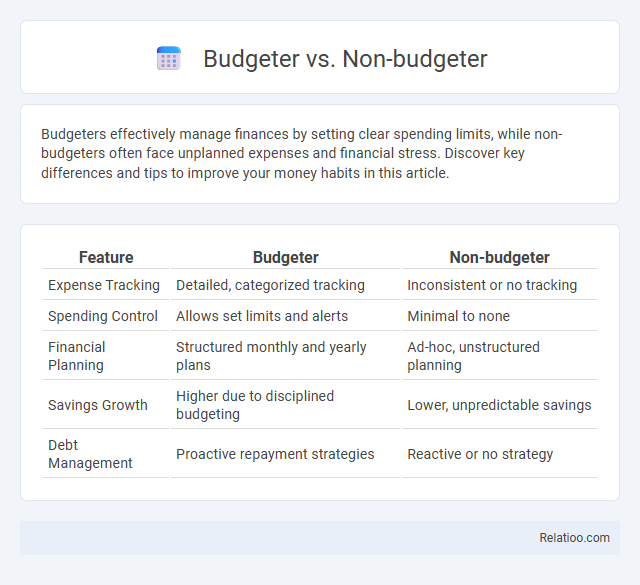

Budgeters effectively manage finances by setting clear spending limits, while non-budgeters often face unplanned expenses and financial stress. Discover key differences and tips to improve your money habits in this article.

Table of Comparison

| Feature | Budgeter | Non-budgeter |

|---|---|---|

| Expense Tracking | Detailed, categorized tracking | Inconsistent or no tracking |

| Spending Control | Allows set limits and alerts | Minimal to none |

| Financial Planning | Structured monthly and yearly plans | Ad-hoc, unstructured planning |

| Savings Growth | Higher due to disciplined budgeting | Lower, unpredictable savings |

| Debt Management | Proactive repayment strategies | Reactive or no strategy |

Understanding the Basics: Budgeter vs Non-budgeter

Budgeters systematically track income and expenses to allocate funds effectively, fostering financial discipline and enabling savings growth. Non-budgeters often lack structured financial planning, leading to unpredictable spending patterns and potential overspending risks. Developing consistent financial habits, such as regular budgeting, directly impacts long-term financial stability and wealth accumulation.

Key Characteristics of a Budgeter

A budgeter systematically tracks income and expenses, sets financial goals, and allocates funds to specific categories, ensuring disciplined money management. Unlike non-budgeters who often face irregular spending and financial uncertainty, budgeters maintain control over their finances, reducing debt and increasing savings. Your financial habits improve significantly by adopting budgeting practices, promoting long-term stability and wealth growth.

Traits Commonly Found in Non-budgeters

Non-budgeters often exhibit traits such as irregular spending patterns, lack of financial goal-setting, and minimal tracking of expenses, leading to inconsistent money management. These individuals may struggle with impulse purchases and experience difficulties in maintaining savings or controlling debt. Understanding these characteristics highlights the importance of adopting disciplined financial habits to enhance fiscal stability and long-term wealth building.

Financial Organization: Tracking Spending Habits

Budgeters consistently track their spending habits, leading to greater financial organization and improved money management. Non-budgeters often lack systematic tracking, resulting in irregular oversight and potential overspending. Developing strong financial habits, such as regular expense monitoring and categorization, enhances budget adherence and long-term financial stability.

Saving Strategies: Proactive vs Reactive Approaches

Budgeters employ proactive saving strategies by setting clear financial goals and systematically allocating funds, enhancing long-term wealth accumulation. Non-budgeters often adopt reactive approaches, saving sporadically in response to unexpected expenses or short-term financial pressures, which limits growth potential. Developing disciplined financial habits fosters consistency in saving, bridging the gap between proactive planning and reactive adjustments for optimized financial health.

Impact on Financial Goals and Stability

Budgeters strategically allocate funds toward savings and expenses, significantly enhancing financial stability and accelerating progress toward financial goals. Non-budgeters often face unpredictable spending patterns that hinder goal achievement and increase the risk of financial instability. Establishing disciplined financial habits empowers you to maintain control over your finances, ensuring consistent growth and security.

Emotional and Psychological Aspects of Budgeting

Budgeters often experience reduced financial stress and greater emotional control by tracking expenses and setting clear spending limits, fostering a sense of security and confidence. Non-budgeters might face anxiety and uncertainty due to unpredictable spending patterns and lack of financial clarity, which can negatively impact their mental well-being. Developing strong financial habits empowers you to cultivate discipline and emotional resilience, improving your overall relationship with money and enhancing psychological stability.

Common Challenges Faced by Both Groups

Budgeters and non-budgeters often struggle with maintaining consistent financial discipline, leading to difficulties in tracking expenses and sticking to savings goals. Both groups face challenges such as unexpected expenses, fluctuating income, and the temptation to overspend, which can undermine long-term financial stability. Poor financial habits like procrastination and lack of financial education further exacerbate these issues, highlighting the need for improved money management strategies across the board.

Long-Term Consequences of Budgeting vs Not Budgeting

Budgeters typically experience enhanced financial stability and wealth accumulation over time due to disciplined spending and saving habits, while non-budgeters often face increased debt and financial stress from impulsive expenditures. Developing strong financial habits such as regular expense tracking and goal-setting supports long-term financial health and resilience against economic fluctuations. Consistent budgeting fosters better credit scores and retirement preparedness, whereas lack of budgeting can lead to missed investment opportunities and inadequate emergency funds.

Tips for Transitioning from Non-budgeter to Budgeter

Transitioning from a non-budgeter to a budgeter requires adopting consistent financial habits like tracking expenses daily and setting clear spending limits. You can improve your money management by using budgeting apps that categorize transactions automatically and provide real-time feedback. Establishing a regular review routine helps reinforce discipline, enabling you to meet savings goals and reduce unnecessary spending effectively.

Infographic: Budgeter vs Non-budgeter

relatioo.com

relatioo.com