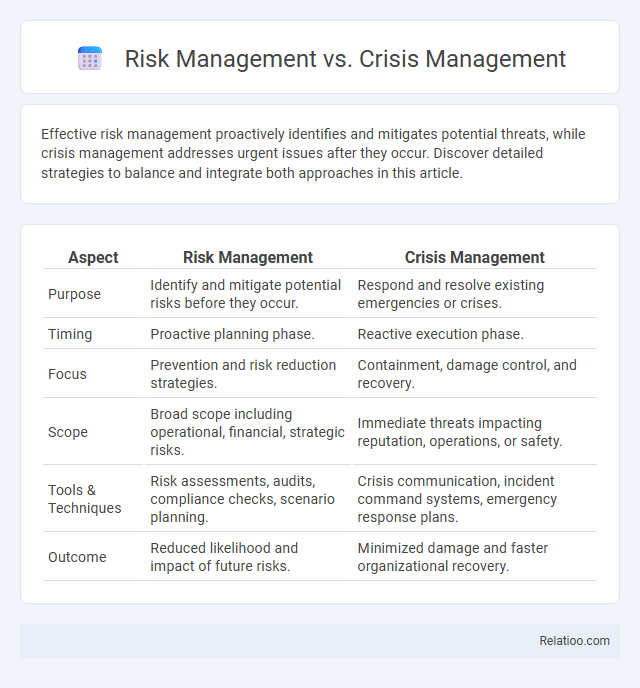

Effective risk management proactively identifies and mitigates potential threats, while crisis management addresses urgent issues after they occur. Discover detailed strategies to balance and integrate both approaches in this article.

Table of Comparison

| Aspect | Risk Management | Crisis Management |

|---|---|---|

| Purpose | Identify and mitigate potential risks before they occur. | Respond and resolve existing emergencies or crises. |

| Timing | Proactive planning phase. | Reactive execution phase. |

| Focus | Prevention and risk reduction strategies. | Containment, damage control, and recovery. |

| Scope | Broad scope including operational, financial, strategic risks. | Immediate threats impacting reputation, operations, or safety. |

| Tools & Techniques | Risk assessments, audits, compliance checks, scenario planning. | Crisis communication, incident command systems, emergency response plans. |

| Outcome | Reduced likelihood and impact of future risks. | Minimized damage and faster organizational recovery. |

Understanding Risk Management

Risk management involves identifying, assessing, and prioritizing potential threats to minimize their impact on your organization, focusing on proactive strategies and controls. Crisis management, in contrast, deals with responding to and mitigating the effects of an actual disruptive event to restore normal operations quickly. Understanding risk management empowers you to anticipate risks early, reducing the likelihood and severity of crises before they occur.

Defining Crisis Management

Crisis Management involves the strategic process of identifying, responding to, and mitigating the impact of unexpected, high-stakes events that threaten an organization's stability. Unlike Risk Management, which focuses on anticipating potential risks and implementing measures to prevent them, Crisis Management activates when a crisis occurs, requiring immediate action to protect stakeholders and reputation. Your ability to effectively manage a crisis depends on rapid decision-making, clear communication, and coordinated response efforts to minimize damage and facilitate recovery.

Key Differences Between Risk and Crisis Management

Risk management involves identifying, assessing, and mitigating potential threats before they materialize, focusing on prevention and preparedness. Crisis management activates when an unexpected event disrupts regular operations, requiring immediate response and damage control to protect your organization's reputation and assets. The key difference lies in timing and approach: risk management is proactive, while crisis management is reactive.

Objectives of Risk Management

Risk management focuses on identifying, assessing, and mitigating potential threats to minimize the impact on organizational goals. Its primary objective is to proactively reduce vulnerabilities through strategic planning, risk analysis, and implementation of controls before incidents occur. Crisis management, by contrast, deals with responding to and recovering from unexpected emergencies to restore normal operations quickly.

Objectives of Crisis Management

Crisis management aims to minimize damage to Your organization by swiftly identifying threats, implementing effective response plans, and maintaining clear communication during emergencies. Unlike risk management, which focuses on preventing potential problems through risk assessment and mitigation, crisis management activates when an incident occurs, prioritizing containment and recovery. Effective crisis management objectives include protecting stakeholders, preserving company reputation, and ensuring operational continuity amidst unforeseen disruptions.

Proactive vs Reactive Approaches

Risk management emphasizes proactive strategies to identify, assess, and mitigate potential threats before they materialize, reducing the likelihood of crises. Crisis management involves reactive measures to contain, control, and resolve incidents after they occur, minimizing damage and restoring stability. Effective organizational resilience integrates proactive risk management with reactive crisis management to ensure comprehensive preparedness and response.

Tools and Techniques in Risk Management

Risk management employs tools such as risk assessment matrices, failure mode and effects analysis (FMEA), and risk registers to identify, evaluate, and prioritize potential risks. Techniques like quantitative risk analysis, scenario planning, and risk mitigation strategies enable organizations to proactively reduce vulnerabilities before crises occur. In contrast, crisis management focuses on response and recovery tools such as communication protocols, incident command systems, and business continuity plans to handle adverse events after they arise.

Strategies for Effective Crisis Management

Effective crisis management strategies prioritize swift communication, comprehensive risk assessment, and proactive planning to minimize organizational damage. Establishing clear roles, rapid decision-making protocols, and continuous stakeholder engagement ensures resilience during unexpected events. Your ability to integrate these elements determines the success of managing crises compared to traditional risk management practices.

Integrating Risk and Crisis Management in Organizations

Integrating risk management and crisis management in organizations creates a cohesive strategy that anticipates potential threats and rapidly responds to unforeseen disruptions, ensuring business continuity and resilience. Your organization benefits from streamlined processes that identify risks early, allowing for proactive mitigation before escalation into crises. This integration leverages comprehensive data analysis and communication protocols to align risk assessment with crisis response, enhancing overall organizational stability and decision-making efficiency.

Best Practices for Building Resilient Businesses

Effective risk management identifies potential threats and implements preventive measures to minimize impact, while crisis management focuses on immediate response strategies during an unexpected event. Integrating robust communication channels, real-time monitoring systems, and cross-functional training improves organizational resilience. Businesses adopting continuous risk assessment, scenario planning, and adaptive recovery protocols ensure faster recovery and sustained operational stability.

Infographic: Risk Management vs Crisis Management

relatioo.com

relatioo.com