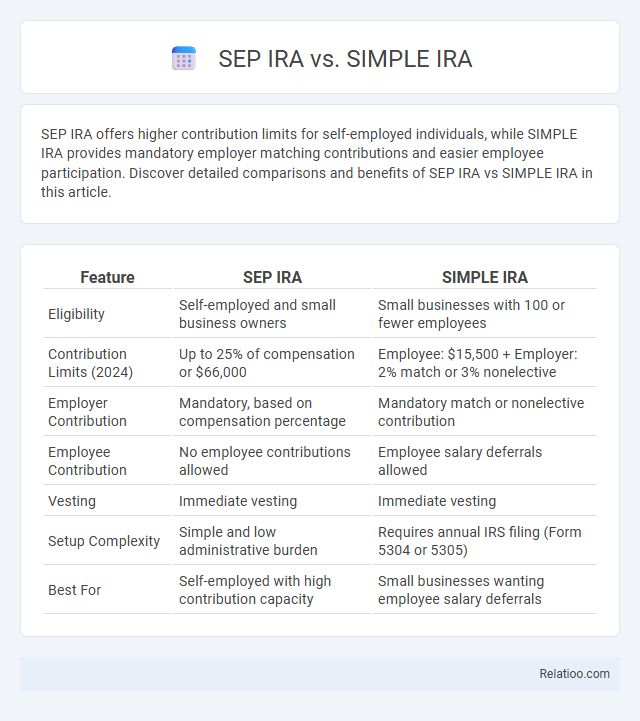

SEP IRA offers higher contribution limits for self-employed individuals, while SIMPLE IRA provides mandatory employer matching contributions and easier employee participation. Discover detailed comparisons and benefits of SEP IRA vs SIMPLE IRA in this article.

Table of Comparison

| Feature | SEP IRA | SIMPLE IRA |

|---|---|---|

| Eligibility | Self-employed and small business owners | Small businesses with 100 or fewer employees |

| Contribution Limits (2024) | Up to 25% of compensation or $66,000 | Employee: $15,500 + Employer: 2% match or 3% nonelective |

| Employer Contribution | Mandatory, based on compensation percentage | Mandatory match or nonelective contribution |

| Employee Contribution | No employee contributions allowed | Employee salary deferrals allowed |

| Vesting | Immediate vesting | Immediate vesting |

| Setup Complexity | Simple and low administrative burden | Requires annual IRS filing (Form 5304 or 5305) |

| Best For | Self-employed with high contribution capacity | Small businesses wanting employee salary deferrals |

Introduction to SEP IRA and SIMPLE IRA

SEP IRA and SIMPLE IRA are popular retirement savings options designed for small business owners and self-employed individuals, offering tax advantages and simplified administration. A SEP IRA allows employers to contribute up to 25% of an employee's compensation, with higher annual limits than SIMPLE IRAs, whereas SIMPLE IRAs encourage small businesses to contribute matching or nonelective contributions with lower administrative costs. Your choice between these plans depends on your business size, contribution flexibility, and desired retirement benefit structure.

Key Differences Between SEP IRA and SIMPLE IRA

SEP IRA allows employers, especially small businesses and self-employed individuals, to contribute up to 25% of an employee's compensation with a maximum limit of $66,000 in 2024, while SIMPLE IRA has lower contribution limits with a maximum employee salary deferral of $15,500 plus an additional $3,500 catch-up contribution for those 50 and older. SEP IRAs do not require employee contributions and have flexible employer contribution requirements, whereas SIMPLE IRAs mandate employer matching contributions of 2% nonelective contributions or dollar-for-dollar matches up to 3% of salary. SEP IRAs generally have fewer administrative requirements and allow higher contribution ceilings, making them suitable for highly compensated employees, while SIMPLE IRAs provide a straightforward and cost-effective retirement savings option for small employers with predictable annual contributions.

Eligibility Requirements

SEP IRA eligibility requires you to be at least 21 years old, have worked for the employer in at least three of the last five years, and earned a minimum of $750 in compensation during the year. SIMPLE IRA plans are available to businesses with 100 or fewer employees who earned at least $5,000 during the previous calendar year, and employees must have earned $5,000 in any two preceding years to participate. Your choice between SEP, SIMPLE, and traditional retirement accounts should consider these eligibility requirements to maximize tax advantages and retirement savings.

