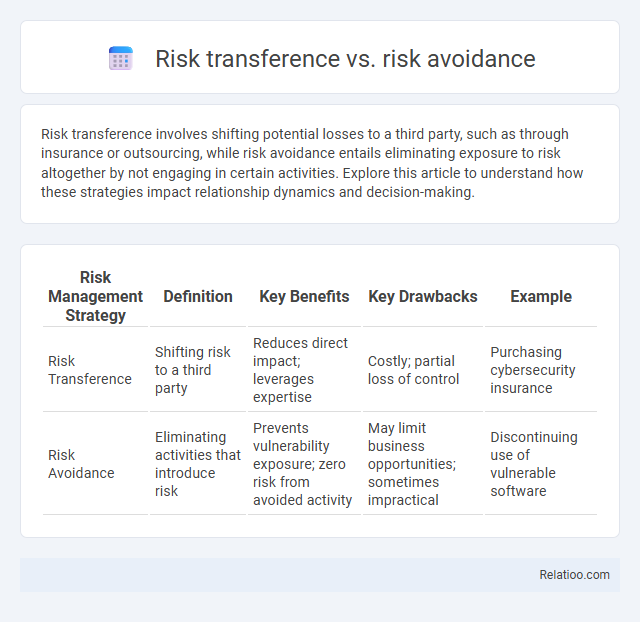

Risk transference involves shifting potential losses to a third party, such as through insurance or outsourcing, while risk avoidance entails eliminating exposure to risk altogether by not engaging in certain activities. Explore this article to understand how these strategies impact relationship dynamics and decision-making.

Table of Comparison

| Risk Management Strategy | Definition | Key Benefits | Key Drawbacks | Example |

|---|---|---|---|---|

| Risk Transference | Shifting risk to a third party | Reduces direct impact; leverages expertise | Costly; partial loss of control | Purchasing cybersecurity insurance |

| Risk Avoidance | Eliminating activities that introduce risk | Prevents vulnerability exposure; zero risk from avoided activity | May limit business opportunities; sometimes impractical | Discontinuing use of vulnerable software |

Introduction to Risk Management Strategies

Risk management strategies encompass risk transference, risk avoidance, and risk retention, each addressing potential threats differently to protect your assets and operations. Risk transference involves shifting the financial consequences of a risk to a third party, such as through insurance or outsourcing. Risk avoidance eliminates exposure to a risk altogether by choosing not to engage in certain activities, minimizing the chance of loss but possibly foregoing opportunities.

Defining Risk Transference

Risk transference involves shifting the potential financial consequences of a risk to a third party, commonly through insurance policies or outsourcing agreements. Unlike risk avoidance, which eliminates exposure to a risk entirely by not engaging in the activity, risk transference allows Your organization to retain operational control while mitigating potential losses. Effective risk transference strategies reduce your vulnerability by legally assigning responsibility for specific risks to external entities equipped to manage them.

Understanding Risk Avoidance

Risk avoidance involves completely eliminating exposure to a risk by choosing not to engage in activities that could lead to that risk, which protects Your assets and operations from potential harm. Risk transference shifts the impact of the risk to a third party, such as through insurance or outsourcing, while risk avoidance seeks to prevent the risk from occurring altogether. Understanding risk avoidance is crucial for developing strategies that maintain business continuity and reduce vulnerability without relying on external risk handlers.

Key Differences Between Transference and Avoidance

Risk transference involves shifting the potential financial impact of a risk to a third party, often through insurance or contractual agreements, while risk avoidance eliminates the risk entirely by choosing not to engage in the activity that generates it. The key difference between risk transference and avoidance lies in their approach: transference accepts the risk but reduces your direct exposure, whereas avoidance removes the risk at the cost of foregoing potential opportunities. Understanding these distinctions helps you decide whether to mitigate risks indirectly or eliminate them completely based on your risk tolerance and business objectives.

Advantages of Risk Transference

Risk transference involves shifting the potential financial consequences of a risk to a third party, often through insurance or contractual agreements, allowing organizations to protect their assets and cash flow. Unlike risk avoidance, which eliminates exposure by not engaging in certain activities, risk transference enables business continuity while managing risks proactively. The primary advantage of risk transference is the reduction of uncertainty and potential losses, preserving organizational resources and enabling strategic focus on core operations.

Benefits of Risk Avoidance

Risk avoidance eliminates potential threats by steering clear of activities or decisions that expose you to risk, effectively reducing exposure to losses and unforeseen costs. Unlike risk transference, which shifts potential impacts to third parties such as insurers or contractors, risk avoidance ensures complete prevention of risk occurrence. Choosing risk avoidance benefits your organization by maintaining operational stability, preserving resources, and fostering a proactive risk management culture.

Practical Examples of Risk Transference

Risk transference involves shifting potential risks to a third party, such as through insurance policies or outsourcing, allowing your organization to mitigate financial exposure from uncertain events. For example, companies often transfer cyber liability risks by purchasing cybersecurity insurance or delegate IT security to specialized service providers, effectively passing the responsibility and cost of data breaches onto others. Unlike risk avoidance, which eliminates exposure by not engaging in risky activities, transference enables continued operations while managing risk through contractual agreements and financial instruments.

Real-World Scenarios: Risk Avoidance in Action

Risk avoidance involves completely eliminating exposure to risk by choosing not to engage in activities that carry potential threats, such as a company deciding not to enter volatile markets to protect its assets. Risk transference, on the other hand, shifts the risk to a third party, often through insurance or outsourcing specific operations, allowing organizations to mitigate financial impact while maintaining business activities. Your decision between avoidance and transference depends on balancing potential losses against operational goals, with risk avoidance offering maximum protection by sidestepping hazards altogether in real-world scenarios.

When to Choose Transference Over Avoidance

Risk transference involves shifting the potential financial impact of a risk to a third party, such as through insurance or outsourcing, while risk avoidance eliminates the risk entirely by not engaging in certain activities. You should choose risk transference over avoidance when the risk is unavoidable but financially manageable through contracts or insurance, allowing your business to continue operations without bearing full exposure. This strategy is effective when the cost of transferring the risk is lower than the potential loss and avoiding the risk would hinder growth or operational efficiency.

Strategic Recommendations for Effective Risk Management

Risk transference involves shifting potential losses to a third party, such as through insurance or outsourcing, while risk avoidance entails eliminating activities that generate risk altogether. Strategic recommendations for effective risk management emphasize balancing these approaches by assessing the organization's risk tolerance, ensuring comprehensive insurance coverage, and implementing contracts that clearly define risk responsibility. Integrating risk transfer mechanisms with proactive avoidance strategies enhances resilience and minimizes exposure without compromising operational objectives.

Infographic: Risk transference vs risk avoidance

relatioo.com

relatioo.com