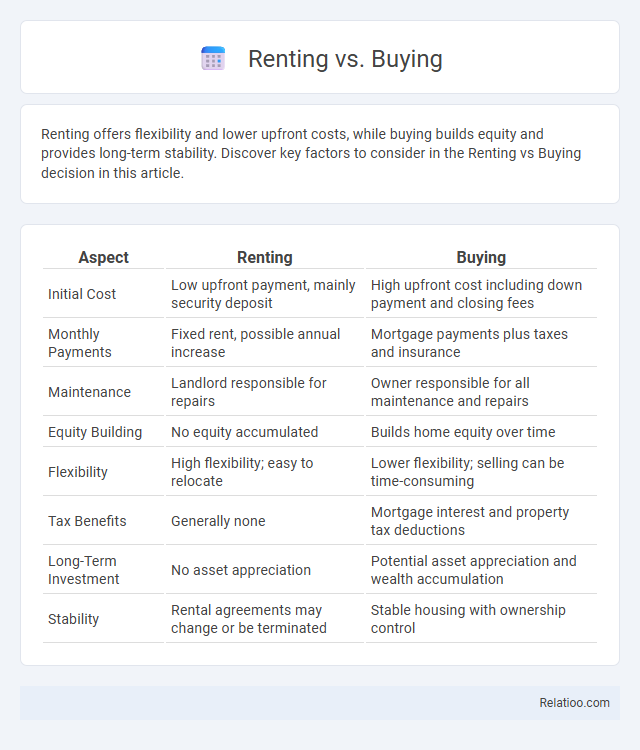

Renting offers flexibility and lower upfront costs, while buying builds equity and provides long-term stability. Discover key factors to consider in the Renting vs Buying decision in this article.

Table of Comparison

| Aspect | Renting | Buying |

|---|---|---|

| Initial Cost | Low upfront payment, mainly security deposit | High upfront cost including down payment and closing fees |

| Monthly Payments | Fixed rent, possible annual increase | Mortgage payments plus taxes and insurance |

| Maintenance | Landlord responsible for repairs | Owner responsible for all maintenance and repairs |

| Equity Building | No equity accumulated | Builds home equity over time |

| Flexibility | High flexibility; easy to relocate | Lower flexibility; selling can be time-consuming |

| Tax Benefits | Generally none | Mortgage interest and property tax deductions |

| Long-Term Investment | No asset appreciation | Potential asset appreciation and wealth accumulation |

| Stability | Rental agreements may change or be terminated | Stable housing with ownership control |

Introduction: Understanding Renting vs Buying

Renting offers flexibility with lower upfront costs and limited maintenance responsibilities, making it ideal for short-term stays or uncertain financial situations. Buying a home requires significant investment, including down payments and mortgage commitments, but builds equity and provides long-term stability. Homeownership combines the benefits of property appreciation and personalized living spaces, contributing to wealth accumulation over time.

Financial Considerations: Upfront and Long-term Costs

Renting involves lower upfront costs, typically requiring only a security deposit and monthly rent payments, while buying a home demands a significant down payment, closing costs, and ongoing expenses like property taxes and maintenance. Homeownership builds equity over time, potentially leading to long-term financial benefits through property appreciation and tax deductions on mortgage interest. Renters avoid repair costs and market risks but miss out on equity growth, making financial goals and market conditions crucial factors in deciding between renting and buying.

Flexibility and Mobility: Lifestyle Impacts

Renting offers the highest flexibility and mobility, allowing individuals to easily relocate for job opportunities or lifestyle changes without the burden of selling property. Buying a home provides stability and long-term investment benefits, but limits relocation options due to the time and costs associated with selling. Homeownership impacts lifestyle by fostering community ties and personalizing living spaces, while renters prioritize adaptability and short-term commitments.

Building Equity: Wealth Creation Potential

Building equity through homeownership is a crucial factor in long-term wealth creation, as monthly mortgage payments increase ownership stake in the property, unlike rent payments that provide no return on investment. Buying a home allows individuals to accumulate tangible assets, leveraging property appreciation to build net worth over time. Renting offers flexibility but lacks the opportunity to build equity, making homeownership a preferred strategy for wealth accumulation in stable real estate markets.

Maintenance and Responsibilities

Renting typically transfers maintenance responsibilities to the landlord, reducing the tenant's financial and time commitments for repairs and upkeep. Buying a home involves direct responsibility for all maintenance costs, including unexpected repairs, which can range from routine tasks like lawn care to significant expenses such as roof replacement. Homeownership requires budgeting for regular maintenance, property taxes, insurance, and potential renovations, reflecting a long-term financial and management commitment.

Tax Implications: Benefits and Limitations

Renting offers limited tax benefits since renters cannot deduct rent payments, whereas homeowners can claim mortgage interest and property tax deductions that significantly reduce taxable income. Buying a home may qualify for tax credits and deductions such as the mortgage interest deduction and property tax deduction, but these benefits are subject to limits like the $750,000 mortgage debt cap under current IRS rules. Homeownership provides potential tax advantages including capital gains exclusions on the sale of a primary residence, but benefits vary by individual tax situations and state-specific property tax policies.

Market Trends: Housing Prices and Rental Rates

Housing prices have surged by approximately 15% nationwide over the past year, impacting affordability for potential homebuyers. Simultaneously, rental rates have increased around 8%, driven by high demand and limited inventory in urban centers. Market trends indicate a tightening supply in both sectors, prompting many to weigh the long-term benefits of homeownership against the flexibility of renting.

Personal and Family Needs

Renting offers flexibility for individuals or families anticipating short-term living arrangements or uncertain job locations, minimizing financial commitment and maintenance responsibilities. Buying a home provides long-term stability, equity building, and personalized living space, which benefits families seeking permanence and investment growth. Homeownership aligns with personal and family goals by enabling customization, fostering community ties, and securing housing costs against inflation.

Risk Factors: Stability and Economic Uncertainty

Renting offers flexibility but exposes you to rent increases and lease non-renewals, presenting varying financial risks during economic uncertainty. Buying a home requires significant upfront investment and carries risks related to market fluctuations, property depreciation, and potential difficulty in selling during downturns. Homeownership provides long-term stability and potential asset appreciation but demands ongoing costs such as maintenance, taxes, and insurance that must be managed despite economic challenges.

Making the Right Decision for You

Evaluating renting versus buying involves assessing your financial stability, long-term goals, and lifestyle preferences to determine the best fit for your situation. Renting offers flexibility and lower upfront costs, while homeownership builds equity and provides stability but requires significant investment and maintenance. Carefully analyzing market trends, interest rates, and your personal priorities ensures making the right decision for your housing needs.

Infographic: Renting vs Buying

relatioo.com

relatioo.com