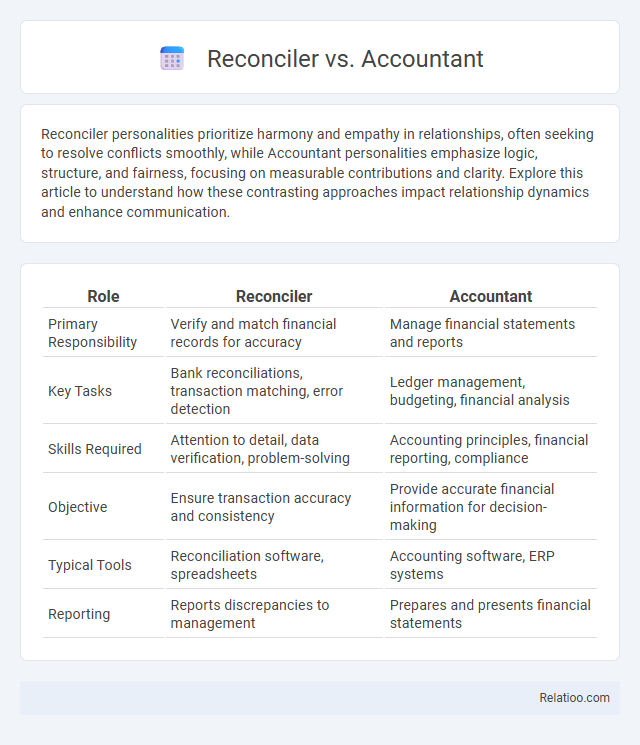

Reconciler personalities prioritize harmony and empathy in relationships, often seeking to resolve conflicts smoothly, while Accountant personalities emphasize logic, structure, and fairness, focusing on measurable contributions and clarity. Explore this article to understand how these contrasting approaches impact relationship dynamics and enhance communication.

Table of Comparison

| Role | Reconciler | Accountant |

|---|---|---|

| Primary Responsibility | Verify and match financial records for accuracy | Manage financial statements and reports |

| Key Tasks | Bank reconciliations, transaction matching, error detection | Ledger management, budgeting, financial analysis |

| Skills Required | Attention to detail, data verification, problem-solving | Accounting principles, financial reporting, compliance |

| Objective | Ensure transaction accuracy and consistency | Provide accurate financial information for decision-making |

| Typical Tools | Reconciliation software, spreadsheets | Accounting software, ERP systems |

| Reporting | Reports discrepancies to management | Prepares and presents financial statements |

Understanding the Roles: Reconciler vs Accountant

The reconciler specializes in verifying and matching financial records to ensure accuracy and consistency, while the accountant manages broader financial tasks such as preparing statements, budgeting, and compliance. Your business relies on the reconciler to identify discrepancies in transactions, preventing errors and fraud, whereas the accountant provides strategic financial analysis and reporting for informed decision-making. Understanding these roles clarifies their unique contributions to maintaining financial integrity and operational efficiency.

Key Responsibilities of a Reconciler

A reconciler is primarily responsible for verifying the accuracy of financial records by comparing transactions and identifying discrepancies in accounts, ensuring that all entries align with bank statements and ledgers. Unlike accountants who manage broader financial reporting, budgeting, and compliance tasks, reconcilers focus on maintaining data integrity through detailed transaction reviews and resolution of inconsistencies. Your role as a reconciler is crucial for preventing errors, detecting fraud, and supporting precise financial statements in the organization.

Core Duties of an Accountant

An accountant's core duties include preparing financial statements, managing ledgers, and ensuring compliance with tax regulations. You rely on accountants to analyze financial data, create budgets, and oversee audits to maintain accurate records. Unlike reconcilers, who focus specifically on matching transactions and resolving discrepancies, accountants handle broader financial reporting and strategic planning tasks.

Skills Required for Reconcilers and Accountants

Reconcilers require strong analytical skills, attention to detail, and proficiency in reconciliation software to identify discrepancies and ensure accurate financial records. Accountants need comprehensive knowledge of accounting principles, financial reporting, and tax regulations, along with expertise in bookkeeping and financial analysis. Both roles demand excellent organizational abilities and familiarity with accounting systems, but reconcilers emphasize transactional accuracy while accountants focus on broader financial management.

Reconciliation Process Explained

The reconciliation process involves matching financial records, such as bank statements and accounting ledgers, to ensure accuracy and identify discrepancies. A reconciler specializes in verifying these discrepancies by systematically comparing transaction details, whereas an accountant manages broader financial tasks including reconciliation, reporting, and compliance. Effective reconciliation minimizes errors, prevents fraud, and supports accurate financial statements essential for business decision-making.

Accounting Workflow Overview

The accounting workflow involves distinct yet interconnected roles such as Reconciler, Accountant, and sometimes an additional Reconciler to ensure accuracy and compliance. Accountants manage financial records, prepare statements, and analyze data, while Reconcilers focus on verifying transactions and matching accounts to detect discrepancies. Your financial process efficiency depends on the seamless collaboration between these roles to maintain precise and reliable accounting systems.

Tools and Software Used: Reconcilers vs Accountants

Reconcilers typically use specialized reconciliation software such as BlackLine, AutoRek, and Trintech to match transactions and identify discrepancies quickly, enhancing accuracy and efficiency. Accountants rely on comprehensive accounting software like QuickBooks, Xero, or SAP ERP, which provide broad financial management capabilities including ledger maintenance, financial reporting, and tax processing. The distinct focus on automated matching and exception management in reconciliation tools versus the wide-ranging financial data handling in accounting software highlights the complementary but specialized technology preferences between Reconcilers and Accountants.

Industry Applications and Relevance

Reconciler roles primarily focus on verifying financial data accuracy by comparing records, essential in industries like banking and retail for fraud prevention and transaction integrity. Accountants manage broader financial tasks such as budgeting, tax compliance, and financial reporting, making them crucial in sectors like corporate finance, manufacturing, and public accounting. Your choice between reconciler and accountant depends on the specific industry demands and the depth of financial oversight required.

Career Paths and Growth Opportunities

Reconciler roles specialize in ensuring accuracy by comparing financial records, offering entry-level access to finance departments with growth potential into senior reconciliation or audit positions. Accountants possess broader responsibilities including financial reporting, tax preparation, and compliance, often advancing to roles such as financial analyst, controller, or CFO with experience and certification. Both career paths provide unique skill development, but accountants generally have wider growth opportunities due to diverse financial expertise and higher demand in various industries.

Choosing the Right Role: Reconciler or Accountant

Choosing the right role between a reconciler and an accountant depends on your focus within financial processes; reconsilers specialize in matching and verifying transactions to ensure accuracy, while accountants handle a broader range of tasks including financial reporting, compliance, and analysis. Reconsiler roles emphasize detail-oriented tasks like bank statement reconciliation and resolving discrepancies, making them critical for maintaining up-to-date ledgers. Accountants require strong knowledge of accounting principles and financial regulations to manage comprehensive financial statements, tax preparation, and strategic budgeting.

Infographic: Reconciler vs Accountant

relatioo.com

relatioo.com