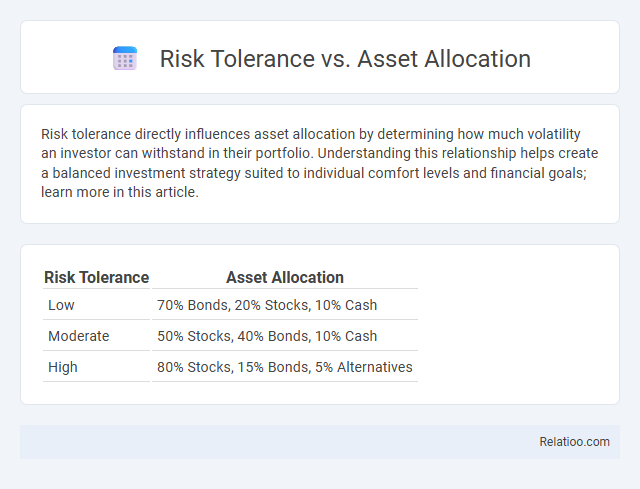

Risk tolerance directly influences asset allocation by determining how much volatility an investor can withstand in their portfolio. Understanding this relationship helps create a balanced investment strategy suited to individual comfort levels and financial goals; learn more in this article.

Table of Comparison

| Risk Tolerance | Asset Allocation |

|---|---|

| Low | 70% Bonds, 20% Stocks, 10% Cash |

| Moderate | 50% Stocks, 40% Bonds, 10% Cash |

| High | 80% Stocks, 15% Bonds, 5% Alternatives |

Understanding Risk Tolerance: Definition and Importance

Risk tolerance defines your ability and willingness to endure market fluctuations and potential losses while pursuing investment goals. Understanding risk tolerance is crucial for creating an asset allocation strategy that balances growth potential with your comfort level during market volatility. Properly aligning your risk tolerance with asset allocation helps optimize portfolio performance and reduces the likelihood of emotional decision-making in turbulent markets.

What is Asset Allocation? Key Concepts

Asset allocation refers to the strategic distribution of investments across various asset classes such as stocks, bonds, and cash to balance risk and reward based on an investor's goals and time horizon. It aims to optimize portfolio performance by diversifying assets, reducing volatility, and managing risk tolerance levels. Key concepts include diversification, rebalancing, and aligning asset allocation with individual risk tolerance to achieve financial objectives.

Relationship Between Risk Tolerance and Asset Allocation

Risk tolerance significantly influences asset allocation by determining the proportion of equities, bonds, and cash an investor includes in their portfolio to balance potential returns with acceptable levels of risk. Investors with high risk tolerance tend to allocate more assets to volatile stocks for growth, while conservative investors prefer a higher share of bonds and cash to preserve capital. Understanding this relationship enables tailored investment strategies that align portfolio construction with individual risk preferences and financial goals.

Factors Influencing Individual Risk Tolerance

Factors influencing individual risk tolerance include age, income, investment goals, and psychological comfort with uncertainty, which directly impact your asset allocation strategy. Higher risk tolerance often leads to a greater proportion of equities, while lower tolerance favors bonds and cash equivalents to preserve capital. Understanding these factors ensures your portfolio aligns with personal financial objectives and your willingness to withstand market fluctuations.

Types of Asset Allocation Strategies

Types of asset allocation strategies include strategic, tactical, and dynamic allocation, each varying in risk exposure and investment horizon alignment. Strategic asset allocation targets a fixed mix of asset classes based on the investor's long-term risk tolerance and goals, while tactical allocation allows for short-term adjustments to capitalize on market opportunities. Dynamic allocation continuously adjusts the portfolio in response to changing risk tolerance levels and market conditions, balancing risk and return more actively.

Assessing Your Risk Profile: Practical Methods

Assessing your risk profile involves evaluating your financial goals, investment time horizon, and emotional capacity to endure market fluctuations. Practical methods include using risk tolerance questionnaires, consulting with financial advisors, and analyzing past investment behavior to align asset allocation strategies with your comfort level. This comprehensive approach ensures your portfolio balance matches your unique risk tolerance and investment objectives.

Aligning Investment Goals with Asset Allocation

Aligning Your investment goals with asset allocation requires a clear understanding of Your risk tolerance to build a balanced portfolio that maximizes returns while minimizing potential losses. Asset allocation involves distributing investments among asset classes such as stocks, bonds, and cash, tailored to match Your comfort level with market fluctuations. Proper alignment ensures that Your portfolio supports long-term financial objectives while managing risk effectively.

Common Mistakes in Matching Risk Tolerance and Investments

Common mistakes in matching risk tolerance with asset allocation include overestimating one's comfort with market volatility, leading to an investment portfolio that is too aggressive. Investors often confuse emotional risk tolerance with financial capacity, resulting in asset allocations that either expose them to unnecessary losses or hinder potential growth. Proper alignment requires comprehensive risk assessment tools and periodic portfolio reviews to ensure investments remain consistent with evolving risk tolerance levels.

Adjusting Asset Allocation as Risk Tolerance Changes

Adjusting asset allocation as risk tolerance changes is crucial for maintaining a balanced investment strategy tailored to your evolving financial goals. When your risk tolerance decreases, shifting towards more conservative assets like bonds or dividend-paying stocks helps protect your portfolio from volatility. Conversely, increasing exposure to equities can capitalize on higher returns when your risk tolerance grows, ensuring alignment with your comfort level and investment horizon.

Building a Resilient Portfolio: Balancing Risk and Return

Balancing risk tolerance and asset allocation is crucial for building a resilient portfolio that can withstand market fluctuations while pursuing your financial goals. Your risk tolerance determines the proportion of equities, bonds, and alternative investments to include, optimizing the trade-off between potential returns and acceptable losses. A well-structured asset allocation aligned with your risk capacity ensures consistent growth and minimizes portfolio volatility over time.

Infographic: Risk Tolerance vs Asset Allocation

relatioo.com

relatioo.com