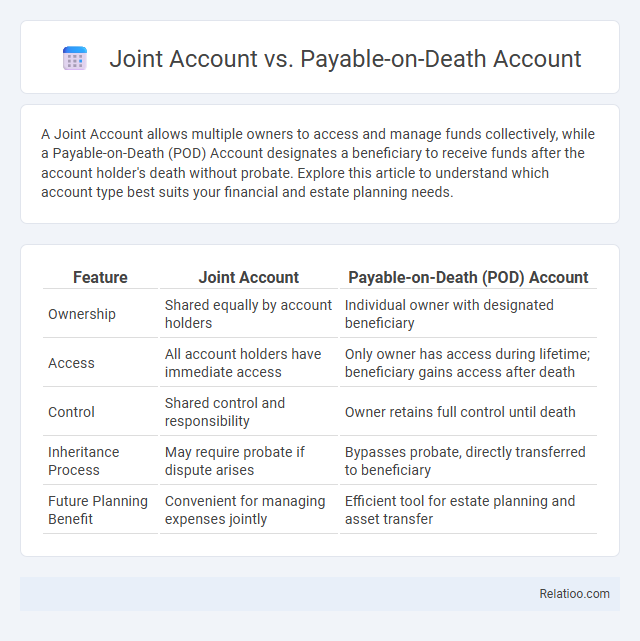

A Joint Account allows multiple owners to access and manage funds collectively, while a Payable-on-Death (POD) Account designates a beneficiary to receive funds after the account holder's death without probate. Explore this article to understand which account type best suits your financial and estate planning needs.

Table of Comparison

| Feature | Joint Account | Payable-on-Death (POD) Account |

|---|---|---|

| Ownership | Shared equally by account holders | Individual owner with designated beneficiary |

| Access | All account holders have immediate access | Only owner has access during lifetime; beneficiary gains access after death |

| Control | Shared control and responsibility | Owner retains full control until death |

| Inheritance Process | May require probate if dispute arises | Bypasses probate, directly transferred to beneficiary |

| Future Planning Benefit | Convenient for managing expenses jointly | Efficient tool for estate planning and asset transfer |

Understanding Joint Accounts

Joint accounts allow multiple individuals to share ownership and access to a single bank account, enabling efficient management of shared finances. Unlike payable-on-death (POD) accounts, where the account transfers directly to a named beneficiary upon the owner's death, joint accounts provide equal rights to all parties during the account holder's lifetime. Understanding the distinctions helps you determine the best option for managing funds with trusted parties while protecting your financial interests.

What is a Payable-on-Death (POD) Account?

A Payable-on-Death (POD) account allows you to designate one or more beneficiaries who receive the funds directly upon your death, avoiding probate and ensuring quick access to the money. Unlike a joint account where co-owners share control and access during your lifetime, a POD account maintains your sole ownership and transfers only upon your passing. This arrangement provides a clear, legally recognized method for your assets to pass smoothly to your named beneficiaries.

Key Differences Between Joint and POD Accounts

Joint accounts allow multiple account holders to manage funds simultaneously with shared ownership and equal access, while payable-on-death (POD) accounts designate a beneficiary who receives the funds only after the primary account holder's death. Unlike joint accounts, POD accounts maintain sole control by the primary owner during their lifetime and avoid probate by directly transferring assets to the named beneficiary. The key difference lies in management rights and ownership: joint accounts involve shared control, whereas POD accounts provide sole control until death with a designated successor.

Ownership and Access to Funds

Joint accounts allow multiple owners who share equal rights to access and manage the funds, making it ideal for partners or family members needing shared control over finances. Payable-on-Death (POD) accounts designate a beneficiary who gains access only after the primary account holder's death, ensuring your funds remain solely under your control during your lifetime. Ownership in joint accounts is shared immediately, while POD accounts provide individual ownership with conditional access, reflecting different estate planning strategies and access levels.

Impact on Estate Planning

Choosing between a Joint Account, Payable-on-Death (POD) Account, and another form of Joint Account significantly impacts your estate planning strategy. Joint Accounts allow co-owners immediate access to funds, which can bypass probate but may expose assets to creditors or unintended heirs. POD Accounts transfer funds directly to named beneficiaries upon death, ensuring a smoother transition with fewer legal complications.

Rights of Survivorship Explained

A Joint Account typically includes the right of survivorship, meaning that if one owner passes away, the surviving owners automatically gain full control of the account without probate. In contrast, a Payable-on-Death (POD) Account designates a beneficiary who only gains access after the account holder's death, bypassing probate while the original owner retains full control during their lifetime. Understanding these distinctions ensures proper estate planning by clearly defining how account ownership and access rights transfer upon death.

Beneficiary Designations in POD Accounts

Payable-on-Death (POD) accounts allow you to designate beneficiaries who receive funds directly upon your death, bypassing probate and ensuring immediate access to your assets. Unlike joint accounts, which grant co-owners equal control and rights to the funds during your lifetime, POD accounts maintain your sole control until death while securely passing the balance to named beneficiaries. Understanding the distinction in beneficiary designations is crucial for estate planning, as POD accounts provide a clear, straightforward transfer process without joint ownership complications.

Probate Implications

Joint accounts allow multiple owners to access funds equally, with the surviving owner(s) typically avoiding probate due to right of survivorship. Payable-on-Death (POD) accounts name a beneficiary who receives the funds directly upon the account holder's death, bypassing probate entirely. Unlike joint accounts, POD accounts maintain sole ownership during the holder's lifetime, minimizing probate complications and providing clearer estate distribution.

Choosing Between Joint and POD Accounts

Choosing between a joint account and a payable-on-death (POD) account depends on your goals for account access and beneficiary designation. A joint account allows multiple people to have full access and management rights, enabling shared control and immediate fund use, while a POD account designates a beneficiary who gains ownership only after your death, preserving your control during your lifetime. Understanding these differences ensures that your financial assets are structured to meet your needs for access, control, and seamless transfer upon your passing.

Frequently Asked Questions

A Joint Account allows multiple individuals to share ownership and access, making it ideal for shared expenses or managing finances together. A Payable-on-Death (POD) Account designates a beneficiary to receive funds upon your death, ensuring smooth transfer without probate. You should consider how each option impacts control, access, and the ease of transferring assets when planning your financial accounts.

Infographic: Joint Account vs Payable-on-Death Account

relatioo.com

relatioo.com