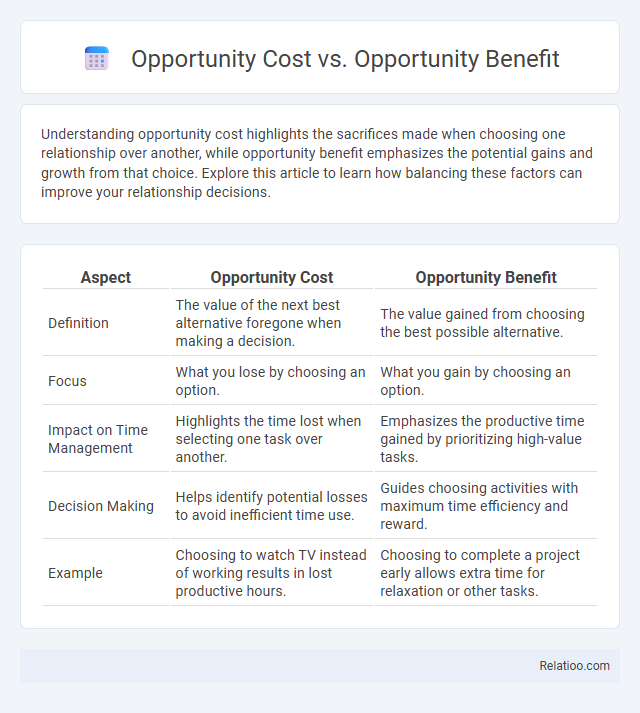

Understanding opportunity cost highlights the sacrifices made when choosing one relationship over another, while opportunity benefit emphasizes the potential gains and growth from that choice. Explore this article to learn how balancing these factors can improve your relationship decisions.

Table of Comparison

| Aspect | Opportunity Cost | Opportunity Benefit |

|---|---|---|

| Definition | The value of the next best alternative foregone when making a decision. | The value gained from choosing the best possible alternative. |

| Focus | What you lose by choosing an option. | What you gain by choosing an option. |

| Impact on Time Management | Highlights the time lost when selecting one task over another. | Emphasizes the productive time gained by prioritizing high-value tasks. |

| Decision Making | Helps identify potential losses to avoid inefficient time use. | Guides choosing activities with maximum time efficiency and reward. |

| Example | Choosing to watch TV instead of working results in lost productive hours. | Choosing to complete a project early allows extra time for relaxation or other tasks. |

Introduction to Opportunity Cost and Opportunity Benefit

Opportunity cost represents the value of the next best alternative you forgo when making a decision, highlighting what you sacrifice to pursue a particular option. Opportunity benefit, in contrast, refers to the positive gains or advantages you receive from choosing one option over others. Understanding both concepts allows your decisions to maximize returns by balancing what is given up against what is gained.

Defining Opportunity Cost

Opportunity cost represents the value of the next best alternative foregone when making a decision, highlighting the trade-offs involved in resource allocation. Unlike opportunity benefit, which emphasizes the positive gains from the chosen option, opportunity cost quantifies what is sacrificed to pursue that benefit. Understanding opportunity cost is crucial for efficient decision-making in economics, business strategy, and personal finance.

Understanding Opportunity Benefit

Opportunity benefit refers to the potential gains or advantages realized when choosing one option over alternatives, directly influencing decision-making effectiveness. Unlike opportunity cost, which emphasizes the lost value of the foregone option, opportunity benefit highlights the positive returns or strategic value gained from the selected choice. Understanding opportunity benefit enables individuals and businesses to maximize resource allocation by focusing on the most rewarding opportunities.

Key Differences Between Opportunity Cost and Opportunity Benefit

Opportunity cost represents the value of the next best alternative that you sacrifice when making a decision, while opportunity benefit is the gain or advantage you receive from the chosen option. The key difference lies in opportunity cost highlighting what you give up, whereas opportunity benefit emphasizes what you gain. Understanding these concepts helps you make informed decisions by weighing potential losses against potential gains effectively.

Real-Life Examples of Opportunity Cost

Opportunity cost represents the value of the next best alternative foregone when a decision is made, such as choosing to spend money on a vacation instead of investing in stocks. Opportunity benefit refers to the advantages gained from selecting a particular option, like acquiring valuable experiences from traveling. Real-life examples of opportunity cost include a student opting to work part-time, sacrificing study hours that could improve exam scores or future job prospects.

Real-Life Examples of Opportunity Benefit

Opportunity cost represents the value of the next best alternative forgone when making a decision, while opportunity benefit refers to the gains or advantages obtained by choosing a particular option. Real-life examples of opportunity benefit include investing in education, where the acquired skills lead to higher earnings potential, or choosing a job with less pay but better work-life balance, resulting in improved mental health and personal fulfillment. These tangible benefits highlight how decisions shape outcomes beyond mere financial comparisons.

The Role of Opportunity Cost in Decision-Making

Opportunity cost represents the value of the next best alternative forgone when making a decision, serving as a critical metric in evaluating trade-offs. Opportunity benefit highlights the potential gain or advantage obtained from selecting a particular choice over others. Understanding opportunity cost enables individuals and businesses to optimize resource allocation by comparing the benefits of different options to make informed, efficient decisions.

The Importance of Opportunity Benefit in Strategic Planning

Opportunity cost measures the potential loss from choosing one alternative over another, while opportunity benefit highlights the gains achieved by selecting the best available option. Recognizing opportunity benefit in strategic planning drives decision-making that maximizes resource allocation and competitive advantage. Emphasizing opportunity benefit enables organizations to focus on value creation and long-term growth rather than merely avoiding losses.

How to Balance Opportunity Cost and Opportunity Benefit

Balancing opportunity cost and opportunity benefit requires carefully evaluating the potential gains against the sacrifices involved in any decision. Your goal is to maximize opportunity benefit by choosing options that offer the highest value while minimizing opportunity cost, which represents what you forgo. Applying techniques such as cost-benefit analysis and prioritizing decisions based on long-term impact helps achieve an optimal balance between these competing factors.

Conclusion: Maximizing Value Through Smart Choices

Opportunity cost highlights the potential value lost when one option is chosen over another, while opportunity benefit emphasizes the gains derived from the selected alternative. Understanding both concepts allows individuals and businesses to make informed decisions that optimize resource allocation and increase overall returns. Maximizing value through smart choices requires balancing opportunity cost and opportunity benefit to achieve the best possible outcome.

Infographic: Opportunity Cost vs Opportunity Benefit

relatioo.com

relatioo.com