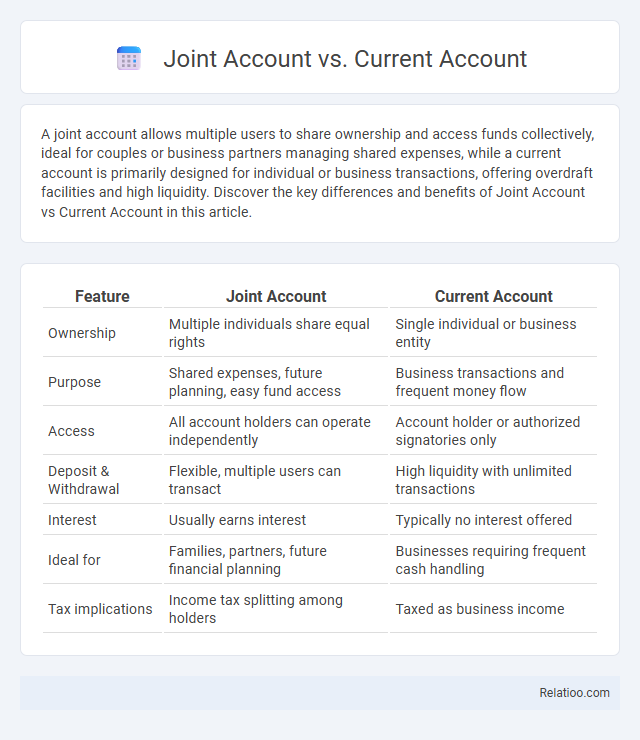

A joint account allows multiple users to share ownership and access funds collectively, ideal for couples or business partners managing shared expenses, while a current account is primarily designed for individual or business transactions, offering overdraft facilities and high liquidity. Discover the key differences and benefits of Joint Account vs Current Account in this article.

Table of Comparison

| Feature | Joint Account | Current Account |

|---|---|---|

| Ownership | Multiple individuals share equal rights | Single individual or business entity |

| Purpose | Shared expenses, future planning, easy fund access | Business transactions and frequent money flow |

| Access | All account holders can operate independently | Account holder or authorized signatories only |

| Deposit & Withdrawal | Flexible, multiple users can transact | High liquidity with unlimited transactions |

| Interest | Usually earns interest | Typically no interest offered |

| Ideal for | Families, partners, future financial planning | Businesses requiring frequent cash handling |

| Tax implications | Income tax splitting among holders | Taxed as business income |

Introduction to Joint and Current Accounts

Joint accounts allow two or more individuals to share ownership, typically used by couples or business partners to manage shared finances with equal access to deposits and withdrawals. Current accounts, primarily designed for frequent transactions, offer unlimited withdrawals, overdraft facilities, and are ideal for businesses or individuals requiring regular access to funds. Understanding the differences helps choose the right account type based on ownership structure and transactional needs.

Definition of Joint Account

A Joint Account is a bank account shared by two or more individuals, allowing each to deposit, withdraw, and manage funds collectively. Unlike a Current Account, which is designed primarily for frequent business transactions and operated individually, a Joint Account provides shared access and responsibility among account holders. Your financial flexibility increases with a Joint Account, making it ideal for couples, business partners, or family members managing shared expenses.

Definition of Current Account

A Current Account is a type of bank account primarily used by businesses and professionals for frequent transactions, allowing unlimited deposits and withdrawals without restrictions. Unlike Joint Accounts, which are held by two or more individuals sharing ownership and access, a Current Account is usually held by a single entity and offers features tailored for managing day-to-day operational finances with overdraft facilities. Understanding the distinct purpose and functionality of Your Current Account helps optimize cash flow management and meet specific financial needs efficiently.

Key Features of Joint Accounts

Joint accounts allow two or more individuals to share ownership and access, providing mutual control over deposits and withdrawals. Key features include shared liability for overdrafts, the ability to track shared expenses, and easy fund transfer between account holders. Unlike current accounts, joint accounts often facilitate combined financial management for couples or business partners.

Key Features of Current Accounts

Current accounts offer high liquidity with unlimited transactions, ideal for businesses and individuals requiring frequent access to funds. Unlike joint accounts, which are shared by two or more holders, current accounts can be individual or joint and often provide overdraft facilities and cheque book options. Your current account enables efficient cash management and seamless payments, making it essential for daily financial operations.

Advantages of Joint Accounts

Joint accounts offer shared access and management, making them ideal for couples, business partners, or family members who want to pool resources and track expenses collaboratively. Unlike current accounts, which are typically held by single individuals or businesses for frequent transactions, joint accounts enhance transparency and convenience by allowing multiple authorized users to conduct deposits, withdrawals, and payments. The key advantages include improved financial coordination, easier bill payments, and streamlined money management across joint ventures or household finances.

Advantages of Current Accounts

Current accounts offer high liquidity, allowing you to manage frequent transactions such as deposits, withdrawals, and bill payments seamlessly. They provide overdraft facilities and multiple checkbook services, enhancing cash flow flexibility for businesses and individuals. Unlike joint accounts, current accounts primarily serve transactional needs with no limits on the number of transactions, ensuring smooth day-to-day financial operations.

Joint Account vs Current Account: Major Differences

A joint account is a bank account shared by two or more individuals, allowing multiple parties equal access to funds, commonly used by couples, business partners, or family members. Current accounts are typically business accounts designed for frequent transactions, offering features like overdraft facilities and unlimited deposits and withdrawals. The major differences lie in ownership structure and usage: joint accounts emphasize shared ownership and access for personal or group funds management, while current accounts focus on transactional efficiency and liquidity for business operations.

Choosing the Right Account for Your Needs

Choosing the right account depends on your financial goals and transaction needs. A joint account allows multiple users to share access and management of funds, ideal for couples or business partners, while a current account offers unlimited transactions and overdraft facilities tailored for daily business operations. Evaluate your need for shared control, transaction volume, and overdraft options to determine whether a joint or current account best suits your financial activities.

Conclusion: Which Account is Best for You?

Choosing between a Joint Account, Current Account, or Savings Account depends on your financial goals and usage patterns. A Joint Account is ideal for shared expenses and managing household finances with transparency, while a Current Account suits businesses needing frequent transactions and unlimited withdrawals. Assessing your need for collaboration, transaction frequency, and fund accessibility will help determine the best account for your financial management.

Infographic: Joint Account vs Current Account

relatioo.com

relatioo.com