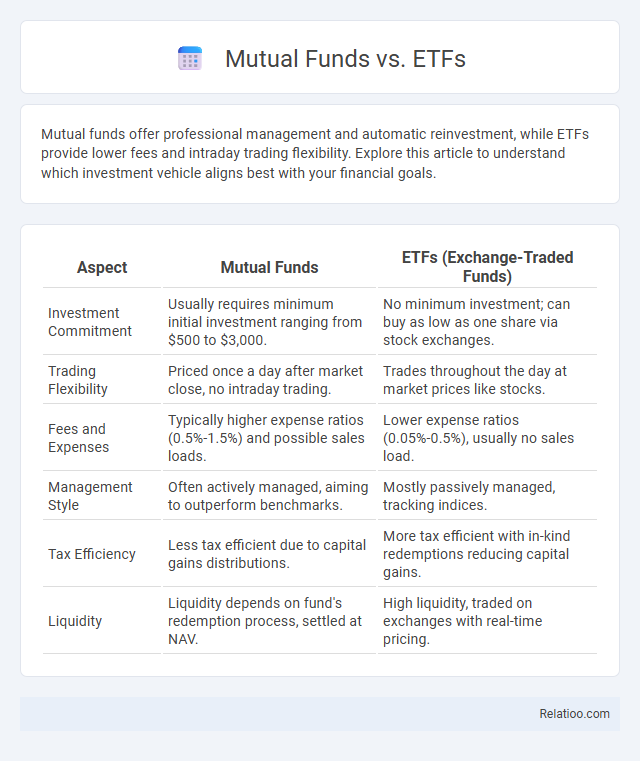

Mutual funds offer professional management and automatic reinvestment, while ETFs provide lower fees and intraday trading flexibility. Explore this article to understand which investment vehicle aligns best with your financial goals.

Table of Comparison

| Aspect | Mutual Funds | ETFs (Exchange-Traded Funds) |

|---|---|---|

| Investment Commitment | Usually requires minimum initial investment ranging from $500 to $3,000. | No minimum investment; can buy as low as one share via stock exchanges. |

| Trading Flexibility | Priced once a day after market close, no intraday trading. | Trades throughout the day at market prices like stocks. |

| Fees and Expenses | Typically higher expense ratios (0.5%-1.5%) and possible sales loads. | Lower expense ratios (0.05%-0.5%), usually no sales load. |

| Management Style | Often actively managed, aiming to outperform benchmarks. | Mostly passively managed, tracking indices. |

| Tax Efficiency | Less tax efficient due to capital gains distributions. | More tax efficient with in-kind redemptions reducing capital gains. |

| Liquidity | Liquidity depends on fund's redemption process, settled at NAV. | High liquidity, traded on exchanges with real-time pricing. |

Introduction to Mutual Funds and ETFs

Mutual funds pool money from multiple investors to create a diversified portfolio managed by professional fund managers, offering broad market exposure and automated rebalancing. Exchange-Traded Funds (ETFs) also provide diversification but trade like stocks on exchanges, enabling intraday buying and selling with typically lower expense ratios than mutual funds. Both investment vehicles offer distinct advantages in liquidity, cost, and management style, catering to different investor preferences and financial goals.

Key Differences Between Mutual Funds and ETFs

Mutual funds pool investors' money to buy a diversified portfolio managed by professionals, typically priced once daily at net asset value (NAV), while ETFs trade like stocks on exchanges throughout the day with fluctuating prices. You benefit from ETFs' intraday liquidity and often lower expense ratios, whereas mutual funds offer automatic reinvestment and minimal transaction fees. Understanding these differences helps optimize your investment decisions based on trading flexibility, costs, and management style.

Structure and Management Styles

Mutual funds pool investor money into a diversified portfolio managed actively by professional fund managers who make decisions to meet specific investment goals. ETFs (Exchange-Traded Funds) are structured as investment funds that trade on stock exchanges, often tracking an index passively with lower management fees and higher liquidity compared to mutual funds. Your choice between mutual funds and ETFs depends on whether you prefer active management with potential for higher returns or passive management with cost efficiency and intraday trading flexibility.

Trading and Pricing Mechanisms

Mutual funds trade only once daily after the market closes, with prices based on the net asset value (NAV) calculated at that time, while ETFs trade throughout the day on stock exchanges with real-time pricing reflecting supply and demand. Your choice impacts liquidity since ETFs offer intraday trading flexibility similar to stocks, whereas mutual funds require end-of-day transactions without intraday price fluctuations. Understanding these trading and pricing mechanisms helps optimize investment strategies by aligning liquidity needs and cost considerations.

Costs and Fees Comparison

Mutual funds typically have higher expense ratios and may include management fees, sales loads, and transaction costs, while ETFs generally feature lower expense ratios and trade like stocks with brokerage commissions. Mutual funds often impose minimum investment amounts and potentially redemption fees, whereas ETFs provide greater liquidity and cost efficiency through real-time trading and generally lower operating expenses. Investors should assess the total cost of ownership, including expense ratios, management fees, and trading commissions, to optimize portfolio returns in both vehicles.

Tax Efficiency Considerations

Mutual funds often generate capital gains distributions that can lead to higher tax liabilities, whereas ETFs use an in-kind redemption process, making them generally more tax-efficient for Your investment portfolio. Tax efficiency is a critical factor when choosing between mutual funds and ETFs, as ETFs typically allow investors to defer capital gains taxes until shares are sold. Understanding the tax implications of each investment type can help You optimize after-tax returns and better manage Your overall investment strategy.

Investment Strategies and Flexibility

Mutual funds offer professional management and diversification but often come with higher fees and less trading flexibility compared to ETFs, which provide intraday trading and lower expense ratios. ETFs allow investors to implement more dynamic investment strategies, such as sector rotation or tactical asset allocation, due to their liquidity and transparency. Investment strategies focusing on long-term growth or income might prefer mutual funds for their systematic approach, while active traders benefit from the flexibility and cost-efficiency of ETFs.

Liquidity and Accessibility

Mutual funds often have limited liquidity, as redemptions typically occur at the end of the trading day at the net asset value (NAV), while ETFs offer higher liquidity with real-time trading on stock exchanges throughout market hours. ETFs provide greater accessibility due to lower minimum investment requirements and ease of transaction similar to stocks, whereas mutual funds may require higher initial investments and have restrictions on purchase and redemption timing. Investors seeking flexible trading and instant access to portfolio adjustments generally prefer ETFs, while those focusing on professional management with periodic liquidity might choose mutual funds.

Risk Factors and Diversification

Mutual funds and ETFs both offer diversified portfolios that help mitigate risk by spreading investments across various assets, but mutual funds often come with higher management fees and less trading flexibility compared to ETFs. ETFs provide the advantage of real-time trading and typically lower expense ratios, making them attractive for investors seeking cost-effective diversification with moderate risk exposure. Your choice between these investment vehicles should consider your risk tolerance, liquidity needs, and long-term financial goals to optimize portfolio diversification and minimize potential losses.

Which Option is Right for You?

Mutual funds offer professional management and diversification but often come with higher fees and minimum investment requirements, making them suitable for long-term investors seeking hands-off growth. ETFs provide flexibility with lower costs, intraday trading, and tax efficiency, appealing to investors who want control and liquidity in their portfolios. Choosing the right option depends on your investment goals, risk tolerance, and need for accessibility, with mutual funds favored for steady, managed growth and ETFs preferred for cost-effective, flexible investing.

Infographic: Mutual Funds vs ETFs

relatioo.com

relatioo.com