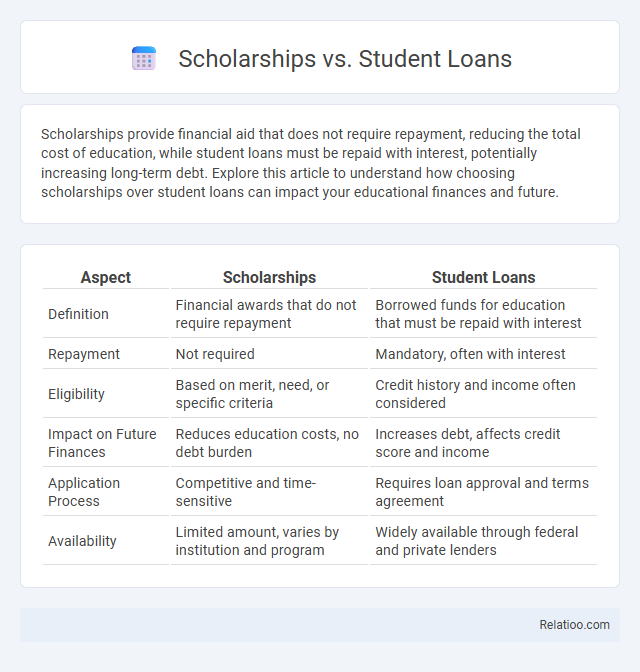

Scholarships provide financial aid that does not require repayment, reducing the total cost of education, while student loans must be repaid with interest, potentially increasing long-term debt. Explore this article to understand how choosing scholarships over student loans can impact your educational finances and future.

Table of Comparison

| Aspect | Scholarships | Student Loans |

|---|---|---|

| Definition | Financial awards that do not require repayment | Borrowed funds for education that must be repaid with interest |

| Repayment | Not required | Mandatory, often with interest |

| Eligibility | Based on merit, need, or specific criteria | Credit history and income often considered |

| Impact on Future Finances | Reduces education costs, no debt burden | Increases debt, affects credit score and income |

| Application Process | Competitive and time-sensitive | Requires loan approval and terms agreement |

| Availability | Limited amount, varies by institution and program | Widely available through federal and private lenders |

Understanding Scholarships and Student Loans

Scholarships provide financial aid that does not require repayment, making them a cost-effective option for funding education, often awarded based on merit, need, or specific criteria. Student loans offer borrowed funds to cover tuition and living expenses but require repayment with interest, impacting long-term financial stability. Understanding the differences between scholarships and student loans helps students make informed decisions, prioritizing grants and scholarships before considering debt-financed education.

Key Differences Between Scholarships and Student Loans

Scholarships provide financial aid based on merit or need that does not require repayment, making them a cost-effective way to fund education. Student loans are borrowed funds that must be repaid with interest, potentially leading to long-term debt after graduation. Understanding these differences is crucial for effective education planning, ensuring students minimize debt while maximizing financial support opportunities.

Eligibility Criteria for Scholarships

Scholarships primarily require applicants to meet specific eligibility criteria such as academic excellence, financial need, community service, or affiliation with certain groups or institutions. Unlike student loans, which are generally accessible based on credit or financial need without merit constraints, scholarships demand a demonstrated commitment to the qualifying factors detailed in their guidelines. Understanding these eligibility requirements is crucial for maximizing scholarship opportunities and effectively integrating them into a comprehensive education planning strategy.

Types of Student Loans Available

Student loans come in various types, including federal loans like Direct Subsidized Loans, which offer need-based interest benefits, and Direct Unsubsidized Loans, available regardless of financial need. Private student loans from banks or credit unions typically require credit checks and have variable interest rates, often with less flexible repayment terms. Understanding these loan types is crucial for effective education planning, as borrowing costs and repayment options significantly impact long-term financial outcomes.

Pros and Cons of Scholarships

Scholarships offer a significant financial advantage by providing tuition funds that don't require repayment, reducing long-term debt burdens for students. However, scholarships often have strict eligibility criteria and limited availability, making competition intense and award amounts sometimes insufficient to cover all educational expenses. Unlike student loans or comprehensive education planning, scholarships may not address ongoing costs such as housing or books, necessitating supplementary financial strategies.

Advantages and Drawbacks of Student Loans

Student loans provide immediate financial support for higher education, allowing students to cover tuition, books, and living expenses without upfront payment. However, they accumulate interest over time, leading to potentially significant debt burdens that can affect credit scores and future financial stability. Unlike scholarships, loans must be repaid, which may result in long-term financial obligations and stress if not managed properly.

Application Processes: Scholarships vs Student Loans

Scholarship application processes often require demonstrating academic excellence, leadership, or community involvement through essays, recommendations, and transcripts, emphasizing merit or specific criteria. In contrast, student loan applications focus primarily on financial need verification, creditworthiness, and legal documentation, involving a more standardized procedure with lenders or government entities. Understanding these distinct application requirements is crucial for effective education planning and securing optimal funding sources.

Impact on Financial Future and Debt

Scholarships provide financial aid that does not require repayment, significantly reducing Your overall debt burden and positively impacting Your financial future by preserving creditworthiness. Student loans, while offering access to education, create obligations that accrue interest over time, potentially delaying wealth accumulation and increasing financial stress. Education planning involves strategizing savings and funding sources to minimize reliance on loans, thereby protecting Your long-term financial stability and ensuring manageable debt levels after graduation.

Choosing the Right Option for Your Education

Choosing the right education funding option depends on your financial situation, academic goals, and long-term repayment ability. Scholarships offer debt-free financial aid based on merit or need, often requiring academic achievements or community involvement. Student loans provide immediate funds but require future repayment with interest, while education planning involves saving early through dedicated accounts or investment plans to minimize reliance on loans and maximize financial security during your studies.

Tips for Maximizing Financial Aid Opportunities

Maximizing financial aid opportunities involves applying early for scholarships with high academic or extracurricular merit requirements and tailoring each application to highlight relevant achievements. Prioritize completing the FAFSA promptly to qualify for federal student loans with favorable terms and state or institutional grants that do not require repayment. Incorporate comprehensive education planning by comparing loan interest rates, repayment options, and scholarship deadlines to create a balanced strategy minimizing debt while maximizing aid benefits.

Infographic: Scholarships vs Student Loans

relatioo.com

relatioo.com