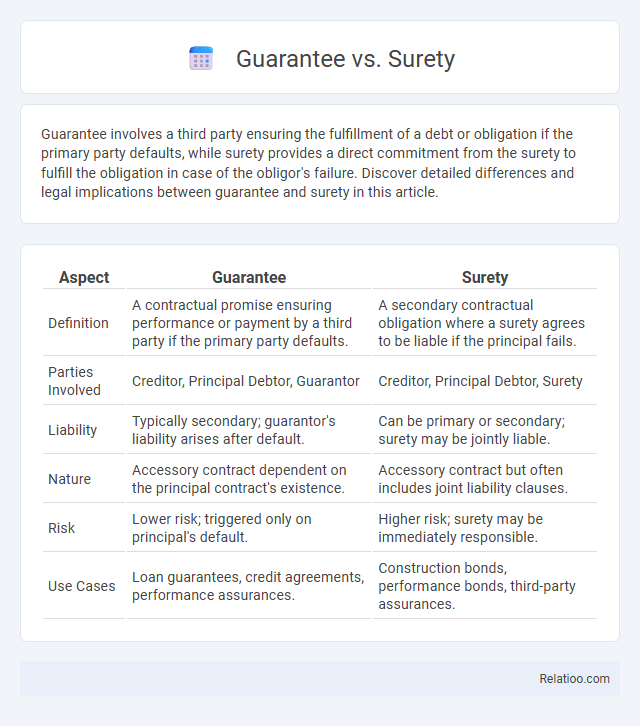

Guarantee involves a third party ensuring the fulfillment of a debt or obligation if the primary party defaults, while surety provides a direct commitment from the surety to fulfill the obligation in case of the obligor's failure. Discover detailed differences and legal implications between guarantee and surety in this article.

Table of Comparison

| Aspect | Guarantee | Surety |

|---|---|---|

| Definition | A contractual promise ensuring performance or payment by a third party if the primary party defaults. | A secondary contractual obligation where a surety agrees to be liable if the principal fails. |

| Parties Involved | Creditor, Principal Debtor, Guarantor | Creditor, Principal Debtor, Surety |

| Liability | Typically secondary; guarantor's liability arises after default. | Can be primary or secondary; surety may be jointly liable. |

| Nature | Accessory contract dependent on the principal contract's existence. | Accessory contract but often includes joint liability clauses. |

| Risk | Lower risk; triggered only on principal's default. | Higher risk; surety may be immediately responsible. |

| Use Cases | Loan guarantees, credit agreements, performance assurances. | Construction bonds, performance bonds, third-party assurances. |

Understanding Guarantee and Surety: Key Definitions

Guarantee involves a commitment by a guarantor to fulfill the obligations of a debtor if they default, while surety is a promise by a surety to answer for the debt or default of another, often reflecting a more direct contractual relationship. A guarantee typically serves as a secondary obligation, triggered only upon the principal debtor's failure, whereas suretyship creates a joint obligation with the principal debtor, making the surety equally liable from the outset. Understanding these distinctions clarifies risk allocation in financial and legal agreements, ensuring proper application in contracts and credit arrangements.

Legal Foundations of Guarantees and Sureties

Guarantees and sureties are both legal instruments used to secure obligations, with guarantees involving a promisor who commits to fulfilling another party's obligation if they default, while sureties act as a secondary party directly liable to the creditor upon the debtor's failure. The legal foundation of guarantees is often grounded in contract law principles, requiring clear consent, consideration, and lawful object, whereas suretyship is established through strict compliance with formal statutory requirements to ensure enforceability. The distinction is crucial in legal contexts as sureties tend to have joint and several liability, making them immediately responsible alongside the principal debtor, whereas guarantees typically involve secondary liability activated only after default.

Roles and Responsibilities: Guarantor vs Surety

The guarantor assumes a secondary obligation, stepping in only if the primary party defaults, ensuring your financial commitment is honored without direct involvement in initial contract terms. The surety undertakes a primary obligation alongside the principal, sharing equal responsibility for fulfilling the contract from the outset and actively ensuring compliance. Understanding these distinct roles clarifies your position in risk management, with guarantors providing backup assurance and sureties delivering joint accountability.

Types of Guarantees and Surety Bonds

Guarantees include financial guarantees, performance guarantees, and advance payment guarantees, each ensuring contractual obligations are met or payments secured. Surety bonds consist of bid bonds, performance bonds, and payment bonds, where a surety company assures the obligee of the principal's fulfillment of contractual duties. Distinguishing between these types helps businesses and individuals select the appropriate instrument for risk management and project assurance.

Key Differences Between Guarantee and Surety

A guarantee involves a commitment by a guarantor to fulfill the obligations of a principal debtor if they default, creating a secondary liability. A surety is a party who ensures the principal's performance or payment, holding primary liability alongside the principal. You should note that while guarantees often arise from contractual agreements, sureties typically require a formal surety bond, emphasizing the principal's primary responsibility and the surety's contingent obligation.

Rights and Liabilities in Guarantee vs Surety Agreements

In Guarantee agreements, the guarantor assumes secondary liability, stepping in only if the principal debtor defaults, while in Surety agreements, the surety takes primary liability alongside the principal debtor, making You directly liable from the outset. The guarantor's rights are typically limited to indemnity and reimbursement from the principal debtor, whereas the surety enjoys rights such as subrogation, contribution, and indemnity upon fulfilling the debtor's obligations. Your liabilities in a Surety contract are more immediate and extensive compared to a Guarantee contract, where liability is contingent and ancillary.

Importance in Commercial and Financial Transactions

Guarantee, surety, and warranty play crucial roles in commercial and financial transactions by mitigating risks and ensuring performance obligations. A guarantee provides a legally binding promise by a guarantor to fulfill a debtor's obligation if they default, enhancing creditor confidence and facilitating credit extension. Suretyship involves a third party assuming responsibility for debt repayment or contractual performance, while warranties offer protection against defects or non-compliance, collectively strengthening transactional security and trust.

Termination and Revocation: Guarantee vs Surety

Termination of a guarantee arises when the principal obligation is fulfilled or the creditor revokes consent under specific conditions, whereas a suretyship can be revoked by the surety before any liability arises, subject to notice. Your rights under a guarantee remain enforceable until the underlying debt is discharged, while a surety's revocation lifts future obligations but does not affect liability for existing debts. The legal distinction hinges on irrevocability and scope, as guarantees often create a direct obligation, unlike suretyships which depend on the principal debtor's default.

Common Pitfalls and Legal Implications

Guarantee, surety, and warranty often create confusion due to overlapping terms but differ significantly in legal obligations and risk allocation. Common pitfalls include misunderstanding the scope of liability--guarantee imposes primary liability on the guarantor for the debtor's obligation, whereas surety involves secondary liability, activated only upon the debtor's default. Legal implications hinge on enforceability, with guarantees typically requiring written contracts to be valid, and suretyship often subject to strict scrutiny regarding the extent of the surety's commitment and potential defenses available under contract law.

Choosing Between Guarantee and Surety: Factors to Consider

Choosing between a guarantee and a surety involves evaluating the level of risk and the parties involved in the obligation. A guarantee creates a direct contractual obligation for the guarantor to pay if the principal defaults, offering stronger protection to the creditor, while a surety involves a secondary obligation typically requiring the creditor to pursue the principal first. Key factors to consider include the financial strength of the guarantor or surety, the intended scope of liability, and jurisdictional legal implications impacting enforcement and creditor remedies.

Infographic: Guarantee vs Surety

relatioo.com

relatioo.com