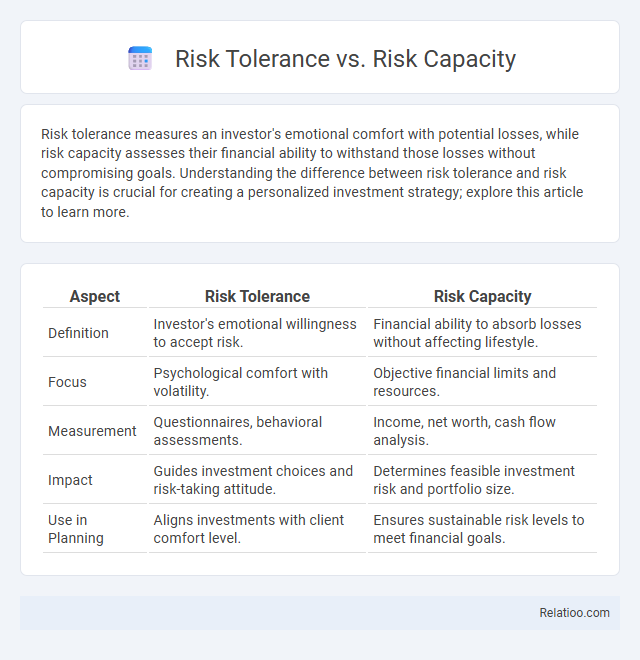

Risk tolerance measures an investor's emotional comfort with potential losses, while risk capacity assesses their financial ability to withstand those losses without compromising goals. Understanding the difference between risk tolerance and risk capacity is crucial for creating a personalized investment strategy; explore this article to learn more.

Table of Comparison

| Aspect | Risk Tolerance | Risk Capacity |

|---|---|---|

| Definition | Investor's emotional willingness to accept risk. | Financial ability to absorb losses without affecting lifestyle. |

| Focus | Psychological comfort with volatility. | Objective financial limits and resources. |

| Measurement | Questionnaires, behavioral assessments. | Income, net worth, cash flow analysis. |

| Impact | Guides investment choices and risk-taking attitude. | Determines feasible investment risk and portfolio size. |

| Use in Planning | Aligns investments with client comfort level. | Ensures sustainable risk levels to meet financial goals. |

Understanding Risk Tolerance and Risk Capacity

Understanding risk tolerance involves assessing your emotional willingness to endure investment fluctuations, while risk capacity measures your financial ability to withstand potential losses without jeopardizing your goals. Proper evaluation of both factors ensures that your investment strategy aligns not only with how much risk you can handle financially but also how much risk you can psychologically accept. Balancing risk tolerance and risk capacity is crucial for creating a sustainable and personalized financial plan that supports long-term success.

Defining Risk Tolerance

Risk tolerance defines an investor's willingness to endure fluctuations in the value of their portfolio without panic-selling or making impulsive decisions. It reflects psychological comfort with potential losses over a specific investment horizon, influenced by factors such as age, financial goals, and experience. Differentiating risk tolerance from risk capacity, which measures financial ability to absorb losses, is crucial for creating a balanced investment strategy that aligns emotions with financial realities.

What is Risk Capacity?

Risk capacity refers to an investor's financial ability to endure potential losses without compromising their long-term financial goals or essential living standards. It is determined by factors such as income stability, investment horizon, liquidity needs, and overall net worth, providing a realistic boundary for acceptable risk levels. Understanding risk capacity helps tailor investment strategies that balance growth potential with financial security.

Key Differences Between Risk Tolerance and Risk Capacity

Risk tolerance refers to your emotional willingness to endure market fluctuations and potential losses, while risk capacity measures your actual financial ability to bear those risks without jeopardizing your goals. Unlike risk tolerance, which is subjective and influenced by personal temperament, risk capacity is objective and based on factors such as income stability, investment horizon, and liquidity needs. Understanding the key differences between these concepts allows you to create a balanced investment strategy that aligns with both your comfort level and financial realities.

Why Risk Tolerance Matters in Financial Planning

Risk tolerance determines how much market volatility you can emotionally withstand while pursuing investment goals, directly influencing asset allocation decisions and portfolio design. Risk capacity assesses your financial ability to absorb potential losses without jeopardizing long-term objectives, ensuring your investment strategy aligns with your financial reality. Understanding your risk tolerance matters because it helps create a personalized financial plan that balances psychological comfort with realistic financial goals, reducing the likelihood of panic-driven decisions during market fluctuations.

The Importance of Assessing Risk Capacity

Assessing risk capacity is crucial for creating a personalized investment strategy that aligns with an individual's financial ability to absorb losses without compromising long-term goals. Unlike risk tolerance, which reflects emotional willingness to take risks, risk capacity measures actual financial strength, liquidity, income stability, and investment horizon. Proper evaluation of risk capacity prevents potential financial distress and ensures sustainable wealth growth by balancing risk exposure with realistic financial constraints.

Factors Influencing Risk Tolerance

Risk tolerance encompasses your emotional ability to endure market fluctuations, shaped by factors such as age, investment experience, financial goals, and personal temperament. Risk capacity, distinct from tolerance, refers to your objective financial ability to withstand losses without compromising lifestyle or goals. Understanding these factors ensures your investment strategy aligns with both your psychological comfort and financial reality, optimizing long-term portfolio performance.

Determinants of Risk Capacity

Risk Capacity is determined by your financial situation, including income stability, assets, liabilities, and time horizon for investments, which together define how much risk you can realistically afford to take without jeopardizing financial goals. Unlike Risk Tolerance, which measures your emotional willingness to accept risk, and Risk Appetite, which reflects your overall approach to risk-taking, Risk Capacity is a practical assessment of your ability to absorb losses. Understanding these determinants is crucial to balancing investment decisions aligned with your financial health and long-term objectives.

Aligning Investment Strategy with Risk Profiles

Aligning investment strategy with risk profiles requires understanding the distinctions between risk tolerance, risk capacity, and risk need. Risk tolerance refers to an investor's emotional comfort with potential losses, while risk capacity measures the financial ability to endure losses without compromising goals. Risk need considers the level of risk necessary to meet investment objectives, making the balance across these factors essential for creating a personalized, effective portfolio.

Practical Steps to Evaluate Your Risk Tolerance and Capacity

Assessing your risk tolerance and risk capacity requires a clear understanding of your financial goals, time horizon, and emotional comfort with market fluctuations. Begin by analyzing your income stability, expenses, and existing assets to gauge your risk capacity, which reflects your ability to endure potential financial losses. You can then measure your risk tolerance by using questionnaires and stress tests that reveal how you emotionally respond to varying degrees of investment risk, helping tailor an investment strategy that aligns with both your capacity and tolerance.

Infographic: Risk Tolerance vs Risk Capacity

relatioo.com

relatioo.com