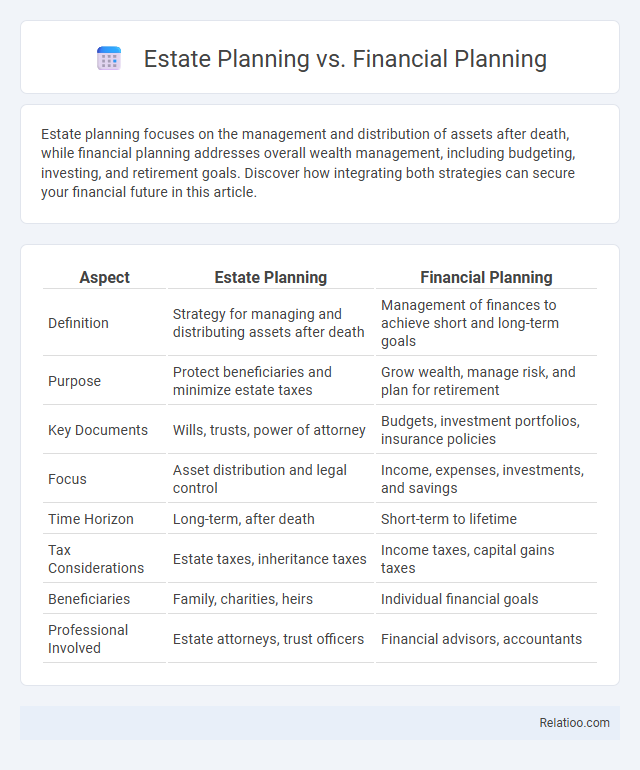

Estate planning focuses on the management and distribution of assets after death, while financial planning addresses overall wealth management, including budgeting, investing, and retirement goals. Discover how integrating both strategies can secure your financial future in this article.

Table of Comparison

| Aspect | Estate Planning | Financial Planning |

|---|---|---|

| Definition | Strategy for managing and distributing assets after death | Management of finances to achieve short and long-term goals |

| Purpose | Protect beneficiaries and minimize estate taxes | Grow wealth, manage risk, and plan for retirement |

| Key Documents | Wills, trusts, power of attorney | Budgets, investment portfolios, insurance policies |

| Focus | Asset distribution and legal control | Income, expenses, investments, and savings |

| Time Horizon | Long-term, after death | Short-term to lifetime |

| Tax Considerations | Estate taxes, inheritance taxes | Income taxes, capital gains taxes |

| Beneficiaries | Family, charities, heirs | Individual financial goals |

| Professional Involved | Estate attorneys, trust officers | Financial advisors, accountants |

Introduction: Understanding Estate Planning vs Financial Planning

Estate planning focuses on managing and distributing assets after death, ensuring legal documents like wills and trusts are in place to protect heirs. Financial planning involves creating strategies for saving, investing, and budgeting to achieve short-term and long-term financial goals. In blended family contexts, combining estate and financial planning becomes essential to address complexities such as stepchildren inheritance rights and equitable asset distribution.

Defining Estate Planning

Estate planning involves arranging the management and disposal of an individual's assets in the event of death or incapacitation, ensuring the distribution aligns with their wishes and minimizes legal complications. It encompasses wills, trusts, powers of attorney, and healthcare directives to protect beneficiaries and reduce estate taxes. Unlike financial planning, which centers on managing assets for growth and retirement, estate planning specifically addresses how assets are transferred and safeguarded after death, particularly complex in blended family situations where inheritance rights may vary.

Defining Financial Planning

Financial planning involves creating a comprehensive strategy to manage an individual's or family's financial goals, including budgeting, saving, investing, tax planning, and retirement preparation. Estate planning focuses specifically on the management and distribution of assets after death to minimize taxes and ensure beneficiaries are protected. In blended families, financial planning must address unique challenges such as merging assets, liabilities, and inheritance considerations to provide clarity and security for all family members.

Key Differences Between Estate and Financial Planning

Estate planning primarily deals with the management and distribution of assets after death, including wills, trusts, and probate processes, while financial planning focuses on budgeting, saving, investing, and managing finances during one's lifetime to achieve financial goals. Key differences include the timing and purpose: estate planning ensures asset transfer and tax minimization post-mortem, whereas financial planning aims to optimize cash flow, retirement, and wealth accumulation. In the context of a blended family, estate planning must address complex inheritance issues and potential conflicts, whereas financial planning centers on equitable resource allocation and long-term financial security for all members.

Core Objectives of Estate Planning

Estate planning primarily focuses on managing and distributing your assets according to your wishes after death, minimizing estate taxes, and ensuring your family's financial security. It involves setting up wills, trusts, powers of attorney, and healthcare directives tailored to address unique family dynamics, especially in blended families where multiple interests must be balanced. By clearly defining your estate plan, you protect your beneficiaries and reduce potential conflicts or legal challenges.

Core Objectives of Financial Planning

Financial planning centers on managing your assets, liabilities, income, and expenses to achieve long-term financial security, retirement goals, and wealth accumulation. Estate planning focuses on organizing your assets and legal documents to ensure efficient transfer of wealth, minimize taxes, and safeguard your heirs' interests. In blended family financial planning, core objectives include equitable distribution of assets and clear communication to address the unique complexities of stepfamilies and protect all members' financial interests.

Common Tools and Strategies in Estate Planning

Common tools in estate planning include wills, trusts, powers of attorney, and advance healthcare directives, which ensure asset distribution aligns with the individual's wishes. Financial planning integrates retirement accounts, life insurance, and investment portfolios to support long-term wealth preservation and family security. Blended family estate planning requires customized strategies like stepchild provisions and marital agreements to address the unique distribution challenges and protect all family members.

Essential Components of a Comprehensive Financial Plan

A comprehensive financial plan integrates estate planning, financial planning, and considerations unique to blended families, addressing asset distribution, tax strategies, and legal guardianship to protect your loved ones. Essential components include wills, trusts, retirement savings, insurance policies, and clear communication among all family members to prevent conflicts and ensure financial security. Tailoring the plan to blend family dynamics enhances asset protection and supports long-term financial goals effectively.

When to Prioritize Estate Planning Over Financial Planning

Estate planning should be prioritized over financial planning when there are complex family dynamics, such as in blended families where asset distribution requires clear legal directives to prevent disputes. In situations involving significant inheritance, trusts, or guardianship arrangements, timely estate planning ensures that wealth transfer aligns with the individual's wishes and provides protection for all beneficiaries. Financial planning focuses on wealth accumulation and management, but estate planning addresses the critical need for asset distribution and legacy preservation during and after life.

Integrating Estate and Financial Planning for Holistic Wealth Management

Integrating estate planning and financial planning is essential for holistic wealth management, especially within blended families where asset distribution can be complex due to multiple stakeholders. Coordinated strategies ensure that legal documents like wills and trusts align with financial goals such as investment portfolios and retirement plans, minimizing conflicts and tax burdens. This unified approach promotes transparent wealth transfer and long-term financial stability, addressing the unique needs of stepchildren, ex-spouses, and new family members.

Infographic: Estate Planning vs Financial Planning

relatioo.com

relatioo.com