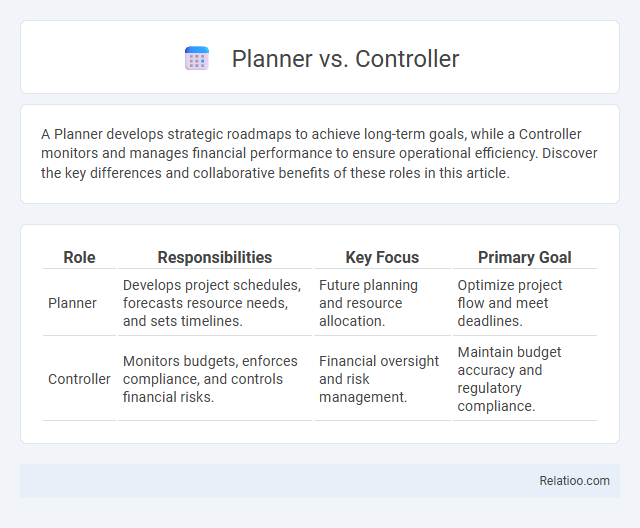

A Planner develops strategic roadmaps to achieve long-term goals, while a Controller monitors and manages financial performance to ensure operational efficiency. Discover the key differences and collaborative benefits of these roles in this article.

Table of Comparison

| Role | Responsibilities | Key Focus | Primary Goal |

|---|---|---|---|

| Planner | Develops project schedules, forecasts resource needs, and sets timelines. | Future planning and resource allocation. | Optimize project flow and meet deadlines. |

| Controller | Monitors budgets, enforces compliance, and controls financial risks. | Financial oversight and risk management. | Maintain budget accuracy and regulatory compliance. |

Understanding Planners and Controllers

Planners focus on strategic resource allocation and scheduling to optimize project timelines and budgets, while controllers oversee financial reporting, compliance, and internal controls to ensure accuracy and integrity of financial data. Understanding planners involves analyzing forecasting techniques, capacity planning, and operational efficiency, whereas controllers emphasize budgeting, variance analysis, and regulatory adherence. Effective collaboration between planners and controllers enhances organizational performance by aligning financial management with operational goals.

Key Differences Between Planners and Controllers

Planners focus on forecasting demand, scheduling resources, and optimizing production workflows, while controllers concentrate on monitoring financial performance, managing budgets, and ensuring compliance with accounting standards. Planners engage in strategic and operational activities to align supply chain processes with market needs, whereas controllers handle detailed financial data analysis and internal controls to safeguard company assets. The primary differentiation lies in planners driving forward-looking operational efficiency, contrasted with controllers maintaining historical financial accuracy and regulatory adherence.

Roles and Responsibilities of a Planner

A Planner is responsible for developing comprehensive project schedules, forecasting resource requirements, and coordinating timelines to ensure on-time delivery. The Controller manages financial oversight, budget tracking, and cost control measures to maintain project profitability. Compared to Controllers, Planners emphasize strategic timeline alignment and risk mitigation to optimize workflow efficiency.

Duties and Functions of a Controller

A Controller manages an organization's financial reporting, budgeting, and internal controls, ensuring accuracy and compliance with accounting standards. Responsibilities include overseeing accounts payable and receivable, preparing financial statements, and coordinating audits to safeguard company assets. Your focus on maintaining financial integrity distinguishes the Controller from Planners, who primarily develop strategies and forecasts for business growth.

Skills Required for Planners vs Controllers

Planners require strong analytical skills, proficiency in forecasting techniques, and the ability to interpret market trends to effectively allocate resources and develop strategic plans. Controllers need expertise in financial reporting, budgeting accuracy, regulatory compliance, and risk management to ensure precise control over an organization's financial health. Your choice between these roles depends on whether you excel in forward-looking strategy and coordination (planner) or meticulous financial oversight and control (controller).

Career Paths: Planner vs Controller

Career paths for planners often lead to roles in strategic project management and operational efficiency, emphasizing forecasting and resource allocation. Controllers typically advance toward senior financial management positions, focusing on budgeting, compliance, and financial reporting. Your choice between these paths depends on whether you prefer analytical planning or financial oversight in corporate decision-making.

Planning Tools vs Controlling Tools

Planning tools, such as Microsoft Project and Asana, enable planners to create schedules, allocate resources, and forecast project timelines effectively. Controlling tools like SAP Controlling and Oracle EPM assist controllers in monitoring budgets, tracking expenses, and managing financial performance. Both sets of tools complement each other by integrating project planning processes with financial control mechanisms to ensure successful project delivery and cost management.

Impact on Project Success: Planner vs Controller

The Planner shapes project success by creating detailed schedules, resource allocations, and risk assessments, ensuring tasks align with strategic goals. The Controller monitors project progress, controls costs, and enforces adherence to timelines, mitigating deviations that could jeopardize outcomes. Effective collaboration between Planner and Controller enhances project efficiency, minimizes delays, and drives targeted results.

Common Challenges Faced by Planners and Controllers

Planners and controllers frequently encounter challenges such as inaccurate data forecasting, which hinders effective resource allocation and budget adherence. Both roles struggle with real-time data integration, impacting their ability to make timely decisions and adjust plans accordingly. Communication gaps between departments often result in misaligned objectives, complicating the synchronization of operational and financial strategies.

Choosing the Right Role: Planner or Controller

Choosing the right role between Planner and Controller depends on your career goals and strengths in data analysis or financial management. Planners focus on forecasting, budgeting, and strategic planning to guide your organization's growth, while Controllers manage financial reporting, compliance, and internal controls to ensure accuracy and accountability. Understanding your preference for forward-looking decision-making or regulatory oversight is key to selecting the most suitable position.

Infographic: Planner vs Controller

relatioo.com

relatioo.com