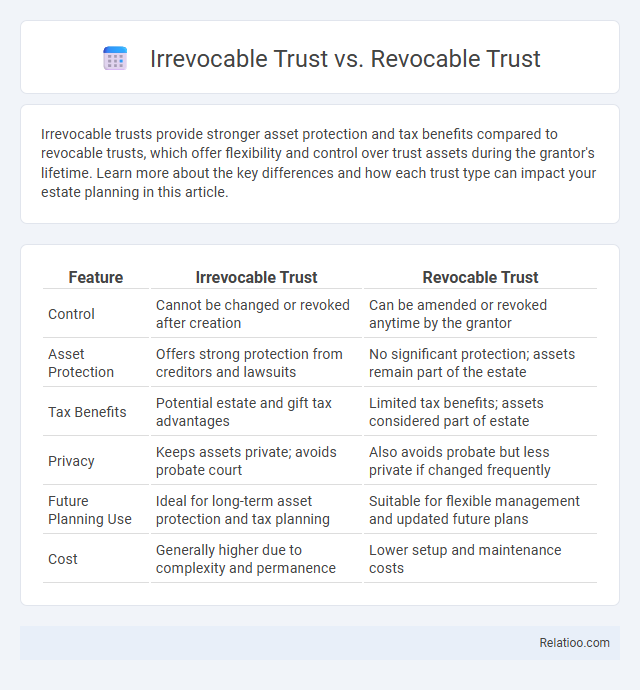

Irrevocable trusts provide stronger asset protection and tax benefits compared to revocable trusts, which offer flexibility and control over trust assets during the grantor's lifetime. Learn more about the key differences and how each trust type can impact your estate planning in this article.

Table of Comparison

| Feature | Irrevocable Trust | Revocable Trust |

|---|---|---|

| Control | Cannot be changed or revoked after creation | Can be amended or revoked anytime by the grantor |

| Asset Protection | Offers strong protection from creditors and lawsuits | No significant protection; assets remain part of the estate |

| Tax Benefits | Potential estate and gift tax advantages | Limited tax benefits; assets considered part of estate |

| Privacy | Keeps assets private; avoids probate court | Also avoids probate but less private if changed frequently |

| Future Planning Use | Ideal for long-term asset protection and tax planning | Suitable for flexible management and updated future plans |

| Cost | Generally higher due to complexity and permanence | Lower setup and maintenance costs |

Understanding Trusts: An Overview

Irrevocable trusts offer strong asset protection and tax benefits by permanently transferring ownership, whereas revocable trusts provide flexibility, allowing the grantor to modify or dissolve the trust during their lifetime. Both trust types facilitate estate planning, but irrevocable trusts are often used for legacy preservation and minimizing estate taxes. Understanding these distinctions helps individuals strategically manage wealth transfer and secure financial legacies effectively.

What Is an Irrevocable Trust?

An irrevocable trust is a legal arrangement where the grantor permanently relinquishes control and ownership of the assets placed within the trust, making changes or revocations impossible without beneficiary consent. Unlike revocable trusts, which allow the grantor to modify or dissolve the trust during their lifetime, irrevocable trusts provide stronger asset protection, tax benefits, and estate planning advantages by removing assets from the grantor's taxable estate. Legacy planning often incorporates irrevocable trusts to ensure efficient wealth transfer and safeguard assets for future generations.

What Is a Revocable Trust?

A revocable trust is a legal arrangement that allows the grantor to maintain control over the assets and make changes or revoke the trust during their lifetime. Unlike irrevocable trusts, revocable trusts provide flexibility and can help avoid probate while offering privacy and continuity in asset management. They differ from legacy planning tools by enabling the grantor to adapt the trust to changing circumstances without sacrificing control.

Key Differences Between Irrevocable and Revocable Trusts

Irrevocable trusts provide strong asset protection by permanently transferring ownership, making changes or revocation impossible without the beneficiary's consent. Revocable trusts offer flexibility by allowing you to alter or dissolve the trust during your lifetime, but they do not protect assets from creditors or estate taxes. Understanding these key differences is essential for structuring your estate plan to balance control, tax benefits, and asset protection effectively.

Control and Flexibility in Trust Management

Irrevocable trusts offer limited control once established, as assets are permanently transferred and cannot be altered or revoked, providing strong asset protection and tax benefits. Revocable trusts grant you full control and flexibility to modify terms or revoke the trust during your lifetime, but they offer less protection from creditors. Legacy planning often involves choosing between these trusts based on your priorities for control versus long-term asset security and flexibility in trust management.

Asset Protection Considerations

Irrevocable trusts offer superior asset protection by removing assets from the grantor's control, shielding them from creditors and lawsuits, unlike revocable trusts where the grantor retains ownership and assets remain vulnerable. Legacy planning often incorporates irrevocable trusts to ensure wealth preservation across generations, mitigating estate taxes and legal claims. In contrast, revocable trusts provide flexibility for asset management and distribution but lack robust protection against creditor claims or legal challenges.

Estate Tax Implications

Irrevocable trusts remove assets from Your taxable estate, potentially reducing estate tax liability by transferring ownership to the trust, while revocable trusts keep assets within Your estate, offering no immediate estate tax benefit but providing flexibility during Your lifetime. Legacy planning often incorporates irrevocable trusts to minimize estate taxes and ensure wealth preservation across generations. Understanding the distinct tax treatments of these trusts is essential for optimizing Your estate's tax efficiency and legacy goals.

Probate Avoidance and Privacy

An irrevocable trust offers strong probate avoidance and enhanced privacy since its terms cannot be altered, removing assets from your estate and shielding them from public probate records. A revocable trust also helps avoid probate but offers less privacy because you retain control over the assets, allowing changes or revocation during your lifetime, which may expose details if probate occurs. Legacy planning often incorporates irrevocable trusts to ensure seamless asset transfer, minimize estate taxes, and maintain confidentiality while protecting your heirs from lengthy probate processes.

Choosing the Right Trust for Your Needs

Choosing the right trust depends on your goals for asset protection, control, and estate planning. Irrevocable trusts offer strong asset protection and tax benefits but limit your ability to make changes once established, ideal for long-term legacy planning. Revocable trusts provide flexibility and ease of management during your lifetime but do not protect assets from creditors or reduce estate taxes, making them suitable for avoiding probate and managing assets efficiently.

Frequently Asked Questions About Irrevocable vs Revocable Trusts

Irrevocable trusts provide permanent asset protection and tax benefits by transferring ownership away from your control, while revocable trusts allow you to retain flexibility and make changes during your lifetime. Common questions about irrevocable vs revocable trusts include concerns about control, tax implications, and probate avoidance, with irrevocable trusts typically offering stronger protection but less adaptability. Your choice depends on priorities like estate planning goals, asset protection, and privacy needs.

Infographic: Irrevocable Trust vs Revocable Trust

relatioo.com

relatioo.com