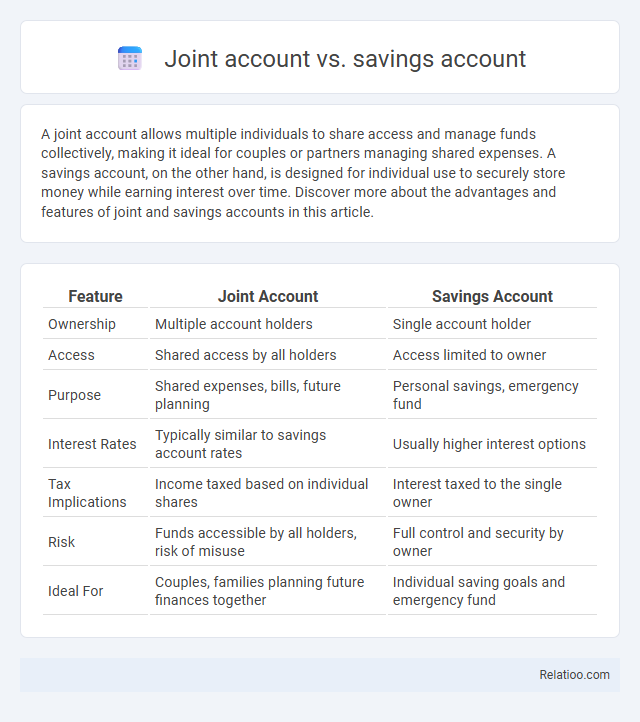

A joint account allows multiple individuals to share access and manage funds collectively, making it ideal for couples or partners managing shared expenses. A savings account, on the other hand, is designed for individual use to securely store money while earning interest over time. Discover more about the advantages and features of joint and savings accounts in this article.

Table of Comparison

| Feature | Joint Account | Savings Account |

|---|---|---|

| Ownership | Multiple account holders | Single account holder |

| Access | Shared access by all holders | Access limited to owner |

| Purpose | Shared expenses, bills, future planning | Personal savings, emergency fund |

| Interest Rates | Typically similar to savings account rates | Usually higher interest options |

| Tax Implications | Income taxed based on individual shares | Interest taxed to the single owner |

| Risk | Funds accessible by all holders, risk of misuse | Full control and security by owner |

| Ideal For | Couples, families planning future finances together | Individual saving goals and emergency fund |

Introduction to Joint Accounts and Savings Accounts

A joint account is a single bank account shared by two or more individuals who have equal access to deposit and withdraw funds, making it ideal for managing shared expenses or household finances. In contrast, a savings account is an individual account designed primarily for accumulating interest over time while promoting financial discipline through restricted withdrawal options. Understanding these distinctions helps in choosing whether to prioritize shared financial management or individual savings growth based on personal or household needs.

Key Differences Between Joint and Savings Accounts

Joint accounts allow multiple individuals to share ownership and access to funds, making them ideal for managing shared expenses or family finances, whereas savings accounts are typically owned by a single individual and focus on accumulating interest over time. Unlike savings accounts, which often impose limits on withdrawals to encourage saving, joint accounts offer more flexible access but may lack the high interest rates associated with savings accounts. Security features, tax implications, and account management responsibilities also differ significantly, with joint accounts requiring trust and collaboration among co-owners, while savings accounts provide more straightforward individual control and privacy.

How Joint Accounts Work

Joint accounts allow two or more individuals to share ownership and control over the account, enabling each holder to deposit, withdraw, and manage funds independently or together. These accounts are commonly used by couples, family members, or business partners to facilitate shared financial responsibilities and simplify bill payments. Unlike individual savings accounts, joint accounts provide equal access and liability for transactions, making them ideal for collaborative money management.

How Savings Accounts Function

Savings accounts function by allowing individuals to deposit money securely while earning interest over time, typically offering higher interest rates compared to joint accounts. Unlike joint accounts, which are shared between two or more account holders and facilitate shared access to funds, savings accounts are usually held individually and emphasize accumulating savings rather than frequent transactions. The savings account's structure encourages disciplined saving habits with limited withdrawals, promoting financial growth through interest compounding.

Pros and Cons of Joint Accounts

Joint accounts offer shared access to funds, making them ideal for managing household expenses and fostering financial transparency between partners. The main advantage is easy collaboration on payments and budgeting; however, they carry the risk of joint liability, where each party is responsible for overdrafts or debts. Your control over the account may be limited due to the need for mutual consent, which can complicate decision-making in times of disagreement.

Pros and Cons of Savings Accounts

Savings accounts offer secure, interest-earning opportunities for your funds with easy access and low risk, making them ideal for emergency funds or short-term goals. However, they often have lower interest rates compared to investments and may impose withdrawal limits or fees, which can reduce overall earnings. Choosing between a joint account and a savings account depends on whether you prioritize shared access and budgeting flexibility or focused, individual savings growth.

Ideal Scenarios for Choosing a Joint Account

Joint accounts are ideal for couples managing shared expenses, business partners requiring equal access to funds, or family members handling household finances collectively. These accounts provide seamless fund pooling and transparency, facilitating easier bill payments and budgeting than individual savings accounts. Unlike savings accounts focused on individual saving goals and interest accumulation, joint accounts prioritize accessibility and collaborative financial management.

Best Uses for Savings Accounts

Savings accounts are ideal for individuals seeking secure, interest-bearing deposits with easy access to funds for short- to medium-term financial goals. Joint accounts, while similar in structure, provide shared access and control, making them suitable for couples or family members managing combined savings or expenses. For personal savings aimed at accumulating interest and maintaining liquidity, a sole savings account typically offers greater simplicity and fewer complications than joint accounts.

Security and Legal Considerations

Joint accounts provide shared access between multiple holders, increasing convenience but also raising concerns about mutual liability and potential disputes over funds. Savings accounts typically offer individual security features, such as FDIC insurance up to $250,000 per depositor, minimizing risk in case of bank failure. Legal considerations in joint accounts include rights of survivorship and the necessity of clear agreements to prevent conflicts, while savings accounts maintain singular ownership and control, simplifying legal matters.

Which Account is Right for You?

Choosing between a joint account and a savings account depends on your financial goals and spending habits. A joint account allows you and another person to manage shared expenses and track spending collectively, making it ideal for couples or business partners. Your best option balances convenience, control, and savings growth based on whether you prioritize collaborative money management or individual account growth.

Infographic: Joint Account vs Savings Account

relatioo.com

relatioo.com