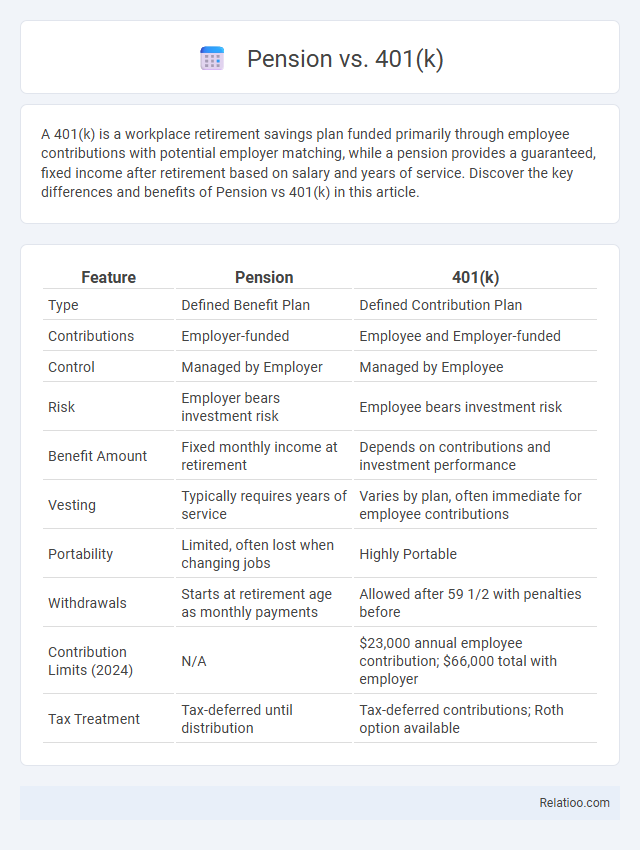

A 401(k) is a workplace retirement savings plan funded primarily through employee contributions with potential employer matching, while a pension provides a guaranteed, fixed income after retirement based on salary and years of service. Discover the key differences and benefits of Pension vs 401(k) in this article.

Table of Comparison

| Feature | Pension | 401(k) |

|---|---|---|

| Type | Defined Benefit Plan | Defined Contribution Plan |

| Contributions | Employer-funded | Employee and Employer-funded |

| Control | Managed by Employer | Managed by Employee |

| Risk | Employer bears investment risk | Employee bears investment risk |

| Benefit Amount | Fixed monthly income at retirement | Depends on contributions and investment performance |

| Vesting | Typically requires years of service | Varies by plan, often immediate for employee contributions |

| Portability | Limited, often lost when changing jobs | Highly Portable |

| Withdrawals | Starts at retirement age as monthly payments | Allowed after 59 1/2 with penalties before |

| Contribution Limits (2024) | N/A | $23,000 annual employee contribution; $66,000 total with employer |

| Tax Treatment | Tax-deferred until distribution | Tax-deferred contributions; Roth option available |

Understanding Pension Plans

Pension plans provide a defined benefit retirement income based on salary history and years of service, offering predictable monthly payments for life. Unlike 401(k) plans, which are defined contribution accounts subject to market fluctuations, pensions shift investment risk to the employer. Understanding pension plans is crucial for retirement planning because they guarantee a steady income stream, enhancing financial security during retirement.

What is a 401(k) Plan?

A 401(k) plan is a tax-advantaged retirement savings account offered by many employers in the United States, allowing employees to contribute a portion of their salary before taxes. Employers often match a percentage of employee contributions, significantly boosting retirement savings potential. Unlike traditional pensions, 401(k) plans place investment control and risk on the employee, who selects from available investment options within the plan.

Key Differences Between Pension and 401(k)

Pensions provide a defined benefit, guaranteeing you a fixed monthly income during retirement based on salary and years of service, while 401(k) plans are defined contribution accounts where your retirement savings depend on contributions and investment performance. Pension plans are typically employer-funded and managed, offering less risk to you, whereas 401(k) accounts require your active participation and carry market investment risks. Understanding these key differences helps you better plan your retirement strategy by balancing guaranteed income with investment control.

Employer Contributions: Pension vs 401(k)

Employer contributions vary significantly between pensions and 401(k) plans, with pensions typically offering defined benefits funded entirely by the employer, ensuring a guaranteed retirement income. In contrast, 401(k) plans often require employee contributions to receive matching amounts from your employer, which can differ in percentage and vesting schedules. Understanding these distinctions helps you optimize employer contributions for your retirement security.

Vesting Periods and Eligibility Requirements

Understanding vesting periods and eligibility requirements is crucial when comparing pensions, 401(k)s, and other retirement plans. Pensions often have defined vesting schedules, typically ranging from three to seven years, before you earn the right to employer contributions, whereas 401(k) plans usually vest employer matches more quickly or immediately but require meeting certain service or age criteria. Your eligibility for these retirement accounts varies by employer and plan type, impacting when and how you can access or secure your retirement benefits.

Retirement Income Security

Retirement income security depends on understanding the distinct roles of pensions, 401(k)s, and other retirement savings options in building a reliable income stream. Pensions offer guaranteed lifetime income, providing financial stability during retirement, while 401(k) plans rely on your contributions and investment performance, which can vary significantly. Your strategy should balance the predictable benefits of pensions with the growth potential and flexibility of 401(k) accounts to ensure sufficient income throughout retirement.

Investment Options and Flexibility

Pension plans typically offer limited investment options managed by the employer, providing predictable retirement income but less individual control. In contrast, 401(k) plans allow participants to choose from a range of mutual funds, stocks, and bonds, offering greater flexibility and potential for higher returns based on personal risk tolerance. Retirement planning benefits from combining these options, balancing the stability of pensions with the customizable investment strategies found in 401(k) accounts.

Portability When Changing Jobs

Pension plans offer limited portability since benefits are often tied to a specific employer and may not fully transfer when you change jobs. A 401(k) plan provides greater flexibility, allowing you to roll over your balance into a new employer's plan or an individual retirement account (IRA), ensuring continuous growth of your retirement savings. Understanding the portability features of each option is crucial for maintaining your retirement funds' growth during career transitions.

Tax Implications for Pension and 401(k)

Pension plans typically provide taxable income upon distribution, with taxes applied at ordinary income rates during retirement, while 401(k) contributions are often made pre-tax, allowing for tax-deferred growth until withdrawal, which is similarly taxed as ordinary income. Early withdrawals from both pensions and 401(k) accounts may incur a 10% penalty in addition to regular income tax unless qualifying exceptions are met. Understanding the differences in tax treatment, including required minimum distributions (RMDs) for 401(k) plans starting at age 73 (as of 2024), is crucial for effective retirement tax planning.

Choosing the Best Retirement Plan for You

Choosing the best retirement plan for you depends on factors such as your income, employer benefits, and long-term financial goals. Pensions provide guaranteed lifetime income funded by employers, while 401(k) plans offer tax advantages and investment flexibility but depend on market performance. Evaluating your risk tolerance, expected retirement age, and contribution limits will help determine whether a pension, 401(k), or a combination of both aligns with your retirement needs.

Infographic: Pension vs 401k

relatioo.com

relatioo.com