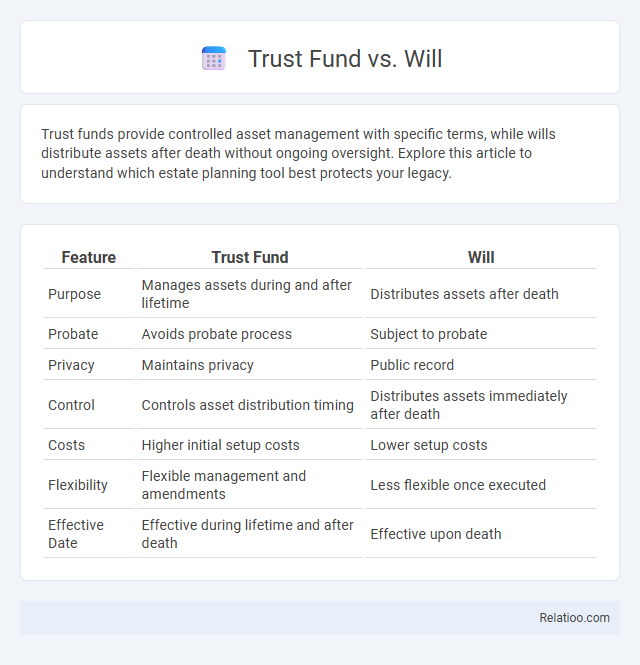

Trust funds provide controlled asset management with specific terms, while wills distribute assets after death without ongoing oversight. Explore this article to understand which estate planning tool best protects your legacy.

Table of Comparison

| Feature | Trust Fund | Will |

|---|---|---|

| Purpose | Manages assets during and after lifetime | Distributes assets after death |

| Probate | Avoids probate process | Subject to probate |

| Privacy | Maintains privacy | Public record |

| Control | Controls asset distribution timing | Distributes assets immediately after death |

| Costs | Higher initial setup costs | Lower setup costs |

| Flexibility | Flexible management and amendments | Less flexible once executed |

| Effective Date | Effective during lifetime and after death | Effective upon death |

Introduction to Trust Funds and Wills

Trust funds provide a structured way to manage and distribute assets, offering control over how and when your beneficiaries receive their inheritance, which is especially valuable in blended family situations. Wills are legal documents outlining your wishes for asset distribution after death but generally require probate, potentially causing delays and public exposure. Understanding the fundamental differences helps you decide the best approach to protect Your family's financial future.

Defining a Trust Fund

A trust fund is a legal arrangement where assets are held by a trustee for the benefit of designated beneficiaries, providing control over the distribution of inheritance and potentially minimizing estate taxes. Unlike a will, a trust fund can avoid probate, ensuring privacy and faster access to assets, which is particularly beneficial in blended families with complex financial and familial relationships. Structuring a trust fund carefully helps protect the interests of stepchildren and second spouses while maintaining clear guidelines for asset management and distribution.

Understanding How a Will Works

A will is a legal document that specifies how a person's assets and estate will be distributed after their death, providing clear instructions to executors and reducing potential disputes among heirs. Unlike a trust fund, which can manage and distribute assets during and after a person's lifetime, a will only takes effect upon death and must go through probate, potentially prolonging the process. In blended families, a will is crucial for ensuring that assets are allocated according to the deceased's intentions, helping protect the rights of stepchildren and spouses while addressing complex family dynamics.

Key Differences Between Trust Funds and Wills

Trust funds provide ongoing management and control of assets, allowing for specific terms and conditions to be set for beneficiaries, while wills distribute assets outright after probate. Trusts avoid probate, offering privacy and faster access to assets, whereas wills become public records and may involve lengthy court procedures. Blended families require careful estate planning, where trusts can protect stepchildren's interests and manage asset distribution more flexibly compared to wills.

Advantages of Setting Up a Trust Fund

Setting up a trust fund offers significant advantages over relying solely on a will, such as avoiding probate, ensuring privacy, and providing greater control over asset distribution tailored to your blended family's unique needs. Trust funds can protect assets from creditors, reduce estate taxes, and enable you to specify conditions for inheritance, benefiting your spouse and children from previous relationships. By using a trust, you can safeguard your legacy and minimize conflicts among beneficiaries in your blended family.

Benefits of Creating a Will

Creating a will ensures your assets are distributed according to your wishes, providing clear legal guidance that prevents disputes among heirs in a blended family. A will allows you to appoint guardians for minor children, protect their financial future, and address complex family dynamics more effectively than a trust alone. You gain control over how your estate is managed and can minimize delays during probate, safeguarding your blended family's interests with personalized directives.

Trust Funds vs Wills: Estate Planning Considerations

Trust funds provide a controlled and often tax-efficient way to manage and distribute assets, offering privacy and protection from probate, whereas wills are simpler documents that dictate asset distribution but must go through probate, making the process public and potentially lengthy. For blended families, trust funds can ensure specific assets are preserved for biological children while providing for a spouse, addressing the complexities that wills may not fully resolve. You should evaluate how each option aligns with your estate planning goals, asset types, and family dynamics to create a comprehensive plan.

Probate Process: Trust Fund vs Will

The probate process for a trust fund bypasses court involvement, allowing Your assets to transfer directly to beneficiaries with greater privacy and efficiency. In contrast, a will must go through probate, which can be time-consuming, costly, and public, potentially delaying asset distribution. For blended families, trust funds can simplify complex inheritance situations by avoiding probate disputes and ensuring clear management of diverse family interests.

Common Situations for Choosing a Trust Fund or Will

Common situations for choosing a trust fund over a will include managing assets for minor children, providing for beneficiaries with special needs, or avoiding probate to ensure privacy and quicker distribution. Wills are typically preferred for straightforward estate plans, naming guardians, or when you want a simpler, cost-effective solution. Your decision should consider family dynamics, complexity of assets, and long-term control over inheritance, especially in blended family scenarios.

Which is Better: Trust Fund or Will?

Choosing between a trust fund and a will depends on your family's specific needs and financial goals. A trust fund offers greater control over asset distribution, avoids probate, and provides privacy, making it advantageous for blended families managing complex inheritances. Your decision should weigh the cost, flexibility, and legal protections each option offers to ensure your estate plan effectively supports your loved ones.

Infographic: Trust Fund vs Will

relatioo.com

relatioo.com