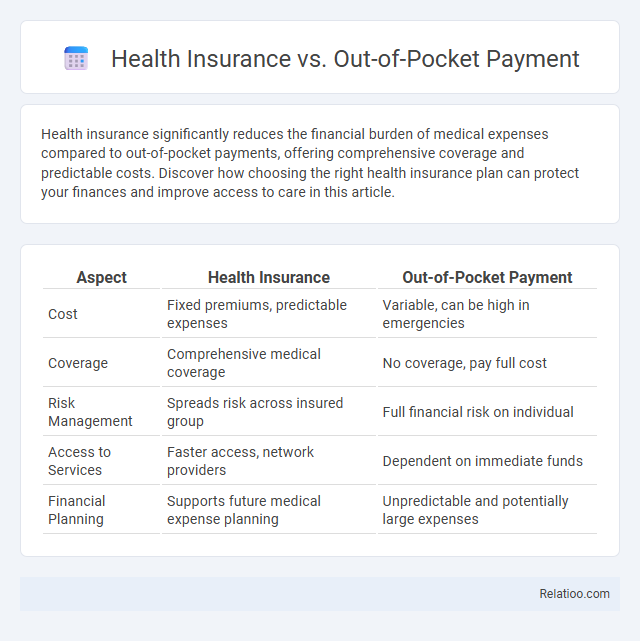

Health insurance significantly reduces the financial burden of medical expenses compared to out-of-pocket payments, offering comprehensive coverage and predictable costs. Discover how choosing the right health insurance plan can protect your finances and improve access to care in this article.

Table of Comparison

| Aspect | Health Insurance | Out-of-Pocket Payment |

|---|---|---|

| Cost | Fixed premiums, predictable expenses | Variable, can be high in emergencies |

| Coverage | Comprehensive medical coverage | No coverage, pay full cost |

| Risk Management | Spreads risk across insured group | Full financial risk on individual |

| Access to Services | Faster access, network providers | Dependent on immediate funds |

| Financial Planning | Supports future medical expense planning | Unpredictable and potentially large expenses |

Understanding Health Insurance: Key Features

Health insurance offers financial protection by covering medical expenses through premiums, copayments, deductibles, and network providers, reducing the burden of high healthcare costs. Out-of-pocket payment requires individuals to bear the full cost of medical services at the time of care, often leading to unpredictable expenses without coverage or reimbursement. Effective health planning integrates understanding insurance benefits, budgeting for potential out-of-pocket costs, and selecting appropriate coverage to optimize healthcare access and affordability.

What Is Out-of-Pocket Payment?

Out-of-pocket payment refers to the direct expenses individuals pay for healthcare services without reimbursement from insurance providers, including deductibles, copayments, and coinsurance. This payment model impacts financial planning by requiring individuals to manage unexpected medical costs, influencing the need for comprehensive health insurance or health savings plans. Understanding out-of-pocket costs is crucial for optimizing health coverage and minimizing financial risk associated with medical care.

Cost Comparison: Insurance Premiums vs Direct Payments

Health insurance premiums involve regular, predictable payments that help mitigate large unexpected medical costs, whereas out-of-pocket payments require paying directly for services, often resulting in higher immediate expenses during emergencies or complex treatments. Health planning can optimize cost-efficiency by balancing insurance coverage levels with anticipated medical needs to minimize total expenditure. Comparing total health expenses, insurance premiums spread risk and cost over time, while out-of-pocket payments may lead to significant financial burden without prior savings or emergency funds.

Coverage and Benefits: What Each Option Offers

Health insurance provides comprehensive coverage for medical expenses, including hospital stays, doctor visits, prescriptions, and preventive care, often reducing out-of-pocket costs through copayments and deductibles. Out-of-pocket payment requires individuals to pay directly for healthcare services, offering no financial protection but flexibility in choosing providers and treatments without insurance restrictions. Health planning, such as Health Savings Accounts (HSAs) or flexible spending plans, enables individuals to allocate funds specifically for future medical expenses, balancing cost control with partial financial security while complementing insurance coverage.

Financial Risks and Protections

Health insurance mitigates financial risks by covering unexpected medical expenses, reducing out-of-pocket payments that can lead to significant financial strain. Out-of-pocket payment exposes individuals to high financial risk, especially during emergencies or chronic illnesses, as costs can quickly escalate beyond personal savings. Health planning involves proactive budgeting and risk assessment, integrating insurance and savings strategies to protect against unpredictable healthcare costs and ensure financial stability.

Access to Healthcare Services

Health insurance provides broader access to healthcare services by reducing direct costs and enabling coverage for preventive care, specialist visits, and emergency treatments. Out-of-pocket payment limits access due to high upfront expenses, often causing delays or avoidance of necessary care, especially among low-income populations. Health planning enhances access by enabling individuals to allocate financial resources effectively, anticipate medical needs, and choose appropriate insurance plans that align with their healthcare requirements.

Flexibility and Choice of Providers

Health insurance offers greater flexibility and a wider choice of providers compared to out-of-pocket payment, allowing individuals to access a broad network of doctors and hospitals without incurring full costs upfront. Out-of-pocket payment provides complete freedom to choose any healthcare provider but can lead to high expenses and financial unpredictability. Health planning, including strategies like Health Savings Accounts (HSAs) and tailored insurance plans, balances cost control with provider flexibility, empowering patients to make informed decisions based on their healthcare needs and budget.

Suitability for Different Individuals and Families

Health insurance offers comprehensive coverage ideal for families seeking financial protection against major medical expenses, while out-of-pocket payment suits individuals with minimal health risks or those preferring direct payments for occasional care. Health planning enables proactive management of healthcare needs by combining insurance with budgeting strategies, tailored to fit your specific lifestyle and medical history. Choosing the right option depends on your family's size, health status, and financial capacity to ensure optimal healthcare affordability and access.

Impact on Long-Term Financial Planning

Health insurance significantly reduces the risk of unexpected medical expenses, providing a financial safety net that supports stable long-term financial planning and wealth preservation. Out-of-pocket payments can lead to substantial financial strain during major health events, disrupting savings goals and increasing vulnerability to debt. Effective health planning that incorporates insurance coverage and cost management strategies ensures optimized resource allocation, enhancing financial resilience over time.

Deciding Between Health Insurance and Out-of-Pocket Payment

Deciding between health insurance and out-of-pocket payment hinges on your financial stability and anticipated healthcare needs. Health insurance offers risk protection by covering a broad range of medical expenses, reducing the impact of unexpected high costs, while out-of-pocket payment gives you direct control but exposes you to potentially significant financial burden. Effective health planning involves analyzing your medical history, expected treatments, and budget to choose the option that balances coverage benefits with affordability for your unique situation.

Infographic: Health Insurance vs Out-of-Pocket Payment

relatioo.com

relatioo.com