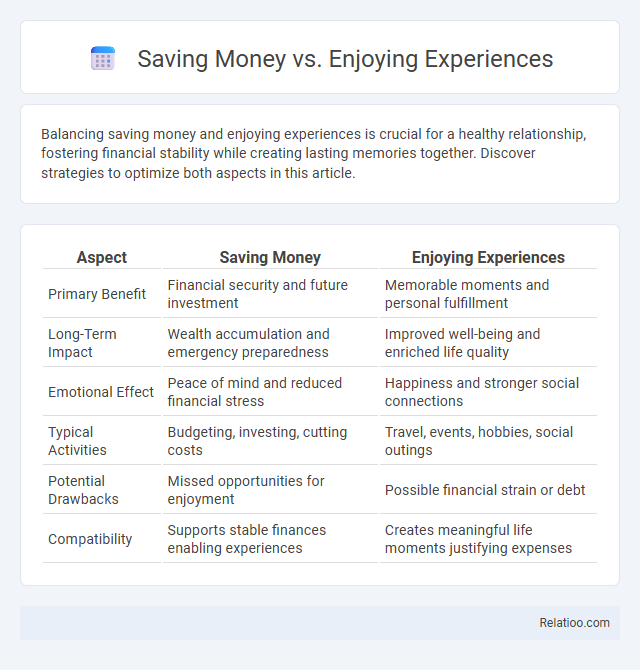

Balancing saving money and enjoying experiences is crucial for a healthy relationship, fostering financial stability while creating lasting memories together. Discover strategies to optimize both aspects in this article.

Table of Comparison

| Aspect | Saving Money | Enjoying Experiences |

|---|---|---|

| Primary Benefit | Financial security and future investment | Memorable moments and personal fulfillment |

| Long-Term Impact | Wealth accumulation and emergency preparedness | Improved well-being and enriched life quality |

| Emotional Effect | Peace of mind and reduced financial stress | Happiness and stronger social connections |

| Typical Activities | Budgeting, investing, cutting costs | Travel, events, hobbies, social outings |

| Potential Drawbacks | Missed opportunities for enjoyment | Possible financial strain or debt |

| Compatibility | Supports stable finances enabling experiences | Creates meaningful life moments justifying expenses |

Introduction to Saving Money vs Enjoying Experiences

Balancing saving money and enjoying experiences is a crucial aspect of achieving your life goals. Saving money provides financial security and enables long-term investments, while enjoying experiences enriches your personal growth and happiness. Understanding how to allocate resources effectively allows you to create a fulfilling and sustainable lifestyle.

The Psychology Behind Saving and Spending

The psychology behind saving versus spending reveals that individuals derive lasting happiness more from meaningful experiences than material possessions, influencing long-term life goals. Cognitive biases such as present bias often lead to prioritizing immediate gratification over future savings, impacting financial stability and goal attainment. Understanding emotional triggers and practicing mindful spending enhances the balance between enjoying life now and securing financial security for future ambitions.

Short-Term Gratification vs Long-Term Financial Goals

Balancing short-term gratification with long-term financial goals requires prioritizing experiences that enrich life while maintaining disciplined savings habits. Allocating funds toward memorable activities can enhance well-being and personal growth, but consistent investment in retirement accounts and emergency funds secures financial stability. Strategic budgeting enables the fulfillment of immediate desires without compromising the achievement of overarching life goals.

Benefits of Prioritizing Savings

Prioritizing savings builds a financial safety net that reduces stress and provides security during emergencies or unexpected expenses. Accumulated savings enable long-term investments that support significant life goals such as homeownership, education, or retirement planning. Consistent saving habits also create freedom to enjoy experiences without debt, ensuring a balanced and sustainable lifestyle.

The Value of Investing in Experiences

Investing in experiences enriches your life by creating lasting memories and personal growth that material possessions cannot match. Studies show that spending on experiences increases overall happiness and strengthens social connections, aligning closely with meaningful life goals. Prioritizing spending on travel, learning, or shared moments supports both emotional well-being and long-term fulfillment beyond financial savings.

Achieving a Balanced Approach

Achieving a balanced approach between saving money and enjoying experiences is essential for long-term life goals. Prioritizing a financial plan that allocates funds for both future security and present enjoyment ensures sustained happiness and stability. Your ability to harmonize spending and saving habits directly impacts the fulfillment of personal aspirations and overall well-being.

Common Financial Mistakes to Avoid

Common financial mistakes include overspending on fleeting experiences at the expense of long-term savings, neglecting to balance enjoying life in the present with securing future financial goals, and failing to establish a clear budget that aligns with personal priorities. Prioritizing either saving money or enjoying experiences without a strategic plan can lead to debt accumulation, missed investment opportunities, and delayed achievement of critical life goals such as retirement or homeownership. Avoiding impulsive purchases, neglecting emergency funds, and ignoring the impact of lifestyle inflation are essential to maintaining financial stability while pursuing meaningful life experiences.

Practical Tips for Saving Without Sacrificing Fun

Balancing saving money with enjoying experiences and pursuing your life goals requires practical strategies like budgeting for discretionary spending and prioritizing meaningful activities that align with your values. You can leverage discounts, off-peak travel deals, and free local events to maximize fun without financial strain. Setting clear savings targets while allowing room for occasional splurges ensures steady progress toward long-term objectives without sacrificing immediate enjoyment.

Real-Life Stories: Finding the Right Balance

Real-life stories reveal how people balance saving money and enjoying experiences by prioritizing their life goals to create lasting happiness. Your financial choices often reflect personal values, where investing in meaningful experiences provides emotional returns that pure savings might miss. Striking the right balance requires mindful planning that aligns with your unique aspirations and long-term well-being.

Conclusion: Choosing What Matters Most

Determining what matters most involves balancing saving money, enjoying experiences, and pursuing life goals to create a fulfilling lifestyle. Prioritizing financial security supports long-term ambitions while allocating resources for meaningful experiences enhances personal growth and happiness. Evaluating individual values and objectives ensures that decisions align with both present satisfaction and future aspirations.

Infographic: Saving money vs Enjoying experiences

relatioo.com

relatioo.com