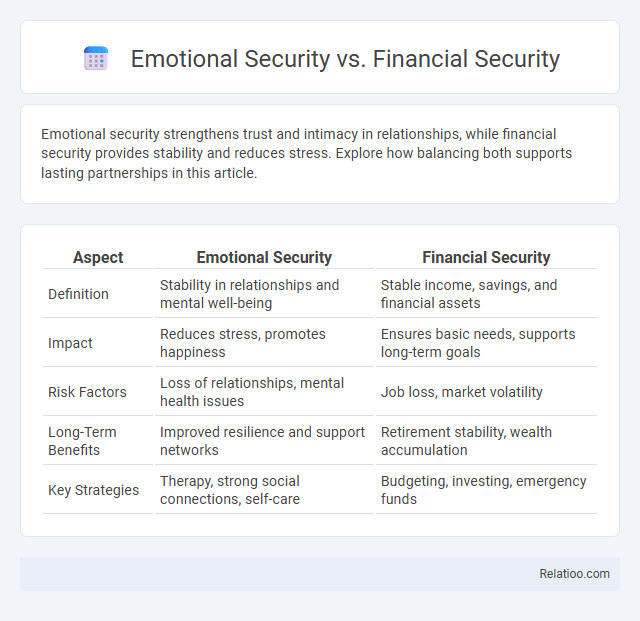

Emotional security strengthens trust and intimacy in relationships, while financial security provides stability and reduces stress. Explore how balancing both supports lasting partnerships in this article.

Table of Comparison

| Aspect | Emotional Security | Financial Security |

|---|---|---|

| Definition | Stability in relationships and mental well-being | Stable income, savings, and financial assets |

| Impact | Reduces stress, promotes happiness | Ensures basic needs, supports long-term goals |

| Risk Factors | Loss of relationships, mental health issues | Job loss, market volatility |

| Long-Term Benefits | Improved resilience and support networks | Retirement stability, wealth accumulation |

| Key Strategies | Therapy, strong social connections, self-care | Budgeting, investing, emergency funds |

Understanding Emotional Security: Definition and Importance

Emotional security refers to a person's sense of safety, stability, and confidence within relationships and their own emotional state, enabling effective stress management and resilience. It plays a crucial role in mental health, influencing self-esteem, interpersonal trust, and overall life satisfaction. Prioritizing emotional security fosters healthier connections and supports balanced decision-making, distinguishing it from financial security which primarily addresses monetary stability.

Financial Security Explained: Key Concepts

Financial security involves having sufficient income, savings, and assets to cover expenses and handle emergencies without stress. Key concepts include budgeting, emergency funds, insurance, and long-term investment strategies that protect against economic fluctuations. Achieving financial security provides peace of mind, enabling individuals to focus on emotional well-being without the constant worry of monetary instability.

The Interplay Between Emotions and Finances

The interplay between emotional security and financial security reveals how your feelings directly impact financial decisions and overall well-being. Emotional security fosters confidence and stability, which helps manage financial stress, while financial security provides a foundation that reduces anxiety and supports emotional health. Understanding this dynamic allows you to create strategies that balance emotional needs with financial goals for a more secure and fulfilling life.

Emotional Security vs Financial Security: Core Differences

Emotional security involves a stable sense of self-worth and trust in relationships, fostering mental well-being and resilience. Financial security centers on having sufficient monetary resources to meet needs, ensuring stability and reducing stress related to economic uncertainty. While emotional security nurtures internal confidence and interpersonal harmony, financial security provides external stability and practical support for life's demands.

How Financial Stability Affects Emotional Well-being

Financial stability provides a foundation that significantly reduces stress and anxiety, directly enhancing emotional well-being by fostering a sense of control and safety. When your financial resources are secure, you can focus more on personal growth and relationships without the constant burden of economic uncertainty. This balance between emotional security and financial stability creates a more resilient mindset, improving overall mental health and life satisfaction.

The Psychological Impact of Financial Insecurity

Financial insecurity disrupts emotional stability by triggering chronic stress, anxiety, and a persistent sense of vulnerability. Your mental well-being deteriorates as uncertainty about meeting basic needs undermines feelings of safety and control. Addressing financial insecurity is crucial to restoring emotional security and promoting overall psychological health.

Building Emotional Security Without Financial Abundance

Building emotional security without financial abundance involves cultivating self-awareness, strong relationships, and resilience to stress independent of monetary resources. Consistent emotional support from trusted friends or family and practicing mindfulness can enhance psychological stability despite financial challenges. Prioritizing mental health and emotional intelligence fosters a secure internal environment critical to well-being beyond economic status.

Achieving Financial Security for Emotional Peace

Achieving financial security provides a foundation for emotional peace by reducing stress related to money management and unexpected expenses. Consistent income, savings, and investment strategies contribute to a stable financial environment that supports mental well-being and reduces anxiety. Prioritizing financial planning and debt management helps create a sense of control, enabling emotional stability and resilience during challenging times.

Strategies to Balance Emotional and Financial Security

Balancing emotional and financial security requires integrating mindful spending habits with stress management techniques to ensure your well-being in both areas. Prioritizing clear communication about finances reduces anxiety, while setting realistic financial goals fosters a stable emotional environment. You can achieve harmony by creating emergency savings and practicing self-care routines that support mental resilience during financial uncertainties.

Choosing What Matters: Prioritizing Emotional or Financial Security

Choosing between emotional security and financial security requires understanding your personal values and long-term goals. Emotional security provides stability through supportive relationships and mental well-being, enhancing overall life satisfaction. Your decision should weigh the tangible benefits of financial security against the profound impact of emotional fulfillment on your happiness and resilience.

Infographic: Emotional Security vs Financial Security

relatioo.com

relatioo.com