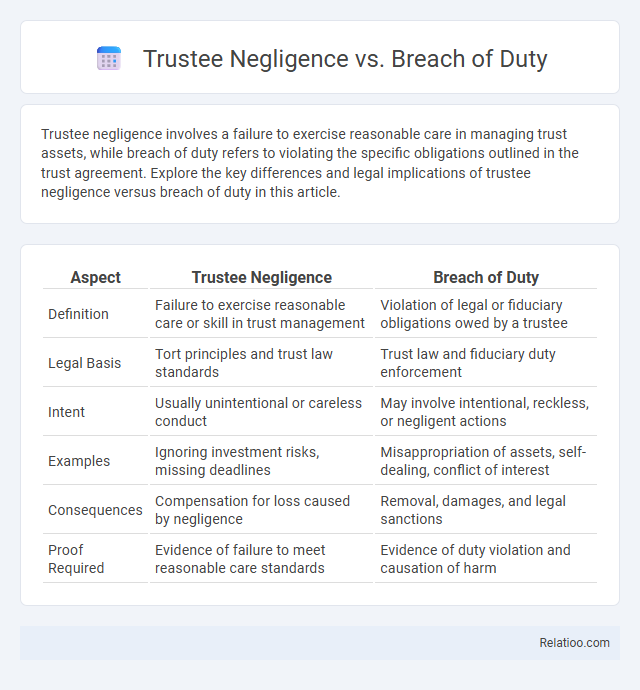

Trustee negligence involves a failure to exercise reasonable care in managing trust assets, while breach of duty refers to violating the specific obligations outlined in the trust agreement. Explore the key differences and legal implications of trustee negligence versus breach of duty in this article.

Table of Comparison

| Aspect | Trustee Negligence | Breach of Duty |

|---|---|---|

| Definition | Failure to exercise reasonable care or skill in trust management | Violation of legal or fiduciary obligations owed by a trustee |

| Legal Basis | Tort principles and trust law standards | Trust law and fiduciary duty enforcement |

| Intent | Usually unintentional or careless conduct | May involve intentional, reckless, or negligent actions |

| Examples | Ignoring investment risks, missing deadlines | Misappropriation of assets, self-dealing, conflict of interest |

| Consequences | Compensation for loss caused by negligence | Removal, damages, and legal sanctions |

| Proof Required | Evidence of failure to meet reasonable care standards | Evidence of duty violation and causation of harm |

Understanding Trustee Responsibilities

Trustee negligence occurs when a trustee fails to act with the care, skill, and diligence expected in managing trust assets, often leading to financial loss or damage. Breach of duty involves a trustee violating specific legal or fiduciary obligations, such as self-dealing or misappropriation of trust property, which undermines the trust's purpose. Negligence is a broader concept encompassing any failure to exercise reasonable care, with trustee responsibilities including loyalty, prudence, impartiality, and adherence to the trust terms.

Defining Trustee Negligence

Trustee negligence occurs when a trustee fails to exercise the care and diligence expected in managing a trust, resulting in harm to the beneficiaries. Breach of duty involves violating specific obligations outlined in the trust agreement or fiduciary law, which may or may not involve negligence. Your understanding of trustee negligence is crucial for recognizing when a trustee has improperly handled trust assets or neglected their responsibilities.

What Constitutes a Breach of Duty?

A breach of duty occurs when a trustee fails to act in the best interests of the beneficiaries, violating the fiduciary responsibilities outlined in the trust agreement or by law. Trustee negligence involves careless or reckless actions that result in harm or loss to the trust, but not all negligence constitutes a breach of duty unless it breaches fiduciary standards. Understanding the distinction helps you evaluate whether the trustee's conduct legally undermines trust obligations or simply reflects poor judgment.

Key Differences Between Negligence and Breach

Trustee negligence occurs when a trustee fails to act with the care and diligence required by their fiduciary duty, while breach of duty involves a violation of specific obligations outlined in a trust agreement or legal standards. Negligence generally refers to a failure to exercise reasonable care resulting in harm, but breach of duty in trustee contexts specifically addresses violations of trust terms or fiduciary responsibilities. Understanding these distinctions helps you identify whether a trustee's actions stem from carelessness or a fundamental breach of their legal obligations.

Legal Standards for Trustee Conduct

Trustee negligence involves a failure to exercise the reasonable care and skill expected in managing a trust, whereas breach of duty specifically refers to violations of fiduciary obligations, such as acting in self-interest or failing to follow trust terms. Negligence in trustee conduct is assessed under the objective standard of a prudent person managing similar affairs, requiring You to meet due diligence and impartiality requirements. Legal standards demand trustees avoid conflicts of interest, maintain accurate records, and act solely in beneficiaries' best interests to prevent liability.

Common Examples of Trustee Negligence

Common examples of trustee negligence include failing to diversify trust investments, neglecting to keep accurate records, and missing deadlines for distributions. Trustee negligence differs from a breach of duty in that it specifically involves a lack of reasonable care, whereas breach of duty encompasses any violation of fiduciary responsibilities, including conflicts of interest or misappropriation of trust assets. General negligence refers to careless behavior causing harm, but trustee negligence focuses on the unique fiduciary role and obligations within trust management.

Recognizing a Breach of Fiduciary Duty

Recognizing a breach of fiduciary duty requires understanding how trustee negligence differs from general negligence and breach of duty. Trustee negligence occurs when a trustee fails to act with the prudence and loyalty required, directly harming the trust's interests. Your ability to distinguish these concepts is crucial in identifying when a trustee violates their fiduciary obligations, potentially entitling you to legal remedies.

Consequences of Trustee Misconduct

Trustee negligence involves a failure to exercise reasonable care, resulting in potential financial loss to the trust beneficiaries, while breach of duty specifically refers to violating fiduciary responsibilities such as loyalty, prudence, or impartiality. Both trustee negligence and breach of duty can lead to severe consequences including removal of the trustee, personal liability for losses, and in some cases legal action for damages. The differing degrees of accountability emphasize the importance of trustees adhering strictly to their fiduciary obligations to prevent misconduct and protect the interests of the trust.

Remedies for Trust Beneficiaries

Trust beneficiaries facing trustee negligence can seek remedies including removal of the trustee, surcharge for losses, and restitution. Breach of duty claims often lead to equitable remedies such as specific performance or injunctions to prevent further violations. When negligence causes harm, beneficiaries may recover compensatory damages reflecting the financial impact on the trust estate.

Preventing Trustee Negligence and Breach of Duty

Preventing trustee negligence and breach of duty requires implementing rigorous oversight mechanisms, including regular audits and comprehensive trustee training focused on fiduciary responsibilities. Clear documentation of all decisions and adherence to trust terms minimizes the risk of liability by demonstrating compliance with legal standards. Establishing a robust governance framework ensures trustees act in the best interest of beneficiaries, thereby reducing instances of negligence and breach of duty.

Infographic: Trustee Negligence vs Breach of Duty

relatioo.com

relatioo.com