A Power of Attorney grants a trusted person authority to manage your financial and legal affairs during your lifetime, while an Executor is responsible for administering your estate after death according to your will. Discover the key differences and responsibilities of each role in this article.

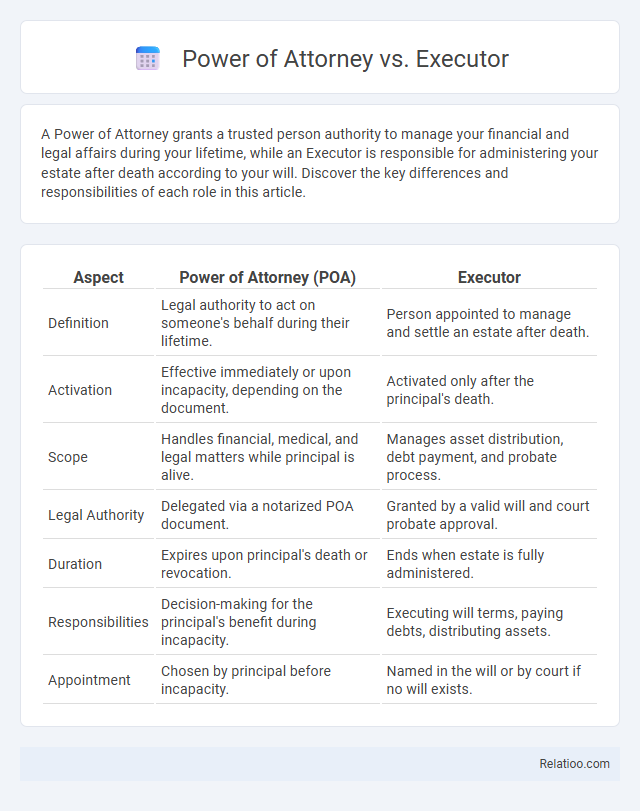

Table of Comparison

| Aspect | Power of Attorney (POA) | Executor |

|---|---|---|

| Definition | Legal authority to act on someone's behalf during their lifetime. | Person appointed to manage and settle an estate after death. |

| Activation | Effective immediately or upon incapacity, depending on the document. | Activated only after the principal's death. |

| Scope | Handles financial, medical, and legal matters while principal is alive. | Manages asset distribution, debt payment, and probate process. |

| Legal Authority | Delegated via a notarized POA document. | Granted by a valid will and court probate approval. |

| Duration | Expires upon principal's death or revocation. | Ends when estate is fully administered. |

| Responsibilities | Decision-making for the principal's benefit during incapacity. | Executing will terms, paying debts, distributing assets. |

| Appointment | Chosen by principal before incapacity. | Named in the will or by court if no will exists. |

Understanding Power of Attorney

Power of Attorney grants a designated person the legal authority to make decisions on behalf of another individual during their lifetime, particularly regarding financial or medical matters. Unlike an Executor, who manages and distributes assets according to a will after death, a Power of Attorney operates only while the principal is alive and capable or incapacitated, depending on the type. Understanding the scope and limitations of a Power of Attorney is crucial for effective estate planning and ensuring decisions align with the principal's wishes.

Defining the Role of an Executor

An executor is a legally appointed individual responsible for managing and distributing your estate according to your will after your death. Unlike a Power of Attorney, which grants authority to act on your behalf during your lifetime, the executor's duties begin only upon your passing. Your executor ensures that your legacy is preserved by settling debts, paying taxes, and distributing assets to beneficiaries as specified in your will.

Key Differences Between Power of Attorney and Executor

Power of Attorney grants You the legal authority to make financial and medical decisions on someone else's behalf during their lifetime, whereas an Executor is responsible for administering a deceased person's estate according to their will. The key difference lies in timing: Power of Attorney is effective while the individual is alive, but an Executor's role begins after death. Legacy refers to the lasting impact or assets passed down, shaped by the actions of both Powers of Attorney and Executors.

When Is Power of Attorney Needed?

A Power of Attorney is needed when You require someone to make financial, legal, or medical decisions on Your behalf during Your lifetime, especially if You become incapacitated or unable to manage Your affairs. This legal document grants the appointed agent authority to handle tasks such as paying bills, managing investments, or consenting to medical treatment, distinct from an Executor who manages Your estate after death. Unlike a legacy, which is a gift specified in a will, a Power of Attorney facilitates real-time decision-making and control over Your assets and well-being while You are alive.

When Does an Executor Take Charge?

An executor takes charge immediately after the individual's death, once the will is validated by the probate court. Unlike a power of attorney, which grants authority during the person's lifetime, the executor's role begins post-mortem to manage estate distribution according to the will. Managing asset liquidation, settling debts, and ensuring that beneficiaries receive their inheritances are primary responsibilities during this period.

Legal Authority: POA vs Executor

The Power of Attorney (POA) grants Your agent legal authority to make financial, legal, or healthcare decisions on Your behalf while You are alive but incapacitated. An Executor's legal authority begins only after Your death, responsible for managing and distributing Your estate according to Your will. Understanding the distinct timing and scope of authority helps protect Your interests both during life and after.

Responsibilities and Limitations of a Power of Attorney

A Power of Attorney grants You the authority to make financial and legal decisions on behalf of another person, but its power ends at the principal's death, unlike an Executor who manages estate distribution after death. Responsibilities of a Power of Attorney include managing banking, paying bills, and handling property, yet limitations prevent altering a will or making decisions beyond the granted scope. Understanding these boundaries ensures proper use of a Power of Attorney while the Executor activates their role posthumously to fulfill legacy intents.

Duties and Obligations of an Executor

An executor is legally responsible for managing and distributing a deceased person's estate according to their will, ensuring all debts and taxes are paid, and handling probate court procedures. Unlike a power of attorney, which grants authority to act on behalf of someone while they are alive, the executor's duties commence only after death. A legacy refers to the assets or property bequeathed in a will, which the executor must oversee transferring to the rightful beneficiaries.

Choosing the Right Individual for Each Role

Selecting the right individual for Power of Attorney ensures your financial and healthcare decisions are managed according to your wishes during incapacity. An Executor must be trustworthy and organized to efficiently handle estate administration and the distribution of assets after your death. Choosing a Legacy representative involves finding someone who understands and respects your values to preserve and communicate your personal and family heritage effectively.

Frequently Asked Questions: Power of Attorney vs Executor

Power of Attorney grants you the legal authority to make financial or medical decisions on someone else's behalf while they are alive but incapacitated, whereas an Executor manages the distribution of assets after a person's death according to their will. Common questions often involve the scope of each role's authority and when each becomes active; Power of Attorney is effective during life, Executor's duties begin post-mortem. Understanding these differences helps ensure your estate planning aligns with your intentions and protects your interests.

Infographic: Power of Attorney vs Executor

relatioo.com

relatioo.com