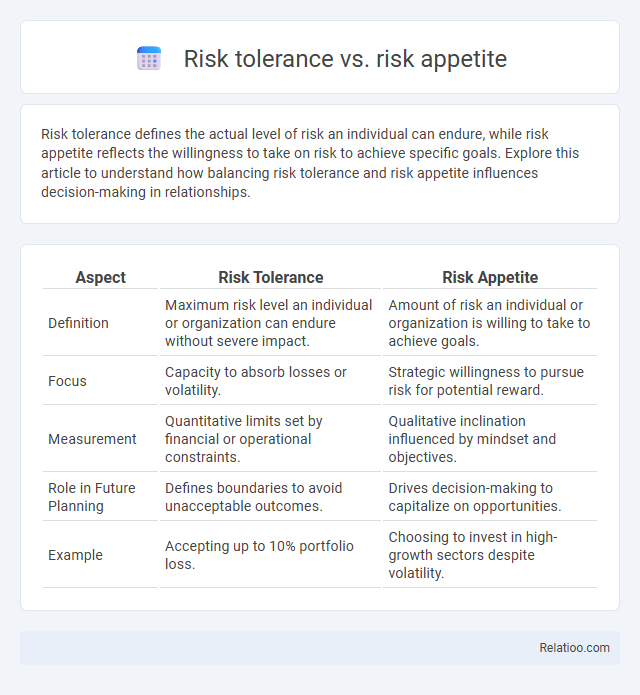

Risk tolerance defines the actual level of risk an individual can endure, while risk appetite reflects the willingness to take on risk to achieve specific goals. Explore this article to understand how balancing risk tolerance and risk appetite influences decision-making in relationships.

Table of Comparison

| Aspect | Risk Tolerance | Risk Appetite |

|---|---|---|

| Definition | Maximum risk level an individual or organization can endure without severe impact. | Amount of risk an individual or organization is willing to take to achieve goals. |

| Focus | Capacity to absorb losses or volatility. | Strategic willingness to pursue risk for potential reward. |

| Measurement | Quantitative limits set by financial or operational constraints. | Qualitative inclination influenced by mindset and objectives. |

| Role in Future Planning | Defines boundaries to avoid unacceptable outcomes. | Drives decision-making to capitalize on opportunities. |

| Example | Accepting up to 10% portfolio loss. | Choosing to invest in high-growth sectors despite volatility. |

Understanding Risk Tolerance and Risk Appetite

Understanding risk tolerance involves recognizing your capacity to endure potential losses without compromising financial stability, while risk appetite reflects the level of risk you are willing to accept to achieve desired returns. Risk tolerance is influenced by factors such as income, investment goals, and time horizon, whereas risk appetite is shaped by personal preferences and market outlook. Balancing both helps You create an investment strategy that aligns your financial objectives with your emotional comfort.

Key Differences Between Risk Tolerance and Risk Appetite

Risk tolerance defines the maximum level of risk an individual or organization is willing to endure during decision-making processes, often quantified through specific metrics or thresholds. Risk appetite represents the overall amount and type of risk an entity is prepared to accept to achieve its strategic objectives, reflecting a broader, qualitative perspective. Key differences include risk tolerance's role as a measurable boundary within risk appetite's broader, strategic risk preference framework, guiding actionable risk management and compliance decisions.

Factors Influencing Risk Tolerance

Risk tolerance, distinct from risk appetite, refers to an individual's or organization's capacity to endure potential losses without significant financial or emotional distress, influenced by factors such as financial situation, investment goals, time horizon, and psychological traits. Risk appetite represents the amount and type of risk an entity is willing to pursue to meet its objectives, shaped by strategic priorities and regulatory environment. Personal experience, market knowledge, and external economic conditions also critically impact risk tolerance, making it a dynamic measure rather than a fixed attribute.

Determinants of Risk Appetite

Risk appetite is influenced by factors such as organizational culture, financial capacity, strategic objectives, and regulatory environment, which dictate the level of risk an entity is willing to pursue for potential rewards. Unlike risk tolerance, which measures the acceptable deviation from objectives, risk appetite reflects the broader willingness to take risks aligned with your business goals. Understanding these determinants helps effectively balance risk-taking and risk management to optimize decision-making outcomes.

The Importance of Defining Risk Parameters

Defining risk parameters such as risk tolerance, risk appetite, and risk capacity is crucial for effective risk management and decision-making. Your organization's risk appetite sets the overall willingness to take risks, while risk tolerance defines acceptable variations within that framework, and risk capacity measures the actual ability to absorb potential losses. Clear distinctions among these parameters enable tailored strategies that balance growth opportunities with financial stability.

Practical Examples of Risk Tolerance and Risk Appetite

Risk tolerance represents an individual's capacity to endure potential losses without emotional distress, such as an investor willing to accept a 10% portfolio loss during market volatility. Risk appetite defines the level of risk an organization is willing to pursue to achieve its strategic objectives, like a startup choosing aggressive market expansion despite high uncertainty. Practical examples include a conservative retiree exhibiting low risk tolerance by investing in bonds, whereas a tech company with high-risk appetite might fund innovative but unproven projects to drive growth.

Assessing Organizational Risk Preferences

Assessing organizational risk preferences requires a clear understanding of risk tolerance, risk appetite, and risk capacity, as each defines different thresholds for risk exposure and decision-making. Risk appetite reflects the level of risk your organization is willing to pursue to achieve strategic objectives, while risk tolerance specifies acceptable variances from those objectives during execution. Evaluating these factors ensures your risk management framework aligns with business goals and supports informed, balanced risk-taking.

Integrating Risk Tolerance and Appetite into Decision-Making

Risk tolerance defines the acceptable level of risk an organization or individual is willing to endure, while risk appetite specifies the amount of risk they are prepared to pursue to achieve objectives; integrating both into decision-making ensures strategic alignment with organizational goals. Embedding risk tolerance and appetite into frameworks helps optimize resource allocation, enhance risk management practices, and support consistent, informed decisions under uncertainty. Effective integration requires continuous assessment of risk indicators and adjusting policies to reflect changing business environments and stakeholder expectations.

Challenges in Aligning Risk Tolerance and Appetite

Aligning risk tolerance and risk appetite presents challenges due to varying stakeholder perceptions and evolving market conditions that influence risk capacity and willingness. Your organization's risk tolerance defines the maximum acceptable risk level based on financial and operational capabilities, while risk appetite reflects the strategic risk levels leaders are prepared to accept to achieve objectives. Discrepancies between these can lead to misaligned decision-making, requiring continuous assessment and communication to ensure cohesive risk management strategies.

Best Practices for Managing Risk Tolerance vs. Risk Appetite

Effective management of risk tolerance versus risk appetite requires clear differentiation between the two: risk tolerance defines the acceptable deviation in risk exposure, while risk appetite represents the overall level of risk your organization is willing to accept. Best practices include establishing clear risk thresholds aligned with strategic objectives, continuously monitoring and adjusting these parameters based on market conditions, and implementing robust communication channels to ensure all stakeholders understand and adhere to the limits. Leveraging quantitative risk assessments and scenario analyses empowers you to make informed decisions that balance potential rewards against acceptable risk levels.

Infographic: Risk Tolerance vs Risk Appetite

relatioo.com

relatioo.com