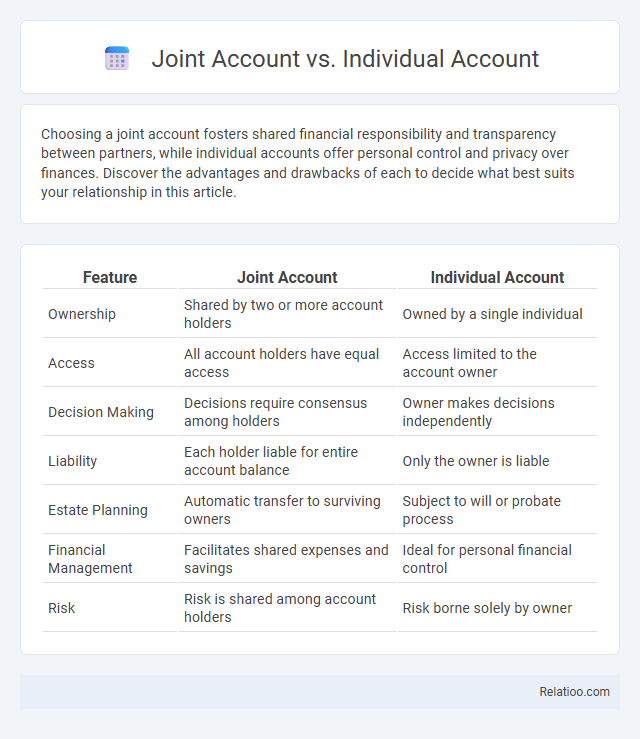

Choosing a joint account fosters shared financial responsibility and transparency between partners, while individual accounts offer personal control and privacy over finances. Discover the advantages and drawbacks of each to decide what best suits your relationship in this article.

Table of Comparison

| Feature | Joint Account | Individual Account |

|---|---|---|

| Ownership | Shared by two or more account holders | Owned by a single individual |

| Access | All account holders have equal access | Access limited to the account owner |

| Decision Making | Decisions require consensus among holders | Owner makes decisions independently |

| Liability | Each holder liable for entire account balance | Only the owner is liable |

| Estate Planning | Automatic transfer to surviving owners | Subject to will or probate process |

| Financial Management | Facilitates shared expenses and savings | Ideal for personal financial control |

| Risk | Risk is shared among account holders | Risk borne solely by owner |

Introduction to Joint and Individual Accounts

A joint account allows two or more individuals to share ownership and access to the same bank account, making it ideal for couples, business partners, or family members who want to manage finances collaboratively. An individual account, on the other hand, is owned and operated by a single person, providing full control over deposits, withdrawals, and account management. Understanding the fundamental differences between joint and individual accounts helps in choosing the right banking solution based on shared financial goals and personal control preferences.

Key Differences Between Joint and Individual Accounts

Key differences between joint and individual accounts include ownership, access, and responsibilities. A joint account is owned and accessed by two or more people, allowing all parties equal rights to manage funds, while an individual account is solely owned and controlled by one person. Your choice determines how transactions are authorized, liability is shared, and financial decisions are made, impacting privacy and account management.

Advantages of Joint Accounts

Joint accounts offer shared access and management of funds, making them ideal for couples, business partners, or families seeking financial transparency and collaboration. You benefit from streamlined bill payments, combined savings efforts, and simplified tracking of expenses, which enhances budgeting and financial planning. Joint accounts also provide legal rights to all account holders, ensuring equal ownership and ease during emergencies or unexpected financial decisions.

Advantages of Individual Accounts

Individual accounts offer complete control over account management, allowing users to make transactions, withdrawals, and decisions independently without requiring consent from others. These accounts provide enhanced privacy and security by limiting access exclusively to the account holder, reducing risks associated with shared information. Furthermore, individual accounts simplify tax reporting and liability, as all income and expenses are attributed to a single person, streamlining financial responsibilities.

Disadvantages of Joint Accounts

Joint accounts pose privacy challenges as all parties have equal access to transaction details, potentially causing trust issues. Your financial liability increases since any account holder can withdraw or incur overdrafts without individual consent. Disputes may arise over fund usage, complicating account management compared to individual accounts.

Disadvantages of Individual Accounts

Individual accounts limit your access to collaborative financial decision-making, which can create challenges in managing shared expenses or goals. These accounts may lack the flexibility needed for joint access, causing delays when multiple parties need to handle transactions or monitor balances. Additionally, individual accounts provide less protection in case of an account holder's incapacity or absence, complicating access for trusted partners.

Ideal Scenarios for Choosing a Joint Account

A joint account is ideal when both parties share financial responsibilities, such as managing household expenses or saving for a common goal like a vacation or a home purchase. Your joint account allows for transparent tracking of contributions and expenditures, fostering trust and collaboration in relationships or partnerships. Unlike individual accounts, joint accounts simplify bill payments and budgeting by consolidating funds, making them perfect for spouses, business partners, or roommates who need shared access and control.

When to Opt for an Individual Account

Opt for an individual account when you seek full control over your finances, ensuring all transactions and decisions are solely yours, which simplifies management and accountability. Individual accounts offer privacy and avoid complications that arise from shared access, making them ideal for personal savings, credit building, or independent income management. Your financial goals and need for autonomy determine that an individual account suits best when joint liability or shared use is unnecessary.

Legal and Financial Implications

Joint accounts involve shared ownership and equal access, creating legal responsibilities for all parties, including liability for overdrafts or debts incurred by any account holder. Individual accounts grant sole control and liability, ensuring privacy and full authority over financial decisions without the risk of co-owner disputes. Legal implications in joint accounts may complicate estate planning and creditor claims, whereas individual accounts simplify asset protection and financial accountability.

How to Decide: Joint Account vs Individual Account

Choosing between a joint account and an individual account depends on factors like financial goals, trust level, and management preferences. Joint accounts offer shared access and transparency, suitable for partners managing household expenses, while individual accounts provide control and privacy for personal finances. Assess usage needs, communication, and future plans to decide which account type aligns best with your financial situation.

Infographic: Joint Account vs Individual Account

relatioo.com

relatioo.com