, helping you ensure a smoother transfer of your legacy to heirs. Properly organizing your estate to maximize non-probate transfers reduces legal expenses and preserves your assets' value for your beneficiaries.

Planning Strategies for Probate and Non-Probate Assets

Effective planning strategies for probate and non-probate assets involve clearly distinguishing between the two to minimize legal complexities and expedite estate distribution. Probate assets, such as individually owned real estate and bank accounts without designated beneficiaries, often require formal court administration, making it essential to utilize tools like wills, trusts, and payable-on-death designations to streamline transfer processes. Non-probate assets, including jointly owned property with rights of survivorship, life insurance policies, and retirement accounts with named beneficiaries, bypass probate and can be strategically managed through beneficiary designations and joint ownership arrangements to ensure seamless legacy transfer and reduce estate taxes.

Infographic: Probate vs Non-Probate Assets

relatioo.com

relatioo.com