Frugal relationships prioritize thoughtful spending and shared financial goals, fostering long-term stability and trust. Discover how balancing frugality and lavishness impacts relationship dynamics in this article.

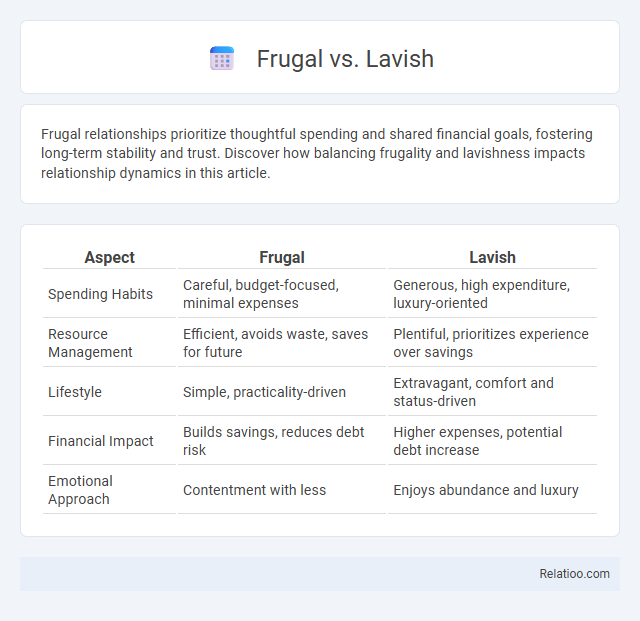

Table of Comparison

| Aspect | Frugal | Lavish |

|---|---|---|

| Spending Habits | Careful, budget-focused, minimal expenses | Generous, high expenditure, luxury-oriented |

| Resource Management | Efficient, avoids waste, saves for future | Plentiful, prioritizes experience over savings |

| Lifestyle | Simple, practicality-driven | Extravagant, comfort and status-driven |

| Financial Impact | Builds savings, reduces debt risk | Higher expenses, potential debt increase |

| Emotional Approach | Contentment with less | Enjoys abundance and luxury |

Understanding Frugal and Lavish Lifestyles

Frugal lifestyles prioritize mindful spending, focusing on saving money and maximizing value through careful budgeting and minimal consumption. Lavish lifestyles emphasize abundant spending on luxury goods, experiences, and status symbols, reflecting a preference for immediate gratification and social prestige. Understanding these contrasting financial habits helps individuals make conscious choices aligned with their long-term goals and financial well-being.

The Psychological Drivers Behind Spending Choices

The psychological drivers behind spending choices often stem from emotional needs and personal values that distinguish frugal, lavish, and typical financial habits. Frugal individuals prioritize long-term security and control, motivated by anxiety about scarcity and a desire for stability. Lavish spenders are frequently driven by status-seeking behavior and instant gratification, reflecting a need for social approval and self-expression through material wealth.

Financial Impact: Saving vs. Splurging

Frugal financial habits emphasize consistent saving and mindful spending, leading to long-term wealth accumulation and financial security. Lavish behaviors often result in frequent splurging on luxury items or experiences, which can deplete savings and increase debt risk. Balancing these approaches by cultivating disciplined saving habits while allowing occasional spending enhances overall financial well-being and reduces monetary stress.

Social Perceptions of Frugality and Luxury

Social perceptions often label frugality as responsible and disciplined, while luxury is associated with success and status. Your financial habits shape how others view your values and priorities, influencing social standing and self-esteem. Understanding these perceptions helps balance practical saving with enjoying life's finer things.

Long-term Benefits of Frugal Living

Frugal living emphasizes mindful spending, saving, and investing to build substantial wealth over time, contrasting sharply with lavish habits that prioritize immediate gratification and high expenses. Financial habits centered on frugality enhance long-term benefits such as increased financial security, reduced debt, and greater investment potential, enabling early retirement and financial independence. Consistent frugal choices cultivate resilience against economic downturns and provide a stable foundation for future generations.

Pitfalls of Lavish Spending Habits

Lavish spending habits often lead to financial instability due to excessive and impulsive purchases that exceed income levels, resulting in mounting debt and depleted savings. Individuals who favor extravagant lifestyles may neglect essential financial goals such as emergency funds and retirement planning, increasing vulnerability to economic downturns. Consistently prioritizing luxury over budgeting undermines long-term wealth accumulation and can cause persistent stress related to money management.

Balancing Quality and Cost: Finding Middle Ground

Striking a balance between frugal and lavish financial habits involves prioritizing quality without overspending, ensuring your purchases provide long-term value rather than short-term gratification. By evaluating costs against benefits, you can allocate resources wisely, avoiding extremes that lead to either unnecessary spending or subpar outcomes. This balanced approach helps you build sustainable financial habits that support both enjoyment and savings.

Real-Life Stories: From Penny Pinchers to Big Spenders

Real-life stories reveal how frugal individuals save consistently by prioritizing needs over wants, turning small savings into substantial wealth. Lavish spenders often showcase their success through high-end purchases but may face financial instability without disciplined habits. Understanding your own financial habits helps balance spending and saving, ensuring long-term security and personal satisfaction.

Tips for Transitioning Between Frugal and Lavish Habits

Transitioning between frugal and lavish habits requires strategic budgeting to balance saving with occasional indulgence, ensuring financial stability while enjoying life's luxuries. Tracking expenses with tools like Mint or YNAB helps identify spending patterns, enabling adjustments to avoid overspending or underutilizing resources. Establishing clear financial goals and prioritizing needs over wants supports a sustainable approach to shifting habits, promoting mindful consumption and long-term wealth building.

Choosing a Lifestyle: What’s Right for You?

Choosing a lifestyle between frugal, lavish, and balanced financial habits depends on your personal values, income, and long-term goals. Frugal living emphasizes careful budgeting and prioritizing essentials, helping you save and build financial security, while lavish spending focuses on indulging in luxury and experiences that enhance your happiness and social status. Understanding your financial habits allows you to create a sustainable lifestyle that aligns with your priorities and ensures financial well-being.

Infographic: Frugal vs Lavish

relatioo.com

relatioo.com