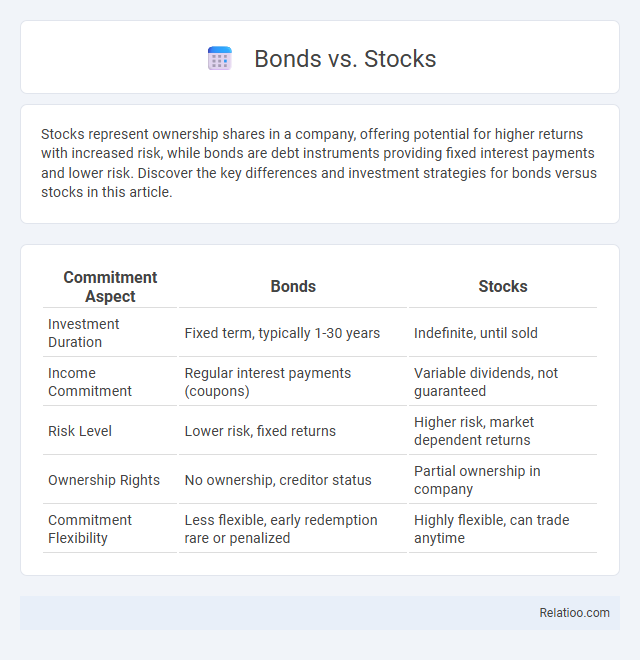

Stocks represent ownership shares in a company, offering potential for higher returns with increased risk, while bonds are debt instruments providing fixed interest payments and lower risk. Discover the key differences and investment strategies for bonds versus stocks in this article.

Table of Comparison

| Commitment Aspect | Bonds | Stocks |

|---|---|---|

| Investment Duration | Fixed term, typically 1-30 years | Indefinite, until sold |

| Income Commitment | Regular interest payments (coupons) | Variable dividends, not guaranteed |

| Risk Level | Lower risk, fixed returns | Higher risk, market dependent returns |

| Ownership Rights | No ownership, creditor status | Partial ownership in company |

| Commitment Flexibility | Less flexible, early redemption rare or penalized | Highly flexible, can trade anytime |

Introduction to Bonds and Stocks

Bonds represent fixed-income securities where investors lend money to entities like governments or corporations in exchange for periodic interest payments and principal repayment at maturity. Stocks signify equity ownership in a company, providing investors with potential dividends and capital appreciation based on the firm's performance. Understanding the fundamental differences between bonds and stocks is essential for constructing a diversified investment portfolio tailored to risk tolerance and financial goals.

What Are Bonds?

Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically a corporation or government entity, with a promise to pay back the principal along with periodic interest payments. Unlike stocks, which offer ownership stakes and potential dividends, bonds provide more predictable income and are generally considered lower-risk investments. Understanding bonds can help you diversify your investment portfolio and balance risk according to your financial goals.

What Are Stocks?

Stocks represent ownership shares in a company, giving you partial equity and the potential for dividends and capital appreciation. Unlike bonds, which are debt instruments paying fixed interest, stocks carry higher risk but offer greater growth opportunities through market price fluctuations. Your investment in stocks exposes you to company performance and market dynamics, making them a core component of many diversified portfolios.

Key Differences Between Bonds and Stocks

Bonds represent debt securities where investors lend money to an entity in exchange for fixed interest payments and return of principal at maturity, while stocks signify ownership shares in a company, entitling shareholders to dividends and capital appreciation. Bonds typically offer lower risk and more predictable returns, making them suitable for income-focused investors, whereas stocks carry higher volatility and potential for greater long-term growth. Understanding the fundamental differences in risk, return, and ownership is essential for optimizing investment portfolios.

Risk and Return Comparison

Bonds generally offer lower risk and more predictable returns compared to stocks, making them suitable for conservative investors seeking income stability. Stocks have higher potential returns but come with increased volatility and greater risk of loss, appealing to those willing to tolerate market fluctuations for growth. Your investment strategy should balance bonds and stocks to align risk tolerance with return objectives, optimizing portfolio performance.

Income Generation: Dividends vs Interest

Bonds generate income primarily through fixed interest payments, providing predictable cash flow and lower risk compared to stocks. Stocks offer dividends, which represent a share of corporate profits distributed to shareholders, often with potential for capital appreciation alongside income. Investment strategies balance bonds and stocks to optimize income generation by combining the stability of interest with the growth potential and dividend yield of equities.

Liquidity and Market Accessibility

Bonds typically offer lower liquidity than stocks, as they may require holding until maturity or finding a buyer in less active secondary markets, whereas stocks trade on highly liquid exchanges with continuous price updates. Investments in stocks provide easier market accessibility for You through online brokerage platforms, allowing instant buying and selling during market hours. Understanding these liquidity differences is essential for tailoring Your investment strategy to meet cash flow needs or long-term growth goals.

Suitability for Different Investor Profiles

Bonds offer fixed income and lower risk, making them suitable for conservative investors or those nearing retirement seeking capital preservation. Stocks provide higher growth potential but with increased volatility, fitting risk-tolerant investors aiming for long-term wealth accumulation. Your investment strategy should balance these assets according to your risk tolerance, time horizon, and financial goals to optimize returns.

Tax Implications: Bonds vs Stocks

Bonds typically generate interest income taxed at ordinary income tax rates, which may be higher than the long-term capital gains tax rates applied to stock dividends and sales. You should consider that qualified dividends from stocks often receive favorable tax treatment compared to bond interest, which could impact your overall tax liability. Understanding these tax implications helps optimize your investment strategy for maximizing after-tax returns.

Which Should You Choose: Bonds or Stocks?

Choosing between bonds and stocks depends on your risk tolerance and investment goals, as stocks offer higher potential returns with greater volatility while bonds provide more stable income through fixed interest payments. Stocks represent ownership in a company and can appreciate significantly, but bonds are debt instruments that prioritize capital preservation and consistent returns. Your investment strategy should balance these options to align with your financial objectives and time horizon.

Infographic: Bonds vs Stocks

relatioo.com

relatioo.com