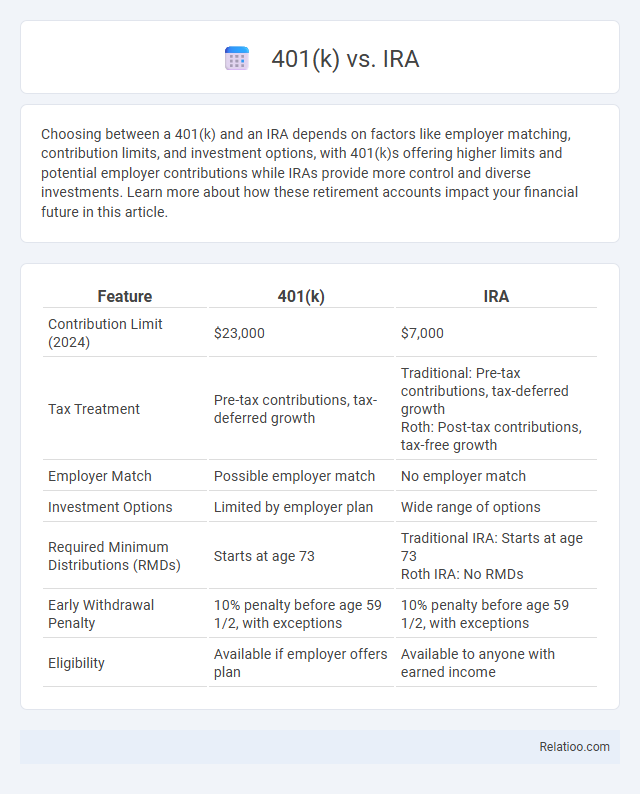

Choosing between a 401(k) and an IRA depends on factors like employer matching, contribution limits, and investment options, with 401(k)s offering higher limits and potential employer contributions while IRAs provide more control and diverse investments. Learn more about how these retirement accounts impact your financial future in this article.

Table of Comparison

| Feature | 401(k) | IRA |

|---|---|---|

| Contribution Limit (2024) | $23,000 | $7,000 |

| Tax Treatment | Pre-tax contributions, tax-deferred growth | Traditional: Pre-tax contributions, tax-deferred growth Roth: Post-tax contributions, tax-free growth |

| Employer Match | Possible employer match | No employer match |

| Investment Options | Limited by employer plan | Wide range of options |

| Required Minimum Distributions (RMDs) | Starts at age 73 | Traditional IRA: Starts at age 73 Roth IRA: No RMDs |

| Early Withdrawal Penalty | 10% penalty before age 59 1/2, with exceptions | 10% penalty before age 59 1/2, with exceptions |

| Eligibility | Available if employer offers plan | Available to anyone with earned income |

Understanding the Basics: What Are 401(k) and IRA Accounts?

401(k) and IRA accounts are essential retirement savings tools designed to help you build a secure financial future with tax advantages. A 401(k) is an employer-sponsored plan allowing you to contribute pre-tax income, often with employer matching, while an IRA is an individual retirement account offering more control and flexibility over investment choices. Understanding these basics helps you optimize contributions and investment strategies to maximize your retirement savings effectively.

Key Differences Between 401(k) and IRA

401(k) plans are employer-sponsored retirement savings accounts with higher contribution limits and potential employer matching, while IRAs are individual accounts with lower annual limits and more flexible investment options. You benefit from 401(k)s through automatic payroll deductions and possibly immediate tax benefits, whereas IRAs offer greater control over investment choices and eligibility for tax deductions varies based on income and participation in employer plans. Understanding these key differences helps optimize your retirement strategy according to your savings goals and financial situation.

Contribution Limits for 401(k) vs IRA

401(k) plans have higher annual contribution limits compared to IRAs, allowing individuals to contribute up to $22,500 in 2024, with an additional $7,500 catch-up contribution for those aged 50 and older. In contrast, IRAs have a lower limit of $6,500 annually, plus a $1,000 catch-up for eligible participants over 50. These difference in contribution limits significantly affect retirement savings potential and tax planning strategies.

Employer Matching: The Advantage of 401(k) Plans

Employer matching in 401(k) plans offers a significant advantage over IRAs and other retirement accounts by providing free contributions that boost your retirement savings immediately. Unlike IRAs, which depend solely on your contributions, many employers match a percentage of your 401(k) deposits, effectively increasing your investment return without extra cost to you. Taking full advantage of this employer match maximizes your retirement funds and accelerates growth, making 401(k) plans a superior option for building a robust retirement portfolio.

Investment Options in 401(k) and IRA

401(k) plans typically offer a curated selection of mutual funds, target-date funds, and company stock, allowing you to benefit from employer-sponsored investment options with potential matching contributions. IRAs provide a broader range of investment choices, including individual stocks, bonds, ETFs, and alternative assets, granting greater flexibility and control over your retirement portfolio. Evaluating your investment preferences and risk tolerance can help you determine which plan aligns best with your long-term retirement goals.

Tax Benefits and Implications

Maximizing your retirement savings involves understanding the tax benefits and implications of 401(k) plans, IRAs, and other retirement accounts. Contributions to a 401(k) are typically made pre-tax, lowering your taxable income, while Traditional IRA contributions may be tax-deductible depending on your income and participation in employer plans. Roth IRAs offer tax-free withdrawals in retirement, making them ideal for tax diversification and long-term tax planning.

Withdrawal Rules and Penalties

401(k) plans typically impose a 10% early withdrawal penalty on distributions taken before age 59 1/2, with some exceptions such as hardship withdrawals and loans. IRAs also have a 10% early withdrawal penalty before 59 1/2, but certain exceptions like first-time home purchases or qualified education expenses apply. Both plans require minimum distributions starting at age 73, and failing to take these required minimum distributions (RMDs) can result in a 25% penalty on the amount not withdrawn.

Rollover Strategies: Moving Funds Between 401(k) and IRA

Rolling over funds from a 401(k) to an IRA allows for greater investment flexibility and often lower fees, enhancing long-term retirement growth potential. Direct rollovers avoid tax penalties, while indirect rollovers must be completed within 60 days to prevent tax consequences and early withdrawal penalties. Understanding the nuances of each account's rules, including contribution limits and required minimum distributions, is essential for optimizing retirement savings and maintaining tax advantages.

Suitability: Who Should Choose 401(k) or IRA?

401(k) plans are ideal for employees seeking employer-sponsored retirement savings with potential matching contributions and higher annual contribution limits, making them suitable for those prioritizing convenience and maximizing tax-advantaged growth. IRAs offer greater flexibility in investment choices and are preferable for self-employed individuals or those without access to a 401(k), especially when seeking traditional or Roth options tailored to individual tax circumstances. Both 401(k) and IRA accounts support long-term retirement goals, but evaluating factors such as income level, employer benefits, and desired control over investments helps determine the most suitable retirement savings vehicle.

Maximizing Retirement Savings: Combining 401(k) and IRA

Maximizing retirement savings involves strategically combining a 401(k) and an IRA to leverage their unique tax advantages and contribution limits. Your 401(k) offers higher contribution limits and potential employer matching, while an IRA provides more investment options and tax flexibility through traditional or Roth accounts. By contributing to both, you diversify your retirement portfolio and enhance your long-term financial security.

Infographic: 401k vs IRA

relatioo.com

relatioo.com