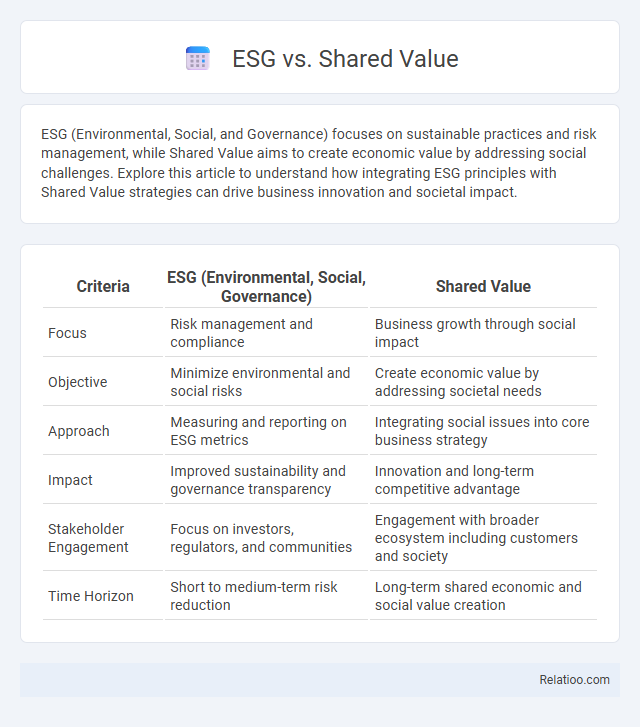

ESG (Environmental, Social, and Governance) focuses on sustainable practices and risk management, while Shared Value aims to create economic value by addressing social challenges. Explore this article to understand how integrating ESG principles with Shared Value strategies can drive business innovation and societal impact.

Table of Comparison

| Criteria | ESG (Environmental, Social, Governance) | Shared Value |

|---|---|---|

| Focus | Risk management and compliance | Business growth through social impact |

| Objective | Minimize environmental and social risks | Create economic value by addressing societal needs |

| Approach | Measuring and reporting on ESG metrics | Integrating social issues into core business strategy |

| Impact | Improved sustainability and governance transparency | Innovation and long-term competitive advantage |

| Stakeholder Engagement | Focus on investors, regulators, and communities | Engagement with broader ecosystem including customers and society |

| Time Horizon | Short to medium-term risk reduction | Long-term shared economic and social value creation |

Understanding ESG: Definition and Scope

ESG (Environmental, Social, and Governance) refers to a set of criteria used to evaluate a company's ethical impact and sustainability practices, encompassing factors like carbon emissions, labor rights, and board diversity. Understanding ESG helps your business align operations with responsible investment standards and stakeholder expectations, enhancing long-term value creation. Unlike Shared Value models, which focus on generating economic value through social impact, ESG emphasizes risk management and compliance across environmental and governance dimensions.

Shared Value: Concept and Principles

Shared Value focuses on creating economic value in a way that also produces value for society by addressing its challenges, aligning business success with social progress. The principles of Shared Value emphasize redefining productivity in the value chain, reconceiving products and markets to meet social needs, and enabling local cluster development to improve the business environment. Your company can drive innovation and competitive advantage by integrating social impact initiatives directly into its core strategy through Shared Value concepts.

Key Differences Between ESG and Shared Value

ESG (Environmental, Social, and Governance) focuses on measuring corporate performance and risk management through specific non-financial criteria, emphasizing compliance and reporting standards. Shared Value, by contrast, integrates social impact directly into core business strategies to create economic value by addressing societal challenges. The key difference lies in ESG's emphasis on accountability and transparency, whereas Shared Value prioritizes innovation and value creation through social progress.

The Business Case for ESG Adoption

ESG adoption drives measurable business benefits by enhancing risk management, improving access to capital, and boosting operational efficiency. Shared Value focuses on creating economic value in a way that also produces value for society, aligning business success with social progress. Your company can leverage ESG principles to achieve sustainable growth while addressing key environmental, social, and governance challenges that resonate with stakeholders.

Creating Shared Value: Strategies and Models

Creating Shared Value (CSV) strategies focus on generating economic value by addressing societal challenges, integrating social progress into core business operations. Unlike ESG, which emphasizes environmental, social, and governance metrics mainly for risk management and compliance, CSV prioritizes innovation and collaboration to create mutual benefits for companies and communities. Your business can leverage CSV models by aligning competitive advantage with social impact, fostering sustainable growth and long-term value creation.

ESG vs Shared Value: Impact on Stakeholders

ESG (Environmental, Social, Governance) focuses on measuring a company's sustainability and ethical impact, guiding investor decisions with standardized metrics that influence risk management and compliance. Shared Value emphasizes creating economic value in a way that also produces value for society by addressing social needs and challenges, fostering innovation and long-term growth. Understanding the distinction helps your organization balance regulatory expectations with transformative stakeholder engagement to drive both financial performance and community benefits.

Measuring Success: Metrics for ESG and Shared Value

Measuring success in ESG relies on quantifiable metrics such as carbon footprint reduction, diversity ratios, and governance compliance scores, reflecting environmental, social, and governance performance. Shared Value metrics focus on economic value creation combined with social impact, using indicators like community well-being improvements, job creation in underserved areas, and revenue growth from socially innovative products. Both frameworks require transparent, data-driven approaches, but Shared Value emphasizes integrated social and economic benefits, whereas ESG prioritizes risk management and regulatory adherence.

Challenges in Implementing ESG and Shared Value

Implementing ESG (Environmental, Social, and Governance) and Shared Value strategies presents challenges such as aligning diverse stakeholder interests, measuring non-financial performance, and integrating sustainability into core business operations. Your organization must navigate complexities in data transparency and reporting standards while fostering long-term commitment beyond short-term profits. Overcoming cultural resistance and ensuring consistent impact measurement are critical for achieving meaningful social and environmental outcomes.

Case Studies: Companies Leading in ESG and Shared Value

Unilever exemplifies leadership in both ESG and Shared Value through its Sustainable Living Plan, reducing environmental impact while improving health and livelihoods globally. Patagonia's commitment to environmental responsibility and social activism demonstrates effective ESG integration, coupled with shared value by supporting sustainable supply chains. Nestle's Creating Shared Value framework drives nutrition, water stewardship, and rural development, showcasing robust ESG practices aligned with long-term value creation.

Future Trends: ESG and Shared Value in Corporate Sustainability

Future trends in corporate sustainability emphasize the integration of ESG (Environmental, Social, and Governance) criteria with Shared Value strategies, driving long-term value creation for both companies and communities. Your organization can leverage ESG metrics to enhance transparency and risk management, while adopting Shared Value principles to innovate products and services that address social challenges. Increasingly, businesses that align ESG compliance with Shared Value initiatives are positioned to achieve sustainable growth and competitive advantage in evolving markets.

Infographic: ESG vs Shared Value

relatioo.com

relatioo.com