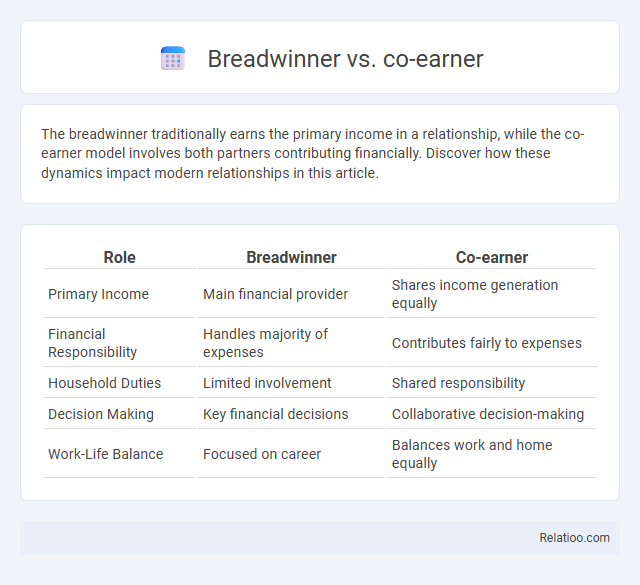

The breadwinner traditionally earns the primary income in a relationship, while the co-earner model involves both partners contributing financially. Discover how these dynamics impact modern relationships in this article.

Table of Comparison

| Role | Breadwinner | Co-earner |

|---|---|---|

| Primary Income | Main financial provider | Shares income generation equally |

| Financial Responsibility | Handles majority of expenses | Contributes fairly to expenses |

| Household Duties | Limited involvement | Shared responsibility |

| Decision Making | Key financial decisions | Collaborative decision-making |

| Work-Life Balance | Focused on career | Balances work and home equally |

Understanding the Breadwinner and Co-earner Roles

The breadwinner typically serves as the primary income provider, responsible for supporting the household financially. The co-earner model involves both partners contributing significantly to the household income, often sharing financial responsibilities more equally. Understanding these roles highlights how economic contributions shape family dynamics and financial decision-making.

Historical Evolution of Household Earnings

The historical evolution of household earnings reveals a shift from traditional breadwinner models, where one partner--usually the male--solely provided for the family, to co-earner arrangements emphasizing dual incomes and shared financial responsibilities. Over time, socio-economic changes such as increased female workforce participation and shifting gender roles have redefined the breadwinner concept, making Your household earnings more dynamic and diverse. This transformation highlights how economic survival and prosperity increasingly depend on the combined efforts of both partners rather than a single income source.

Gender Dynamics in Income Contribution

Gender dynamics in income contribution reveal distinct patterns among breadwinners, co-earners, and dual breadwinner households, with men traditionally more likely to be sole breadwinners while women increasingly participate as co-earners. Research indicates that dual breadwinner arrangements promote greater financial equality and shift household power dynamics by reducing dependence on a single income. Understanding your role within these frameworks can highlight the impact of evolving gender norms on economic contributions and family decision-making.

Financial Implications: Single vs Shared Responsibility

Financial implications differ significantly between breadwinner and co-earner roles, as a single breadwinner carries full responsibility for household expenses, increasing financial risk and pressure. In contrast, a co-earner model spreads income sources, enhancing financial stability and allowing for shared savings and investment opportunities. Your financial security improves when responsibilities are shared, reducing reliance on one income and diversifying financial risk.

Impact on Family Relationships and Dynamics

The breadwinner model, where one partner primarily earns income, often leads to clear but potentially rigid family roles, impacting decision-making dynamics and sometimes causing resentment or imbalance in household responsibilities. Co-earner families, with both partners contributing financially, tend to promote more egalitarian relationships and shared decision-making, which can strengthen emotional bonds but also introduce stress from juggling work and family duties. In households blending breadwinner and co-earner roles, dynamics can become complex as partners negotiate income contributions and caregiving roles, influencing communication patterns and mutual expectations within the family.

Work-Life Balance for Breadwinners and Co-earners

Breadwinners often face intense pressure to prioritize work over personal life, resulting in challenges maintaining a healthy work-life balance due to their primary role as the main income provider. Co-earners share financial responsibilities more evenly, allowing for greater flexibility to balance career demands with family and personal time, which can reduce stress and improve overall well-being. Understanding your role as either a breadwinner or co-earner is essential in implementing strategies that support sustainable work-life integration tailored to your specific circumstances.

Societal Expectations and Stereotypes

Societal expectations often cast the breadwinner as the primary financial provider, reinforcing traditional gender roles where men dominate earnings and women handle domestic duties. The co-earner model challenges these stereotypes by promoting shared financial responsibility, reflecting a shift toward gender equality in many modern households. Understanding these dynamics helps you navigate societal pressures and fosters more inclusive views on family roles and financial contributions.

Effects on Career Growth and Personal Development

Breadwinner roles often demand long hours and high responsibility, which can limit Your opportunities for career growth and personal development due to increased stress and time constraints. Co-earner dynamics promote shared financial and emotional support, enabling both partners to balance career advancement and personal growth more effectively. Breadwinner-co-earner relationships encourage collaboration but may still create disparities in career progression if one partner prioritizes work over development.

Challenges Facing Modern Households

Modern households face complex financial and emotional challenges when roles are defined as Breadwinner versus Co-earner versus Dual Breadwinner models, impacting income distribution and work-life balance. Breadwinner households often struggle with pressure on a single income source, while Co-earner families navigate challenges in dividing domestic responsibilities alongside dual incomes. Dual Breadwinner families encounter stress related to coordinating schedules, childcare, and career advancement, emphasizing the need for flexible work policies and supportive social systems.

Strategies for Achieving Financial Partnership

Achieving financial partnership involves balancing the roles of breadwinner and co-earner by aligning your income contributions and financial goals. Your strategy should include transparent communication about earnings, shared budgeting, and equitable decision-making to ensure both partners feel valued and responsible. Prioritizing joint investments and savings plans creates a stable foundation for long-term financial success and mutual support.

Infographic: Breadwinner vs Co-earner

relatioo.com

relatioo.com