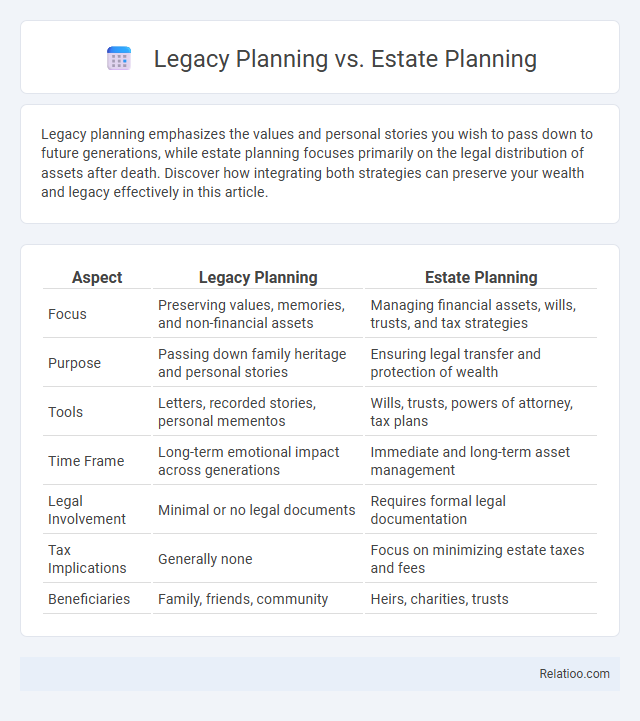

Legacy planning emphasizes the values and personal stories you wish to pass down to future generations, while estate planning focuses primarily on the legal distribution of assets after death. Discover how integrating both strategies can preserve your wealth and legacy effectively in this article.

Table of Comparison

| Aspect | Legacy Planning | Estate Planning |

|---|---|---|

| Focus | Preserving values, memories, and non-financial assets | Managing financial assets, wills, trusts, and tax strategies |

| Purpose | Passing down family heritage and personal stories | Ensuring legal transfer and protection of wealth |

| Tools | Letters, recorded stories, personal mementos | Wills, trusts, powers of attorney, tax plans |

| Time Frame | Long-term emotional impact across generations | Immediate and long-term asset management |

| Legal Involvement | Minimal or no legal documents | Requires formal legal documentation |

| Tax Implications | Generally none | Focus on minimizing estate taxes and fees |

| Beneficiaries | Family, friends, community | Heirs, charities, trusts |

Understanding Legacy Planning and Estate Planning

Legacy planning focuses on the values, stories, and personal impact you want to pass down to future generations, while estate planning concentrates on the legal distribution of your assets after death. Understanding estate planning involves creating wills, trusts, and powers of attorney to manage your property and financial matters effectively. Your comprehensive financial plan benefits from integrating both approaches to ensure your wealth and legacy purpose align seamlessly.

Key Differences Between Legacy Planning and Estate Planning

Legacy planning focuses on preserving your values, memories, and non-financial assets to impact future generations emotionally and culturally, while estate planning primarily addresses the legal and financial distribution of your assets after death. Key differences between legacy planning and estate planning include legacy planning's emphasis on storytelling, philanthropy, and imparting life lessons, whereas estate planning involves wills, trusts, tax strategies, and asset protection. Understanding these distinctions helps you create a comprehensive plan that ensures both your financial security and lasting personal impact.

Goals and Objectives of Legacy Planning

Legacy planning centers on establishing long-term goals that extend beyond wealth transfer, emphasizing values, life lessons, and philanthropic intentions. It aims to preserve family heritage, instill ethical principles, and support causes aligned with personal beliefs. Unlike estate planning, which primarily addresses asset distribution and legal matters, legacy planning focuses on emotional and social impact for future generations.

Goals and Objectives of Estate Planning

Estate planning centers on organizing your assets to ensure their smooth transfer, minimize taxes, and provide clear directives for healthcare and financial decisions during incapacity. While both legacy planning and estate planning involve transferring assets, legacy planning emphasizes your lasting impact and values beyond financial wealth. Understanding your estate planning goals helps you protect your loved ones' interests and fulfill your wishes in a legally effective manner.

Components of an Effective Legacy Plan

Components of an effective legacy plan include clearly defined personal values, comprehensive asset distribution strategies, and provisions for charitable giving to ensure your wishes are honored and lasting impact achieved. Estate planning focuses primarily on legal mechanisms such as wills, trusts, powers of attorney, and healthcare directives to manage and protect your assets during and after your lifetime. Legacy planning extends beyond asset allocation by integrating family heritage, ethical considerations, and philanthropic goals to shape how your legacy influences future generations.

Essential Elements of an Estate Plan

An estate plan includes essential elements such as a will, power of attorney, healthcare directives, and trusts to manage and distribute your assets according to your wishes. Legacy planning focuses more on your values and intentions, ensuring your wealth and personal legacy benefit future generations through philanthropic goals and family governance. While both overlap, the core of estate planning is legally safeguarding your assets and healthcare preferences, directly impacting your financial security and legacy.

Emotional and Family Considerations in Legacy Planning

Legacy planning emphasizes emotional and family considerations by focusing on the values, memories, and lessons passed down through generations, unlike estate planning which primarily addresses legal and financial asset distribution. It involves thoughtful communication and intentional decisions to nurture family bonds, preserve heritage, and ensure that personal beliefs and stories endure beyond monetary wealth. This holistic approach fosters emotional healing and strengthens family unity during transitional periods, complementing the technical aspects of estate and financial planning.

Tax Implications in Legacy vs Estate Planning

Estate planning primarily focuses on organizing and managing an individual's assets during their lifetime and after death to minimize estate taxes, probate costs, and provide clear instructions for asset distribution. Legacy planning, while encompassing estate planning, places greater emphasis on aligning wealth transfer with personal values, charitable giving, and long-term impact, which can involve strategic tax planning to reduce income, gift, and estate taxes. Tax implications in legacy planning often include advanced strategies such as setting up trusts, charitable remainder trusts, or donor-advised funds to optimize tax benefits and preserve wealth for future generations.

Choosing the Right Professionals for Planning

Selecting the right professionals for Legacy Planning, Estate Planning, and Wealth Preservation is crucial to securing Your financial future and honoring Your values. Estate planning attorneys, financial advisors, and tax specialists offer tailored strategies that address legal, tax, and investment concerns specific to each planning type. Your choice of experienced professionals will directly impact the effectiveness of these plans in safeguarding assets, minimizing taxes, and ensuring Your wishes are fulfilled.

Integrating Legacy and Estate Planning for Maximum Impact

Integrating legacy planning and estate planning ensures a comprehensive approach to preserving wealth, values, and family goals across generations. Estate planning focuses on the legal distribution of assets, while legacy planning emphasizes the transmission of personal values, stories, and philanthropic intentions. Combining both strategies maximizes impact by aligning financial security with enduring family legacies and social contributions.

Infographic: Legacy Planning vs Estate Planning

relatioo.com

relatioo.com