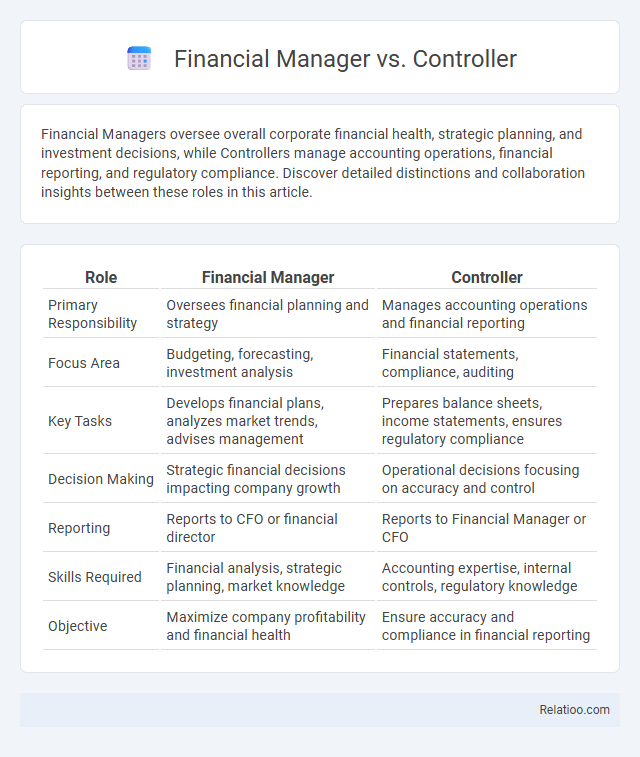

Financial Managers oversee overall corporate financial health, strategic planning, and investment decisions, while Controllers manage accounting operations, financial reporting, and regulatory compliance. Discover detailed distinctions and collaboration insights between these roles in this article.

Table of Comparison

| Role | Financial Manager | Controller |

|---|---|---|

| Primary Responsibility | Oversees financial planning and strategy | Manages accounting operations and financial reporting |

| Focus Area | Budgeting, forecasting, investment analysis | Financial statements, compliance, auditing |

| Key Tasks | Develops financial plans, analyzes market trends, advises management | Prepares balance sheets, income statements, ensures regulatory compliance |

| Decision Making | Strategic financial decisions impacting company growth | Operational decisions focusing on accuracy and control |

| Reporting | Reports to CFO or financial director | Reports to Financial Manager or CFO |

| Skills Required | Financial analysis, strategic planning, market knowledge | Accounting expertise, internal controls, regulatory knowledge |

| Objective | Maximize company profitability and financial health | Ensure accuracy and compliance in financial reporting |

Overview: Financial Manager vs Controller

Financial Managers oversee an organization's overall financial health by developing strategies for budgeting, forecasting, and investment planning, while Controllers primarily focus on maintaining accurate financial records, managing accounting operations, and ensuring regulatory compliance. Financial Managers analyze financial data to guide long-term business decisions, whereas Controllers oversee internal controls and the preparation of financial statements. Both roles require strong expertise in finance but differ in scope, with Financial Managers driving strategic growth and Controllers managing day-to-day financial accuracy.

Key Responsibilities and Roles

Financial Managers oversee an organization's overall financial health by developing strategies, managing investments, and preparing financial reports to guide executive decision-making. Controllers focus on internal controls, ensuring accurate accounting, budgeting, and compliance with financial regulations to maintain financial integrity. Your choice between a Financial Manager and Controller depends on whether you prioritize strategic financial leadership or detailed financial management and reporting.

Core Skills and Qualifications

Financial Managers require strong leadership, strategic planning, and financial analysis skills, often holding a CPA or MBA and extensive experience in budgeting and forecasting. Controllers specialize in internal controls, compliance, and financial reporting accuracy, typically possessing a CPA certification and expertise in GAAP and audit processes. Financial Managers emphasize investment management and financial decision-making, whereas Controllers focus on maintaining financial integrity and organizational accounting systems.

Strategic vs Operational Focus

Financial Managers primarily emphasize strategic financial planning, investment analysis, and long-term growth initiatives to align with company objectives. Controllers concentrate on operational focus, overseeing accounting activities, budgeting, and ensuring accurate financial reporting and compliance. While Financial Managers drive high-level financial strategy, Controllers manage daily financial operations to support organizational efficiency and regulatory adherence.

Involvement in Financial Planning and Analysis

A Financial Manager leads the overall financial planning process, developing strategies to optimize your company's financial health and ensure compliance with budgets and forecasts. Controllers specialize in detailed financial analysis, overseeing accounting accuracy and generating reports that inform management decisions. While both roles involve financial planning and analysis, Financial Managers take a broader strategic approach, whereas Controllers focus on precise data management and operational control.

Decision-Making Authority

Financial Managers wield broad decision-making authority, overseeing financial strategy, budgeting, and investment choices to drive organizational growth. Controllers focus on internal controls, financial reporting accuracy, and compliance, exerting decision-making authority primarily in regulatory and accounting processes. Financial Managers typically make high-level financial decisions that shape overall business direction, while Controllers make operational decisions ensuring financial integrity and adherence to policies.

Reporting Structure and Hierarchy

The Financial Manager typically reports to the Controller or Chief Financial Officer (CFO) and oversees day-to-day financial operations and department staff. The Controller, positioned above the Financial Manager, is responsible for the overall accounting functions, financial reporting accuracy, and compliance, often reporting directly to the CFO or company president. In larger organizations, the Financial Manager focuses on operational aspects while the Controller consolidates financial data, ensuring hierarchy aligns with company size and complexity.

Salary and Compensation Comparison

Financial Managers typically earn a median salary of around $134,180 per year, while Controllers have a slightly higher average salary, often ranging between $120,000 to $160,000 depending on company size and industry. Compensation packages for Controllers frequently include bonuses and profit-sharing linked to financial performance, whereas Financial Managers may receive stock options and performance incentives aligned with broader business objectives. Overall, Financial Managers tend to have a more diverse compensation structure, whereas Controllers focus on higher base salaries with financial accountability bonuses.

Career Progression and Advancement

Financial Manager roles emphasize strategic financial planning and leadership, offering significant opportunities for career advancement into executive positions like CFO. Controllers focus on detailed accounting, compliance, and internal controls, making them essential for organizational stability and often serving as a stepping stone to Financial Manager roles. Your career progression depends on developing strong analytical skills and gaining experience in both financial reporting and management to move seamlessly between these positions.

Choosing the Right Role for Your Organization

Selecting the right financial leadership role depends on your organization's size, complexity, and strategic goals. A Financial Manager oversees day-to-day financial operations, focusing on budgeting and reporting, while a Controller handles internal controls, financial compliance, and detailed financial statements. Choosing between these roles ensures your organization's financial health aligns with regulatory standards and supports effective decision-making.

Infographic: Financial Manager vs Controller

relatioo.com

relatioo.com