Negligence in trusts refers to a trustee's failure to exercise reasonable care, while willful misconduct involves intentional wrongdoing or reckless disregard for the trust's duties. Explore this article to understand the critical distinctions and legal implications between negligence and willful misconduct in trust management.

Table of Comparison

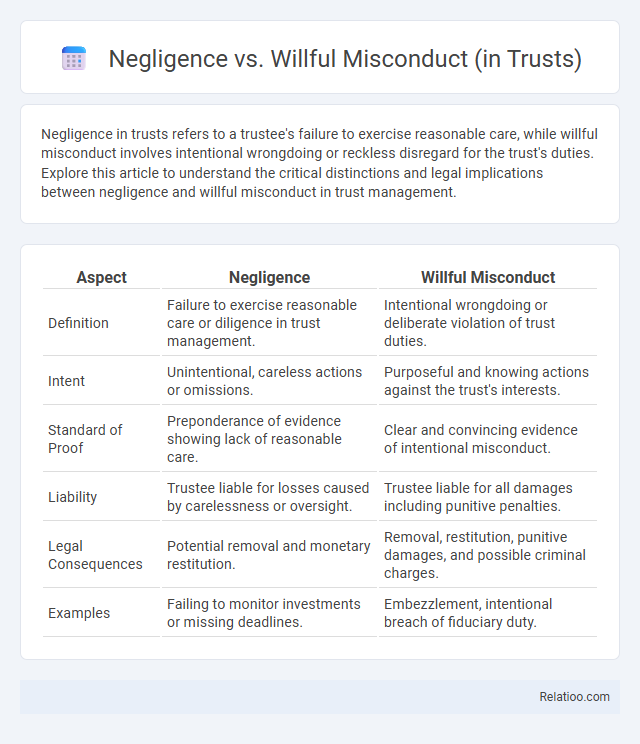

| Aspect | Negligence | Willful Misconduct |

|---|---|---|

| Definition | Failure to exercise reasonable care or diligence in trust management. | Intentional wrongdoing or deliberate violation of trust duties. |

| Intent | Unintentional, careless actions or omissions. | Purposeful and knowing actions against the trust's interests. |

| Standard of Proof | Preponderance of evidence showing lack of reasonable care. | Clear and convincing evidence of intentional misconduct. |

| Liability | Trustee liable for losses caused by carelessness or oversight. | Trustee liable for all damages including punitive penalties. |

| Legal Consequences | Potential removal and monetary restitution. | Removal, restitution, punitive damages, and possible criminal charges. |

| Examples | Failing to monitor investments or missing deadlines. | Embezzlement, intentional breach of fiduciary duty. |

Defining Negligence in Trust Administration

Negligence in trust administration refers to the failure of a trustee to exercise the care, skill, and diligence that a reasonably prudent person would under similar circumstances, leading to potential harm or loss to the trust. Willful misconduct involves intentional wrongdoing or reckless disregard of fiduciary duties, which is a more severe breach than negligence. You must understand these distinctions to protect your interests and ensure proper management of trust assets.

Understanding Willful Misconduct by Trustees

Willful misconduct by trustees involves intentional or reckless actions that breach fiduciary duties, exceeding mere negligence, which typically denotes failure to exercise reasonable care. Unlike negligence, willful misconduct reflects deliberate wrongdoing, such as misappropriation of trust assets or knowingly violating trust terms. Courts impose stricter liabilities on trustees for willful misconduct to protect beneficiaries' interests and maintain trust integrity.

Legal Standards for Trustee Conduct

Trustees must adhere to strict legal standards distinguishing negligence from willful misconduct, with negligence involving failure to exercise reasonable care, while willful misconduct entails intentional wrongdoing or reckless disregard. Your fiduciary duty requires acting prudently and in good faith, avoiding actions that could harm the trust, as courts evaluate trustee conduct based on these standards. Understanding these differences is crucial in trust administration to minimize liability and ensure compliance with trust law principles.

Key Differences: Negligence vs Willful Misconduct

Negligence in trusts refers to a failure to exercise the standard of care that a reasonably prudent person would in similar circumstances, resulting in unintended harm or loss to the trust. Willful misconduct involves intentional or reckless actions with knowledge that harm is likely, demonstrating a conscious disregard for the trust's interests or legal duties. The key difference lies in intent; negligence is characterized by carelessness or omission, whereas willful misconduct requires deliberate or reckless wrongdoing.

Examples of Negligence in Trust Management

Examples of negligence in trust management include failing to diversify trust investments, overlooking tax obligations, and neglecting to keep accurate records of trust assets and transactions. Trustees who neglect to monitor trust property or miss deadlines for required distributions can be held liable for breaching their fiduciary duties. These negligent acts contrast with willful misconduct, where trustees intentionally violate trust terms or act in bad faith.

Illustrations of Willful Misconduct in Trusts

Willful misconduct in trusts involves intentional or reckless actions that violate fiduciary duties, such as knowingly misappropriating trust assets or intentionally ignoring beneficiary interests, contrasting with simple negligence which results from carelessness without intent. Your understanding of willful misconduct is critical when trustees deliberately breach trust terms or act in bad faith, exemplified by actions like fraudulently transferring trust property or conspiring to defraud beneficiaries. Courts often impose stricter liability and penalties for willful misconduct due to the intentional nature of the breach, differentiating it clearly from inadvertent negligence.

Consequences for Trustees: Negligence vs Willful Misconduct

Trustees found guilty of negligence in managing trusts may face removal and be liable for losses caused by their failure to exercise reasonable care, while willful misconduct results in stricter consequences including personal liability for all damages, potential disqualification from trusteeship, and possible civil or criminal penalties. Your actions as a trustee must adhere to fiduciary duties, since negligence breaches can result in financial restitution, but willful misconduct involves intentional wrongdoing or gross recklessness with more severe consequences. Courts typically distinguish negligence from willful misconduct by evaluating the trustee's intent and degree of carelessness, directly impacting the severity of penalties and trustee accountability.

Protecting Beneficiaries from Trustee Misconduct

Trustees owe a fiduciary duty to protect beneficiaries from harm caused by negligence or willful misconduct. Courts distinguish willful misconduct as intentional or reckless behavior, warranting harsher penalties compared to ordinary negligence, which involves failure to exercise reasonable care. Robust trust provisions and vigilant oversight mechanisms help shield beneficiaries by holding trustees accountable for breaches arising from either negligence or willful violations.

Trustee Liability and Legal Remedies

Trustee liability in negligence cases arises when a trustee fails to exercise the care, skill, and diligence expected, resulting in loss to the trust beneficiaries; remedies typically include compensatory damages to restore the trust fund. In contrast, willful misconduct involves intentional or reckless actions by the trustee that breach fiduciary duties, often leading to stricter penalties such as restitution, surcharge, or removal as trustee. Legal remedies for willful misconduct are more severe than for negligence, emphasizing the protection of trust property and beneficiary interests through equitable relief and potential punitive consequences.

Best Practices to Avoid Negligence and Willful Misconduct

To avoid negligence and willful misconduct in trusts, you should consistently adhere to fiduciary duties by maintaining clear documentation, conducting thorough due diligence, and regularly reviewing trust activities. Implementing standardized procedures and seeking professional advice ensure accountability and minimize risks of breaches. Staying informed about legal standards and applying prudent judgment protect your trust's integrity and beneficiaries' interests.

Infographic: Negligence vs Willful Misconduct (in Trusts)

relatioo.com

relatioo.com