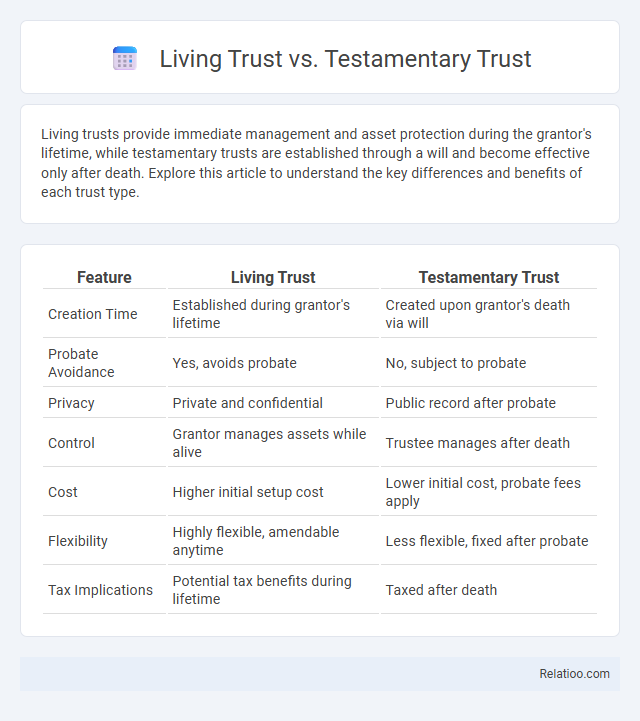

Living trusts provide immediate management and asset protection during the grantor's lifetime, while testamentary trusts are established through a will and become effective only after death. Explore this article to understand the key differences and benefits of each trust type.

Table of Comparison

| Feature | Living Trust | Testamentary Trust |

|---|---|---|

| Creation Time | Established during grantor's lifetime | Created upon grantor's death via will |

| Probate Avoidance | Yes, avoids probate | No, subject to probate |

| Privacy | Private and confidential | Public record after probate |

| Control | Grantor manages assets while alive | Trustee manages after death |

| Cost | Higher initial setup cost | Lower initial cost, probate fees apply |

| Flexibility | Highly flexible, amendable anytime | Less flexible, fixed after probate |

| Tax Implications | Potential tax benefits during lifetime | Taxed after death |

Introduction to Living Trusts and Testamentary Trusts

Living trusts provide a flexible estate planning tool that allows grantors to manage assets during their lifetime and facilitate seamless transfer to beneficiaries without probate. Testamentary trusts are created through a will and only become effective upon the grantor's death, offering controlled distribution of assets according to specific terms. Understanding the distinctions between living and testamentary trusts is crucial for optimizing legacy planning and ensuring tailored asset protection.

Definition of a Living Trust

A Living Trust is a legal arrangement created during your lifetime to hold and manage your assets, allowing for seamless transfer to beneficiaries without probate. Unlike a Testamentary Trust, which is established through a will and takes effect after death, a Living Trust provides greater privacy and control over your estate while you are alive. Understanding the distinctions between Living Trusts, Testamentary Trusts, and Legacy Planning helps you tailor your estate strategy to protect your wealth and fulfill your long-term goals effectively.

Definition of a Testamentary Trust

A testamentary trust is a legal arrangement established through a will that only becomes effective upon your death, designed to manage and distribute assets to beneficiaries under specified conditions. Unlike living trusts, which are created during your lifetime, testamentary trusts provide structured control over your estate, often protecting assets for minors or individuals with special needs. Legacy planning involves the broader strategy of preserving and transferring wealth, where testamentary trusts play a crucial role in ensuring your wishes are honored long after you pass.

Key Differences Between Living and Testamentary Trusts

Living trusts are established during your lifetime and provide immediate management of assets, while testamentary trusts are created through a will and only take effect after your death. Key differences include control and privacy; living trusts avoid probate, offering faster asset distribution and confidentiality, whereas testamentary trusts must go through probate, which can be public and time-consuming. Your choice impacts how efficiently and privately your estate is administered, influencing the ease with which your heirs receive their inheritance.

Advantages of a Living Trust

A Living Trust offers advantages such as avoiding probate, which speeds up asset distribution and maintains privacy by keeping estate details out of public court records. It provides greater flexibility and control over asset management during the grantor's lifetime and after death, allowing for seamless handling of incapacity or disability. Unlike Testamentary Trusts, which only take effect after death and require probate, Living Trusts enable immediate asset protection and simplified administration.

Advantages of a Testamentary Trust

A Testamentary Trust offers significant advantages by providing control over asset distribution after death, enabling beneficiaries to receive funds gradually according to the settlor's wishes. It facilitates tax planning opportunities by potentially reducing estate taxes and protecting assets from creditors or beneficiaries' financial mismanagement. Compared to Living Trusts and general Legacy Planning, Testamentary Trusts are established through a will, making them ideal for individuals seeking to safeguard minors or vulnerable beneficiaries while maintaining estate flexibility.

Probate Implications: Living Trust vs Testamentary Trust

Living trusts avoid probate by transferring assets directly to beneficiaries upon death, ensuring faster access and privacy. Testamentary trusts are established through a will and must go through probate, which can delay asset distribution and involve court fees. Choosing a living trust minimizes probate complications, while testamentary trusts are subject to judicial oversight and potential delays.

Tax Considerations for Each Trust Type

Living trusts offer tax benefits by avoiding probate and allowing income to be taxed at the grantor's individual rate during their lifetime. Testamentary trusts, established after death, provide income tax advantages by distributing taxable income among beneficiaries, potentially lowering overall tax burdens but are subject to estate taxes and probate delays. Your legacy planning should evaluate the specific tax implications of each trust type to optimize estate taxes, income taxes, and probate costs effectively.

Choosing the Right Trust for Your Estate Planning Needs

Choosing the right trust for your estate planning needs depends on factors such as control, flexibility, and timing of asset distribution. A living trust provides immediate management of assets during the grantor's lifetime and avoids probate, while a testamentary trust is established through a will and activates only after death, offering more court supervision. Legacy planning combines these trusts with other strategies to ensure asset protection, minimize taxes, and fulfill long-term financial goals for heirs.

Frequently Asked Questions About Living and Testamentary Trusts

Living trusts offer you the advantage of avoiding probate and maintaining privacy during asset distribution, while testamentary trusts are established through a will and become effective only after your death. Frequently asked questions often concern the costs, control, and timing of these trusts; living trusts tend to be more expensive upfront but provide immediate asset management, whereas testamentary trusts usually incur probate delays but can be tailored for specific post-death needs. Legacy planning involves integrating both trusts to ensure your assets are efficiently managed and protected according to your wishes over time.

Infographic: Living Trust vs Testamentary Trust

relatioo.com

relatioo.com