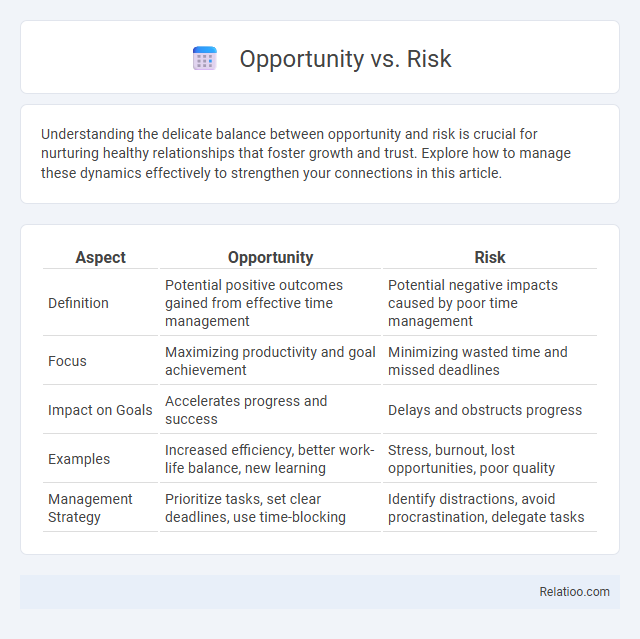

Understanding the delicate balance between opportunity and risk is crucial for nurturing healthy relationships that foster growth and trust. Explore how to manage these dynamics effectively to strengthen your connections in this article.

Table of Comparison

| Aspect | Opportunity | Risk |

|---|---|---|

| Definition | Potential positive outcomes gained from effective time management | Potential negative impacts caused by poor time management |

| Focus | Maximizing productivity and goal achievement | Minimizing wasted time and missed deadlines |

| Impact on Goals | Accelerates progress and success | Delays and obstructs progress |

| Examples | Increased efficiency, better work-life balance, new learning | Stress, burnout, lost opportunities, poor quality |

| Management Strategy | Prioritize tasks, set clear deadlines, use time-blocking | Identify distractions, avoid procrastination, delegate tasks |

Understanding Opportunity vs Risk

Understanding opportunity vs risk involves evaluating potential gains against possible losses to make informed decisions. Opportunity represents the potential for positive outcomes or growth, while risk signifies the likelihood of negative consequences or failure. Effective decision-making requires balancing these factors through careful analysis of market conditions, resource allocation, and competitive advantages.

Key Differences Between Opportunity and Risk

Opportunity represents potential positive outcomes or benefits that can be gained from a decision or action, whereas risk involves the possibility of negative consequences or losses. Opportunities often require investment and strategic planning to maximize gains, while risks demand mitigation strategies to minimize potential harm. Understanding these key differences enables businesses to balance growth prospects with protective measures effectively.

Identifying Opportunities in Uncertainty

Identifying opportunities in uncertainty requires analyzing potential risks and benefits to determine viable paths for growth and innovation. Businesses use data-driven risk assessment models and scenario planning to uncover hidden opportunities while mitigating threats. Embracing uncertainty with adaptive strategies allows organizations to capitalize on emerging trends and gain competitive advantages.

Assessing and Quantifying Risks

Assessing and quantifying risks involves identifying potential threats to your project or business and measuring their likelihood and impact using qualitative and quantitative methods such as risk matrices, Monte Carlo simulations, or sensitivity analysis. Effective risk assessment enables you to allocate resources efficiently, prioritize mitigation efforts, and prepare contingency plans that minimize negative outcomes. By understanding risk metrics and their potential effects on objectives, you enhance decision-making and increase the chances of seizing opportunities without exposing your organization to uncontrolled hazards.

The Role of Perception in Opportunity and Risk

Perception plays a pivotal role in differentiating opportunity from risk, as it influences how individuals interpret uncertain situations and potential outcomes. Cognitive biases and personal experiences shape whether a scenario is viewed as a chance for growth or a potential threat, impacting decision-making processes. Understanding these perceptual differences enables better risk management and the identification of genuine opportunities in business and investment contexts.

Strategies for Balancing Opportunity and Risk

Effective strategies for balancing opportunity and risk involve identifying potential gains while assessing the likelihood and impact of associated threats. By conducting thorough risk assessments and leveraging data-driven decision-making, you can optimize your investment or business growth. Employing diversification and contingency planning strengthens your ability to capitalize on opportunities without compromising stability.

Decision-Making Frameworks: Opportunity vs Risk

Decision-making frameworks balance opportunity and risk by evaluating potential benefits against possible losses to optimize outcomes. Risk assessment tools quantify uncertainties, while opportunity analysis identifies potential gains, enabling strategic choices that maximize value and minimize negative impacts. Integrating both elements ensures decisions align with organizational goals and risk tolerance, fostering resilient growth.

Real-World Examples: Successes and Failures

Companies like Tesla exemplify opportunity by capitalizing on electric vehicle innovation, demonstrating rapid market growth and environmental impact. Conversely, Kodak's failure to adapt to digital photography highlights risk mismanagement and lost market relevance. Amazon's continuous expansion into diverse sectors shows how embracing opportunities while managing risks leads to sustained success.

Tools for Evaluating Opportunity and Risk

Tools for evaluating opportunity and risk include SWOT analysis, risk matrices, and cost-benefit analysis, which help quantify potential rewards against possible dangers. You can leverage predictive analytics and decision trees to forecast outcomes and assess uncertainties in business ventures. Utilizing these frameworks ensures informed decision-making by balancing potential gains with inherent risks efficiently.

Cultivating a Mindset for Opportunity with Risk Awareness

Balancing opportunity with risk awareness requires cultivating a mindset that views challenges as catalysts for growth rather than obstacles. Your ability to identify potential risks while embracing opportunities enables informed decision-making that maximizes success and minimizes losses. Developing risk literacy alongside optimism empowers you to navigate uncertainty with confidence and strategic insight.

Infographic: Opportunity vs Risk

relatioo.com

relatioo.com