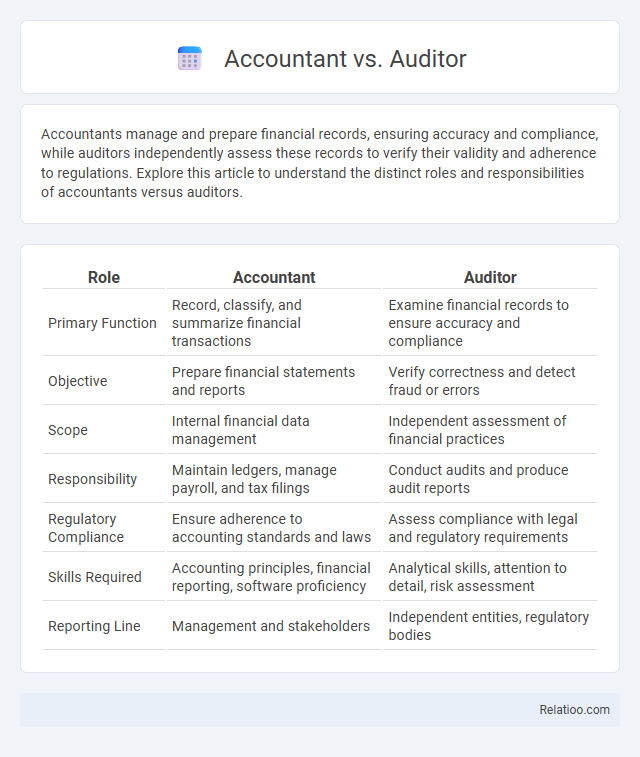

Accountants manage and prepare financial records, ensuring accuracy and compliance, while auditors independently assess these records to verify their validity and adherence to regulations. Explore this article to understand the distinct roles and responsibilities of accountants versus auditors.

Table of Comparison

| Role | Accountant | Auditor |

|---|---|---|

| Primary Function | Record, classify, and summarize financial transactions | Examine financial records to ensure accuracy and compliance |

| Objective | Prepare financial statements and reports | Verify correctness and detect fraud or errors |

| Scope | Internal financial data management | Independent assessment of financial practices |

| Responsibility | Maintain ledgers, manage payroll, and tax filings | Conduct audits and produce audit reports |

| Regulatory Compliance | Ensure adherence to accounting standards and laws | Assess compliance with legal and regulatory requirements |

| Skills Required | Accounting principles, financial reporting, software proficiency | Analytical skills, attention to detail, risk assessment |

| Reporting Line | Management and stakeholders | Independent entities, regulatory bodies |

Overview: Accountant vs Auditor

Accountants manage and record your financial transactions, ensuring accuracy in bookkeeping, tax filings, and financial reporting, while auditors independently examine these records to verify their compliance and integrity. The key difference lies in their roles: accountants prepare and organize financial data, whereas auditors evaluate and validate that data for accuracy and adherence to regulations. Understanding this distinction helps you optimize financial management and enhance transparency in your business operations.

Key Roles and Responsibilities

Accountants manage financial records, prepare statements, and ensure compliance with accounting standards, focusing on accurate financial reporting and tax obligations. Auditors evaluate financial statements and internal controls, verifying accuracy and detecting fraud to enhance financial transparency and integrity. Duties of both roles include adherence to regulatory requirements, but accountants primarily handle day-to-day financial tasks while auditors conduct independent assessments for assurance purposes.

Core Skills and Qualifications

Accountants possess strong analytical skills, proficiency in accounting software, and expertise in financial reporting, often holding certifications like CPA or CMA. Auditors require deep knowledge of auditing standards, risk assessment, and internal controls, typically certified as Certified Internal Auditors (CIA) or Chartered Accountants (CA). Your choice between these roles depends on your skills in detail-oriented financial analysis for accountants or systematic evaluation and compliance verification for auditors, with duties tailored accordingly.

Educational Pathways

Accountants typically pursue a degree in accounting or finance, often earning certifications such as CPA (Certified Public Accountant) to enhance career prospects. Auditors generally follow a similar educational pathway but may specialize in auditing through additional training or certifications like the CIA (Certified Internal Auditor). Understanding the duty scope requires knowledge of regulatory standards and ethical practices, often covered in professional courses and ongoing education tailored to each role.

Daily Job Tasks

Accountants primarily manage financial records, prepare balance sheets, and ensure compliance with tax regulations, focusing on accurate data entry and financial reporting. Auditors examine these financial statements to verify accuracy and adherence to laws, conduct internal controls testing, and assess risk management strategies. Duty-related tasks vary by role but generally include maintaining ethical standards, following regulatory guidelines, and ensuring transparent financial practices within organizations.

Compliance and Ethical Standards

Accountants ensure accurate financial record-keeping and adherence to regulatory frameworks, while auditors independently verify these records to maintain transparency and trust. Both roles are critical in enforcing compliance with accounting principles, tax laws, and organizational policies. Upholding ethical standards and professional integrity is essential for preventing fraud, ensuring accountability, and fostering stakeholder confidence.

Career Opportunities and Advancement

Accountants manage financial records, preparing reports that ensure compliance and inform business decisions, while auditors independently verify these records to detect errors or fraud, offering a critical review function. Career opportunities for accountants often lead to roles like financial analyst, controller, or CFO, with certifications such as CPA boosting advancement potential. Auditors can progress into senior audit roles, internal audit leadership, or risk management, with qualifications like CIA enhancing their career trajectory; understanding your duty in either role is essential for ethical practice and professional growth.

Tools and Technologies Used

Accountants primarily use advanced accounting software like QuickBooks, Sage, and Microsoft Excel for data entry, financial reporting, and tax preparation, ensuring accuracy and compliance. Auditors rely heavily on data analytics tools such as ACL, IDEA, and SAP GRC to conduct risk assessments, test controls, and verify financial records with precision. Your ability to leverage these specialized technologies is crucial in enhancing efficiency and maintaining transparency across financial and auditing processes.

Salary and Job Outlook

Accountants typically earn a median salary of $73,000 annually, with steady job growth projected at 7% through 2031, reflecting ongoing demand for financial record keeping and tax preparation. Auditors command a slightly higher median salary around $75,000 due to specialized skills in verifying financial statements and compliance, with job outlook growth also near 7%. Your choice between these professions should consider salary potential and job stability, while understanding that auditors often face stricter regulatory duties and accountability compared to accountants.

Choosing the Right Path: Which is Best for You?

Accountants manage financial records, ensuring accuracy in bookkeeping, tax preparation, and compliance with accounting standards, making it ideal for those detail-oriented in daily financial operations. Auditors independently evaluate financial statements and internal controls to verify integrity and regulatory compliance, suited for individuals focused on critical analysis and risk assessment. Choosing between accountant, auditor, or duty roles depends on your skills and interests in financial reporting, regulatory adherence, and organizational oversight.

Infographic: Accountant vs Auditor

relatioo.com

relatioo.com