Annuities provide guaranteed income for life, while 401(k) plans offer tax-deferred growth with employer matching options. Discover the key differences and which retirement strategy suits you better in this article.

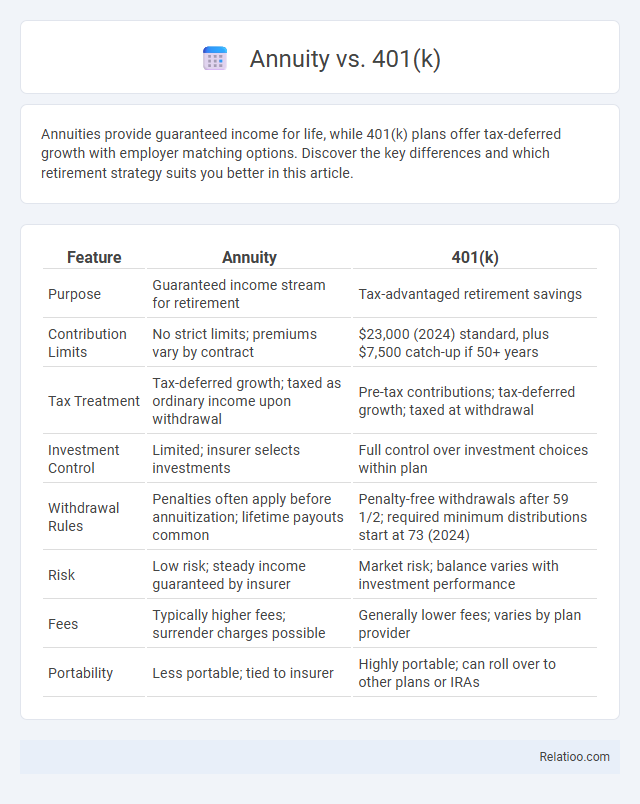

Table of Comparison

| Feature | Annuity | 401(k) |

|---|---|---|

| Purpose | Guaranteed income stream for retirement | Tax-advantaged retirement savings |

| Contribution Limits | No strict limits; premiums vary by contract | $23,000 (2024) standard, plus $7,500 catch-up if 50+ years |

| Tax Treatment | Tax-deferred growth; taxed as ordinary income upon withdrawal | Pre-tax contributions; tax-deferred growth; taxed at withdrawal |

| Investment Control | Limited; insurer selects investments | Full control over investment choices within plan |

| Withdrawal Rules | Penalties often apply before annuitization; lifetime payouts common | Penalty-free withdrawals after 59 1/2; required minimum distributions start at 73 (2024) |

| Risk | Low risk; steady income guaranteed by insurer | Market risk; balance varies with investment performance |

| Fees | Typically higher fees; surrender charges possible | Generally lower fees; varies by plan provider |

| Portability | Less portable; tied to insurer | Highly portable; can roll over to other plans or IRAs |

Introduction to Annuity vs 401(k)

An annuity provides a steady income stream, often guaranteed for life, which can complement your 401(k) savings designed for long-term retirement growth through tax-deferred contributions and employer matches. Understanding the differences in payout options, tax treatment, and risk exposure helps you optimize your retirement strategy. Your choice between annuity and 401(k) depends on goals for guaranteed income versus investment growth potential.

What Is an Annuity?

An annuity is a financial product designed to provide a steady income stream, typically during retirement, by converting a lump sum or series of payments into regular disbursements. Unlike a 401(k), which is a tax-advantaged retirement savings plan tied to your employer, an annuity offers guaranteed payments that can last for life or a specified period. Understanding how an annuity fits into your retirement strategy can help you balance growth, risk, and income stability to secure your financial future.

What Is a 401(k) Plan?

A 401(k) plan is a tax-advantaged retirement savings account offered by employers that allows you to contribute a portion of your salary on a pre-tax basis, reducing your taxable income. Your contributions grow tax-deferred until withdrawal, typically after age 59 1/2, with many plans offering employer matching to boost your retirement funds. Compared to annuities, 401(k) plans provide flexibility in investment choices and potential for higher returns, making them a foundational component of retirement planning.

Key Differences Between Annuity and 401(k)

Annuities provide guaranteed income for life or a set period, making them ideal for individuals seeking steady retirement cash flow, while 401(k) plans offer tax-advantaged growth through investments with no guaranteed payouts. Your 401(k) balance fluctuates based on market performance, and withdrawals are subject to required minimum distributions after age 73, whereas annuities allow for customized payout options and can protect against market volatility. Understanding these key differences helps you align retirement planning strategies with income security and growth objectives.

Pros and Cons of Annuities

Annuities provide guaranteed income streams, protecting against longevity risk, but often come with high fees and less liquidity compared to 401(k)s, which offer tax advantages and employer matching but rely on market performance. Unlike 401(k) plans, annuities typically have fewer contribution limits and can provide lifetime income, yet they may lack the growth potential and flexibility to change investments easily. In retirement planning, choosing between annuities and 401(k)s involves balancing the security of steady payouts against the potential for higher returns and tax deferral in 401(k) accounts.

Pros and Cons of 401(k) Plans

401(k) plans offer tax-deferred growth and employer matching contributions, which can significantly boost retirement savings over time. However, they have contribution limits set by the IRS and may incur early withdrawal penalties before age 59 1/2. Investment options within 401(k)s can be limited, potentially affecting diversification and overall portfolio performance.

Tax Implications: Annuity vs 401(k)

Annuities offer tax-deferred growth, meaning your investment earnings are not taxed until you withdraw funds, allowing your money to compound without immediate tax impact. 401(k) contributions are often made pre-tax, reducing your taxable income now, but withdrawals during retirement are taxed as ordinary income, potentially at a higher rate. Understanding these tax implications can help you optimize your retirement strategy and tailor your savings to fit your financial goals.

Withdrawal Rules and Penalties

Understanding withdrawal rules and penalties is crucial when comparing annuities, 401(k)s, and retirement accounts. Annuities typically allow penalty-free withdrawals after age 59 1/2 but may impose surrender charges if funds are accessed early, while 401(k) plans usually penalize early withdrawals with a 10% IRS tax penalty before age 59 1/2 unless specific exceptions apply. Your ability to access retirement funds without penalties depends on the type of account and timing of withdrawals, making it essential to plan accordingly to avoid unnecessary costs.

Suitability: Who Should Choose Annuity or 401(k)?

Annuities suit individuals seeking guaranteed income streams and financial security in retirement, especially those with low risk tolerance or insufficient pension coverage. A 401(k) is ideal for employees looking for tax-deferred growth and employer matching contributions, favoring those who want investment control and potential higher returns. Your choice depends on your retirement goals, income stability preferences, and risk tolerance, with annuities offering steady payouts and 401(k)s providing growth opportunities.

Conclusion: Which Is Better for Your Retirement?

Choosing between an annuity, 401(k), or other retirement options depends on your financial goals, risk tolerance, and desired income stability. A 401(k) offers tax advantages and employer matching contributions, making it ideal for long-term growth, while annuities provide guaranteed income streams that reduce the risk of outliving your savings. You should evaluate your need for steady income versus growth potential to determine which option aligns best with your retirement strategy.

Infographic: Annuity vs 401k

relatioo.com

relatioo.com