Budgeting involves setting financial targets and allocating resources for a specific period, while forecasting predicts future financial outcomes based on current data and trends. Learn more about how budgeting differs from forecasting and their impact on financial planning in this article.

Table of Comparison

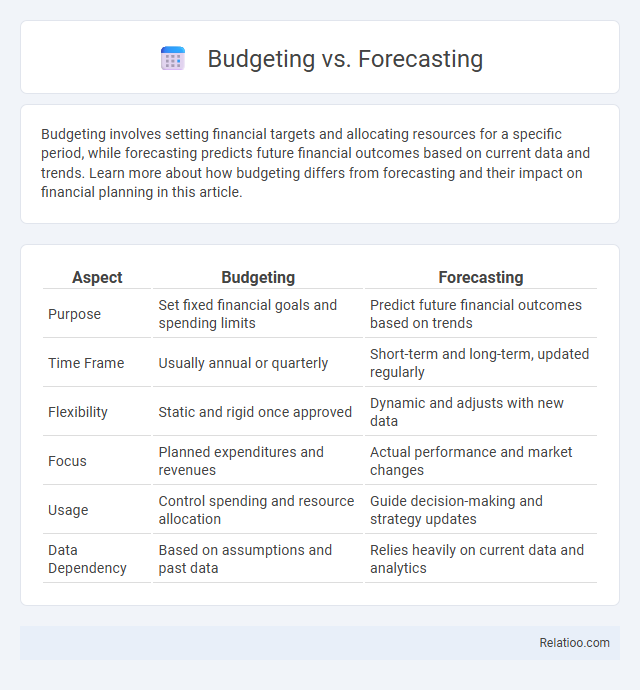

| Aspect | Budgeting | Forecasting |

|---|---|---|

| Purpose | Set fixed financial goals and spending limits | Predict future financial outcomes based on trends |

| Time Frame | Usually annual or quarterly | Short-term and long-term, updated regularly |

| Flexibility | Static and rigid once approved | Dynamic and adjusts with new data |

| Focus | Planned expenditures and revenues | Actual performance and market changes |

| Usage | Control spending and resource allocation | Guide decision-making and strategy updates |

| Data Dependency | Based on assumptions and past data | Relies heavily on current data and analytics |

Understanding Budgeting and Forecasting

Budgeting involves creating a detailed financial plan that outlines expected revenues and expenses over a specific period, serving as a control mechanism to guide financial decisions and resource allocation. Forecasting predicts future financial outcomes based on historical data, market trends, and economic indicators, enabling businesses to anticipate potential challenges and adjust strategies proactively. Understanding the distinction between budgeting and forecasting is essential for effective financial management, as budgeting sets targets while forecasting provides a dynamic tool for adapting to changing conditions.

Key Differences Between Budgeting and Forecasting

Budgeting establishes a fixed financial plan outlining expected revenues and expenses for a specific period, serving as a control mechanism to guide spending and resource allocation. Forecasting provides dynamic projections based on current and historical data, adapting to changing market conditions and informing strategic adjustments. Financial management encompasses both budgeting and forecasting, utilizing these tools to optimize capital allocation, manage cash flow, and achieve organizational financial goals.

Goals and Objectives of Budgeting

Budgeting focuses on setting specific financial goals and objectives to allocate resources efficiently and ensure spending aligns with organizational priorities. It establishes a detailed plan to control costs and maximize resource utilization by forecasting expected revenues and expenses within a given period. Forecasting projects future financial performance based on historical data, while financial management encompasses the broader strategic oversight of budgeting, forecasting, and resource allocation to achieve long-term business sustainability.

Purposes and Benefits of Forecasting

Forecasting aims to predict future financial outcomes based on historical data and market trends, enabling businesses to make informed decisions and allocate resources efficiently. Unlike budgeting, which sets fixed financial plans, forecasting provides dynamic insights that help in anticipating risks, identifying opportunities, and adjusting strategies proactively. The benefits of accurate forecasting include improved cash flow management, risk mitigation, and enhanced strategic planning, ultimately driving better business performance and sustainability.

Budgeting Process: Steps and Best Practices

The budgeting process begins with setting clear financial goals aligned with your organization's strategic objectives, followed by gathering detailed income and expense data to create an accurate spending plan. Key steps include involving stakeholders for input, using historical data for realistic assumptions, regularly monitoring actual performance against the budget, and adjusting forecasts to stay on track. Best practices emphasize transparency, thorough documentation, and integrating budgeting with forecasting and overall financial management to ensure optimal resource allocation and informed decision-making.

Forecasting Methods and Techniques

Forecasting methods and techniques in financial management include quantitative approaches such as time series analysis, regression models, and econometric forecasting, which utilize historical data to predict future financial trends. Qualitative methods like expert judgment, Delphi technique, and scenario analysis help incorporate market insights and uncertainty into financial predictions. You can improve budgeting accuracy and strategic planning by integrating these forecasting techniques to anticipate revenue, expenses, and cash flow effectively.

When to Use Budgeting vs. Forecasting

Budgeting is essential when you need a fixed financial plan for a specific period, helping you allocate resources and set spending limits tied to your organization's goals. Forecasting suits dynamic environments where predicting financial outcomes based on current trends allows you to adjust strategies proactively. Your business benefits most by using budgeting for control and forecasting for flexibility in financial decision-making.

Common Challenges in Budgeting and Forecasting

Common challenges in budgeting and forecasting include data inaccuracies, unrealistic assumptions, and lack of alignment with organizational goals, which can hinder effective financial planning. Your financial management efforts may suffer due to these issues, leading to cash flow problems and missed strategic opportunities. Implementing robust data validation and collaboration processes helps mitigate these obstacles and improves budget reliability.

Integrating Budgeting and Forecasting for Better Financial Planning

Integrating budgeting and forecasting enhances your financial planning by providing a dynamic and comprehensive framework to allocate resources and anticipate future revenues and expenses. Budgeting establishes fixed financial targets, while forecasting adapts these goals based on real-time data and market trends, improving accuracy and decision-making. This synergy between budgeting and forecasting empowers financial management to optimize cash flow, control costs, and achieve strategic objectives effectively.

Best Tools and Software for Budgeting and Forecasting

Top budgeting and forecasting tools like Adaptive Insights, Anaplan, and QuickBooks offer robust features tailored to streamline your financial planning and enhance accuracy. These platforms provide real-time data integration, customizable templates, and predictive analytics, ensuring efficient financial management and insightful decision-making. Leveraging software with AI-driven forecasting capabilities and cloud-based collaboration can significantly optimize your budgeting processes and financial performance.

Infographic: Budgeting vs Forecasting

relatioo.com

relatioo.com