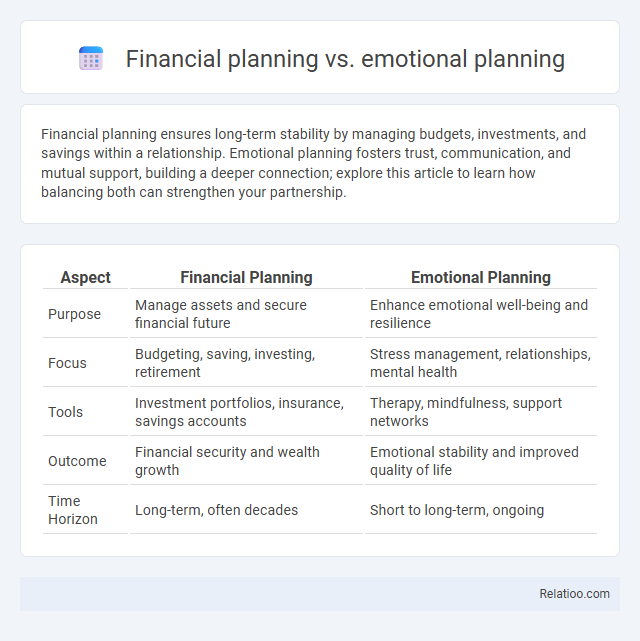

Financial planning ensures long-term stability by managing budgets, investments, and savings within a relationship. Emotional planning fosters trust, communication, and mutual support, building a deeper connection; explore this article to learn how balancing both can strengthen your partnership.

Table of Comparison

| Aspect | Financial Planning | Emotional Planning |

|---|---|---|

| Purpose | Manage assets and secure financial future | Enhance emotional well-being and resilience |

| Focus | Budgeting, saving, investing, retirement | Stress management, relationships, mental health |

| Tools | Investment portfolios, insurance, savings accounts | Therapy, mindfulness, support networks |

| Outcome | Financial security and wealth growth | Emotional stability and improved quality of life |

| Time Horizon | Long-term, often decades | Short to long-term, ongoing |

Introduction to Financial and Emotional Planning

Financial planning involves managing your income, expenses, investments, and savings to achieve long-term financial stability and goals, while emotional planning focuses on understanding and regulating your feelings to improve mental well-being and decision-making. Both forms of planning are essential for a balanced life, as financial stress often impacts emotional health, and vice versa. Integrating these approaches allows you to build a secure future while maintaining emotional resilience, which is vital for personal and relationship growth.

Key Differences Between Financial and Emotional Planning

Financial planning centers on managing assets, budgeting, investments, and long-term monetary goals, while emotional planning addresses mental well-being, coping strategies, and emotional resilience. Couple therapy focuses on improving communication, resolving conflicts, and strengthening relationship dynamics, which often intertwine with emotional aspects but do not primarily address finances. Understanding these key differences helps you balance practical money management with emotional health for a holistic approach to personal and relational growth.

The Importance of Financial Planning

Financial planning plays a crucial role in establishing stability and security within relationships by managing budgets, setting savings goals, and preparing for future expenses. Unlike emotional planning or couple therapy, which address psychological and relational challenges, financial planning provides a tangible framework for reducing stress related to money management. Effective financial planning helps couples align their financial priorities, prevent conflicts over money, and create a roadmap for long-term financial health.

The Significance of Emotional Planning

Emotional planning plays a crucial role in financial decision-making by fostering emotional intelligence and resilience, which directly impact spending habits and long-term financial stability. Unlike financial planning, which focuses on budgets, investments, and risk management, emotional planning addresses the psychological triggers behind money behaviors, reducing conflicts and improving communication within couples. Integrating emotional planning with couple therapy enhances relationship dynamics, leading to more cohesive and effective joint financial strategies.

Core Elements of Effective Financial Planning

Effective financial planning centers on comprehensive budgeting, risk assessment, and goal setting to ensure long-term financial stability. Emotional planning involves recognizing personal values, managing stress related to money, and fostering healthy financial habits that align with psychological well-being. Couple therapy integrates communication skills, conflict resolution, and shared financial objectives to harmonize partners' economic decisions and emotional needs.

Core Elements of Effective Emotional Planning

Effective emotional planning centers on self-awareness, emotional regulation, and clear communication, enabling individuals to navigate feelings and stressors constructively. Core elements include identifying emotional triggers, developing coping strategies, and fostering empathy, which strengthen resilience and interpersonal relationships. Financial planning emphasizes budgeting and investment decisions, while couple therapy focuses on resolving relational conflicts, making emotional planning crucial for personal well-being and healthy interactions.

How Financial and Emotional Planning Intersect

Financial and emotional planning intersect significantly in managing stress and communication within relationships, as unresolved financial concerns often fuel emotional tension. Your ability to create a comprehensive plan that addresses both budgetary goals and emotional well-being can improve decision-making and foster trust between partners. Couple therapy provides a structured environment for aligning financial priorities with emotional needs, enhancing overall relationship stability.

Common Mistakes in Financial and Emotional Planning

Common mistakes in financial planning include neglecting to set realistic budgets and failing to prepare for emergencies, which can lead to significant stress and instability. Emotional planning often suffers from overlooking the importance of boundaries and inadequate communication, resulting in unresolved conflicts and deteriorating relationships. Couple therapy addresses these issues by providing structured support to improve financial transparency and foster emotional understanding, helping partners avoid pitfalls in both financial and emotional management.

Tips for Balancing Financial and Emotional Priorities

Balancing financial and emotional priorities requires clear communication and setting shared goals to align both practical needs and feelings. You should establish a budget that respects each partner's values while also scheduling regular check-ins to address emotional well-being and financial adjustments. Prioritizing transparency, empathy, and mutual support enhances harmony in both your financial planning and emotional connection.

Choosing the Right Approach: Financial, Emotional, or Both?

Choosing the right approach between financial planning, emotional planning, or couple therapy depends on the specific needs of the relationship. Financial planning addresses budgeting, investments, and debt management to secure a stable future. Emotional planning and couple therapy focus on communication, conflict resolution, and strengthening emotional bonds, often complementing financial strategies for holistic relationship health.

Infographic: Financial planning vs Emotional planning

relatioo.com

relatioo.com