Contribution Limits Comparison

SEP IRA allows employers to contribute up to 25% of an employee's compensation or $66,000 for 2024, whichever is less, making it ideal for self-employed individuals and small businesses. SIMPLE IRA permits employee salary deferrals up to $15,500 in 2024 with an additional $3,500 catch-up contribution for those over 50, alongside mandatory employer matching contributions. Traditional retirement accounts have varying contribution limits, often lower than SEP IRAs, with 401(k) plans capping employee contributions at $23,000 in 2024, highlighting key differences for optimizing retirement savings.

Employer Responsibilities

Employer responsibilities for SEP IRA include making contributions up to 25% of employee compensation with flexible funding requirements, while SIMPLE IRA mandates employer matching contributions of up to 3% or a 2% nonelective contribution for all eligible employees. Both plans require timely deposits of employee and employer contributions and adherence to IRS reporting standards. SIMPLE IRA involves additional duties such as providing employees with plan information and facilitating salary reduction agreements, whereas SEP IRA offers simpler administration with fewer ongoing obligations.

Employee Participation and Contributions

SEP IRA allows only employer contributions, enabling employers to contribute up to 25% of an employee's compensation, with no employee contributions permitted. SIMPLE IRA encourages both employee and employer participation, permitting employees to contribute up to $15,500 in 2023, with mandatory employer matching contributions up to 3% of compensation. Retirement plans vary widely, but employee participation and contribution limits often depend on the plan type, IRS regulations, and employer policies, emphasizing the importance of selecting the right plan to maximize savings and tax benefits.

Tax Advantages and Implications

SEP IRAs offer significant tax advantages for self-employed individuals and small business owners by allowing contributions to be tax-deductible and grow tax-deferred until retirement. SIMPLE IRAs provide tax-deferred growth and deductions for employer and employee contributions, with lower contribution limits but mandatory employer matching or nonelective contributions. Retirement accounts like traditional IRAs and 401(k)s also offer tax deferral, but SEP and SIMPLE IRAs are specifically tailored to small businesses with different implications on contribution limits, employer involvement, and tax treatment upon withdrawal.

Withdrawal Rules and Penalties

SEP IRA withdrawals before age 59 1/2 typically incur a 10% early withdrawal penalty plus income tax on the amount withdrawn, while SIMPLE IRA withdrawals have a harsher penalty of 25% if taken within the first two years of participation, reverting to the standard 10% afterward. Required minimum distributions (RMDs) start at age 73 for both SEP and SIMPLE IRAs, ensuring you begin drawing retirement income as mandated by the IRS. Understanding these withdrawal rules and penalties helps you manage your retirement savings effectively and avoid unexpected taxes or penalties on your distributions.

Pros and Cons of SEP IRA vs SIMPLE IRA

SEP IRA offers higher contribution limits up to 25% of compensation or $66,000 (2024), making it ideal for self-employed individuals or small business owners seeking maximum tax-deferred growth. SIMPLE IRA, limited to $15,500 in employee contributions plus mandatory employer matching, provides easier administration and mandatory employer contributions but lower contribution capacity. SEP IRA lacks required employer contributions and allows flexible funding amounts each year, whereas SIMPLE IRA mandates contributions, which can increase costs for employers despite simplified setup and lower per-employee administrative burdens.

How to Choose the Right Plan for Your Business

Choosing the right retirement plan for your business depends on factors such as the number of employees, contribution limits, and administrative complexity. SEP IRAs suit small businesses seeking high contribution limits and minimal paperwork, while SIMPLE IRAs cater to businesses with up to 100 employees looking for easy setup and mandatory employer matching. Assess employee needs, desired employer contributions, and long-term retirement goals to determine whether SEP IRA, SIMPLE IRA, or other retirement plans best align with your business strategy.

Infographic: SEP IRA vs SIMPLE IRA

relatioo.com

relatioo.com