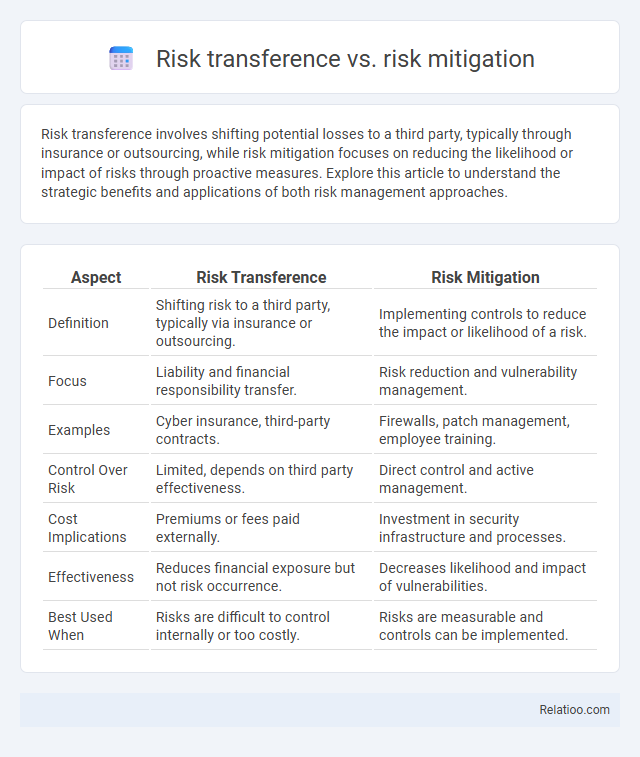

Risk transference involves shifting potential losses to a third party, typically through insurance or outsourcing, while risk mitigation focuses on reducing the likelihood or impact of risks through proactive measures. Explore this article to understand the strategic benefits and applications of both risk management approaches.

Table of Comparison

| Aspect | Risk Transference | Risk Mitigation |

|---|---|---|

| Definition | Shifting risk to a third party, typically via insurance or outsourcing. | Implementing controls to reduce the impact or likelihood of a risk. |

| Focus | Liability and financial responsibility transfer. | Risk reduction and vulnerability management. |

| Examples | Cyber insurance, third-party contracts. | Firewalls, patch management, employee training. |

| Control Over Risk | Limited, depends on third party effectiveness. | Direct control and active management. |

| Cost Implications | Premiums or fees paid externally. | Investment in security infrastructure and processes. |

| Effectiveness | Reduces financial exposure but not risk occurrence. | Decreases likelihood and impact of vulnerabilities. |

| Best Used When | Risks are difficult to control internally or too costly. | Risks are measurable and controls can be implemented. |

Understanding Risk Management: An Overview

Risk transference involves shifting potential losses to a third party, such as through insurance or outsourcing, minimizing direct exposure to threats. Risk mitigation focuses on reducing the impact or likelihood of risks by implementing controls, safety measures, or process improvements. Understanding risk management requires distinguishing these strategies to effectively balance risk retention and reduction within organizational frameworks.

Defining Risk Transference

Risk transference involves shifting the potential financial impact of a risk to a third party, typically through insurance policies or outsourcing specific tasks. Unlike risk mitigation, which aims to reduce the likelihood or severity of a risk through proactive measures, transference reallocates responsibility without eliminating the risk itself. Your strategic approach to managing risks should clearly differentiate transference from mitigation to ensure appropriate allocation and control.

Defining Risk Mitigation

Risk mitigation involves implementing strategies and controls to reduce the likelihood or impact of risks, such as adopting safety protocols or diversifying investments. Risk transference shifts potential losses to third parties, commonly through insurance or outsourcing, transferring financial responsibility rather than reducing the risk itself. Understanding risk mitigation is crucial for proactive risk management, emphasizing prevention and reduction rather than shifting risk.

Key Differences Between Risk Transference and Mitigation

Risk transference involves shifting the financial impact of a risk to a third party, such as through insurance or outsourcing, while risk mitigation focuses on reducing the likelihood or severity of the risk through proactive measures. You can manage your organization's exposure effectively by understanding that transference does not eliminate risk but reallocates it, whereas mitigation aims to control and minimize the risk directly. Key differences include the responsibility for risk consequences, with transference handing off risk to another entity, and mitigation requiring internal actions to lower potential damage.

Advantages of Risk Transference

Risk transference involves shifting potential losses to a third party, often through insurance or contracts, reducing the financial impact on the original party. This strategy offers clear advantages such as protecting cash flow, limiting liability, and enabling organizations to focus on core activities without bearing full exposure. By transferring risk, companies can achieve greater operational stability and predictability in uncertain environments.

Advantages of Risk Mitigation

Risk mitigation reduces potential losses by implementing proactive measures to minimize the impact or likelihood of risks, enhancing overall project stability and decision-making. Unlike risk transference, which shifts the responsibility to third parties such as insurance providers, mitigation directly addresses root causes to prevent issues from escalating. This approach improves control over risk outcomes, reduces dependency on external entities, and often results in long-term cost savings and improved operational resilience.

Common Methods of Risk Transference

Risk transference involves shifting the financial consequences of a risk to a third party, often through insurance policies, contractual agreements, or outsourcing. Common methods of risk transference include purchasing liability insurance, entering into indemnity contracts, and outsourcing specific business functions to specialists who assume associated risks. Your choice between risk transference and risk mitigation depends on factors like cost, expertise, and risk tolerance, where mitigation seeks to reduce the impact or likelihood of the risk within your control.

Effective Strategies for Risk Mitigation

Effective strategies for risk mitigation involve identifying potential threats and implementing controls to reduce their impact, such as safety protocols, insurance policies, and contingency planning. Risk transference shifts the financial burden of loss to a third party, typically through contracts or insurance, while risk mitigation focuses on lowering the likelihood or severity of risk occurring. Your organization benefits most when blending transference with proactive risk mitigation to create a comprehensive risk management framework.

When to Choose Transference Over Mitigation

Risk transference involves shifting the potential financial impact of a risk to a third party, such as through insurance or outsourcing, while risk mitigation focuses on reducing the likelihood or consequences of a risk within your organization. You should choose transference over mitigation when the risk is financially significant but beyond your capacity to effectively control or reduce, making it more cost-efficient to transfer the responsibility. Transference is particularly useful for risks that are infrequent yet have severe financial repercussions, ensuring your business continuity without dedicating excessive resources to risk control.

Integrating Both Approaches for Optimal Risk Management

Risk transference involves shifting potential losses to a third party, such as through insurance, while risk mitigation focuses on reducing the likelihood or impact of risks through preventive measures and controls. Integrating both approaches enhances your risk management strategy by balancing protection and proactive risk reduction, ensuring comprehensive coverage against potential threats. Employing a combination of transference and mitigation allows organizations to optimize resource allocation and maintain operational resilience.

Infographic: Risk transference vs risk mitigation

relatioo.com

relatioo.com