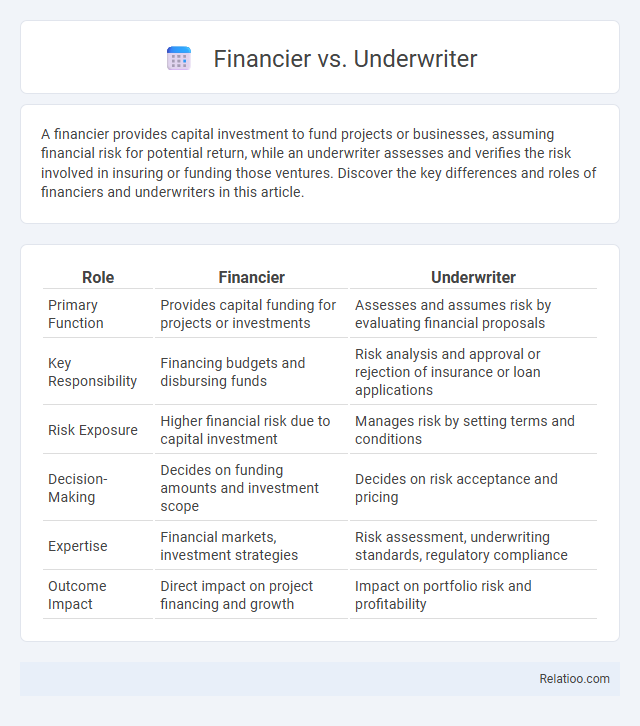

A financier provides capital investment to fund projects or businesses, assuming financial risk for potential return, while an underwriter assesses and verifies the risk involved in insuring or funding those ventures. Discover the key differences and roles of financiers and underwriters in this article.

Table of Comparison

| Role | Financier | Underwriter |

|---|---|---|

| Primary Function | Provides capital funding for projects or investments | Assesses and assumes risk by evaluating financial proposals |

| Key Responsibility | Financing budgets and disbursing funds | Risk analysis and approval or rejection of insurance or loan applications |

| Risk Exposure | Higher financial risk due to capital investment | Manages risk by setting terms and conditions |

| Decision-Making | Decides on funding amounts and investment scope | Decides on risk acceptance and pricing |

| Expertise | Financial markets, investment strategies | Risk assessment, underwriting standards, regulatory compliance |

| Outcome Impact | Direct impact on project financing and growth | Impact on portfolio risk and profitability |

Introduction: Defining Financier and Underwriter

A financier is an individual or institution that provides capital for businesses or projects, often assuming significant financial risk to earn a return on investment. An underwriter acts as a financial intermediary who evaluates and assumes the risk of insuring or guaranteeing securities, loans, or insurance policies, ensuring the issuer or borrower meets credit and compliance standards. Your understanding of these roles clarifies how capital is sourced and risks are managed in financial markets.

Roles and Responsibilities

Financiers primarily provide capital funding to businesses or projects, assuming financial risk in exchange for potential returns. Underwriters assess and evaluate the risks associated with insurance policies, securities offerings, or loans, ensuring compliance and determining terms acceptable to the financing institution. The role of financiers includes allocating resources and managing investments, whereas underwriters focus on risk analysis, approval processes, and safeguards to protect the financial interests of their organizations.

Key Differences Between Financier and Underwriter

A financier provides capital for projects or businesses by investing or lending funds, directly assuming financial risk associated with the investment. An underwriter, meanwhile, assesses and assumes the risk of insuring or guaranteeing securities, loans, or insurance policies, ensuring that financial transactions meet regulatory standards and market conditions. Your key difference lies in the financier's focus on funding and risk-taking, while the underwriter's role centers on evaluating, pricing, and managing financial risk exposure.

Types of Financiers in the Financial Sector

Types of financiers in the financial sector include banks, venture capitalists, angel investors, private equity firms, and government agencies, each providing capital through loans, equity investments, or grants. Underwriters specialize in assessing risk for securities issuance, guaranteeing the sale by purchasing securities from the issuer and reselling them to investors. Financiers broadly supply funding but vary by source, risk exposure, and investment horizon, shaping diverse financial ecosystems.

Types of Underwriters and Their Functions

Types of underwriters include insurance underwriters, who assess risk and determine policy terms; securities underwriters, responsible for evaluating and managing initial public offerings and bond issuances; and loan underwriters, who analyze creditworthiness for mortgage or loan approvals. Your financial decisions benefit from understanding these roles, as underwriters act as risk assessors and facilitators in various financial transactions. Financiers primarily provide capital or funding, whereas underwriters evaluate and guarantee the financial viability and risk associated with the investment or loan.

Risk Assessment Methods

Financiers evaluate investment opportunities using comprehensive financial analysis and market research to manage potential losses, emphasizing creditworthiness and return expectations. Underwriters specifically focus on assessing risks related to insurance policies or securities issuance through detailed evaluation of applicant information and risk modeling to determine approval and terms. Your decision-making process benefits from understanding that financiers prioritize overall financial viability, while underwriters apply specialized risk assessment methods to mitigate potential liabilities in underwriting contracts.

Involvement in Funding and Investment

A financier directly provides capital to fund projects or businesses, taking on financial risk and potential returns. An underwriter evaluates and assumes risk by guaranteeing the sale of securities or loans, ensuring the transaction secures necessary funds but may not provide direct financing. Your understanding of these roles clarifies how funding and investment processes operate, highlighting the financier's active capital deployment versus the underwriter's risk assessment and guarantee functions.

Impact on Financial Markets

Financiers provide capital to businesses or projects, influencing liquidity and investment opportunities within financial markets. Underwriters assess risk and guarantee the sale of securities, ensuring stability and confidence in market transactions. Your understanding of their distinct roles can help optimize investment strategies and enhance market efficiency.

Skills and Qualifications Required

Financiers require strong analytical skills, financial modeling expertise, and a deep understanding of market trends and investment strategies to manage capital effectively. Underwriters must possess keen risk assessment abilities, proficiency in regulatory compliance, and solid knowledge of insurance or loan policies to evaluate and approve applications accurately. Both roles demand strong communication skills and attention to detail, while financiers often need advanced degrees in finance or economics, and underwriters typically require certifications such as Chartered Property Casualty Underwriter (CPCU) or relevant licenses.

Choosing Between a Financier and an Underwriter

Choosing between a financier and an underwriter depends on the specific needs of the business and the stage of the funding process. A financier provides direct capital investment or loans to businesses, focusing on funding growth, while an underwriter assesses risk and guarantees the sale of securities during capital raising events such as IPOs or bond issuances. Understanding the role each plays in financial markets helps businesses optimize their capital structure and ensure successful fundraising efforts.

Infographic: Financier vs Underwriter

relatioo.com

relatioo.com