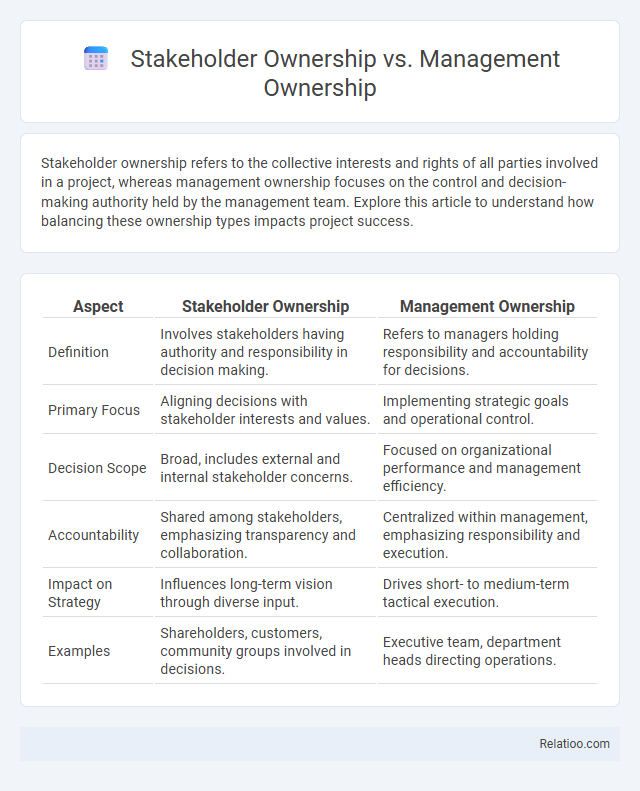

Stakeholder ownership refers to the collective interests and rights of all parties involved in a project, whereas management ownership focuses on the control and decision-making authority held by the management team. Explore this article to understand how balancing these ownership types impacts project success.

Table of Comparison

| Aspect | Stakeholder Ownership | Management Ownership |

|---|---|---|

| Definition | Involves stakeholders having authority and responsibility in decision making. | Refers to managers holding responsibility and accountability for decisions. |

| Primary Focus | Aligning decisions with stakeholder interests and values. | Implementing strategic goals and operational control. |

| Decision Scope | Broad, includes external and internal stakeholder concerns. | Focused on organizational performance and management efficiency. |

| Accountability | Shared among stakeholders, emphasizing transparency and collaboration. | Centralized within management, emphasizing responsibility and execution. |

| Impact on Strategy | Influences long-term vision through diverse input. | Drives short- to medium-term tactical execution. |

| Examples | Shareholders, customers, community groups involved in decisions. | Executive team, department heads directing operations. |

Introduction to Stakeholder Ownership vs Management Ownership

Stakeholder ownership refers to the interests and influence of all parties affected by a company's decisions, including customers, employees, suppliers, and the community, while management ownership specifically denotes the shares and control held by the company's executives and managers. Understanding the distinction between stakeholder ownership and management ownership is crucial for aligning business goals with the needs of various parties and ensuring balanced decision-making. Your company's strategic success depends on effectively managing these ownership dynamics to foster long-term value and sustainability.

Defining Stakeholder Ownership

Stakeholder ownership refers to the interest and influence that various parties have in a company's success, encompassing employees, customers, suppliers, and the community, beyond just shareholders. Unlike management ownership, which specifically denotes equity held by a company's executives, stakeholder ownership emphasizes a broader responsibility and impact on decision-making and company outcomes. Understanding your role as a stakeholder highlights how your interests align with sustainable growth and corporate governance, ensuring diverse perspectives contribute to the organization's long-term value.

Understanding Management Ownership

Management ownership refers to the shares held by a company's executives and key managers, aligning their interests with shareholders through direct financial stakes. You benefit when management ownership is significant, as it often indicates executives are motivated to enhance company performance and shareholder value. Understanding the distinctions between stakeholder ownership, where various parties hold interests, and management ownership helps clarify decision-making dynamics and corporate governance structures.

Key Differences Between Stakeholder and Management Ownership

Stakeholder ownership refers to the broader group of individuals or entities invested in a company's success, including shareholders, employees, customers, and suppliers, while management ownership specifically involves equity held by executives and managers who are directly involved in day-to-day operations. The key difference lies in influence and control: management ownership grants decision-making power and operational control that align management's interests with company performance, whereas stakeholder ownership represents a more diverse set of interests with varying degrees of influence. Understanding this distinction is crucial for corporate governance, as management ownership incentivizes leadership accountability, whereas stakeholder ownership emphasizes broader accountability to all parties affected by business outcomes.

Advantages of Stakeholder Ownership

Stakeholder ownership enhances organizational accountability by involving diverse interests such as employees, customers, suppliers, and community members, leading to more balanced and inclusive decision-making. This inclusive approach fosters long-term sustainability, as stakeholders are motivated to support the company's success beyond short-term financial gains typical in management or sole ownership structures. Furthermore, stakeholder ownership encourages transparency and collaboration, reducing conflicts and promoting shared value creation across all parties involved.

Benefits of Management Ownership

Management ownership aligns executives' incentives with company performance, driving stronger commitment and strategic decision-making that benefits long-term growth. It enhances accountability and fosters a culture of responsibility, as managers directly share in the financial success of the organization. This ownership model often results in increased innovation and operational efficiency, leading to higher shareholder value compared to stakeholder or passive ownership structures.

Challenges and Risks of Each Ownership Model

Stakeholder ownership presents challenges in aligning diverse interests, often leading to conflicts and slow decision-making processes that can hinder your company's agility. Management ownership risks include potential conflicts of interest and a focus on short-term gains, which may compromise long-term sustainability and stakeholder trust. Ownership concentrated in a single entity or group increases risks of reduced accountability and potential misuse of power, threatening organizational transparency and stability.

Impact on Corporate Governance

Stakeholder ownership emphasizes the influence of diverse groups such as employees, customers, and communities on corporate governance, promoting broader accountability and ethical decision-making. Management ownership aligns managerial interests with shareholders by giving executives equity stakes, which can enhance performance but may also lead to conflicts of interest if not properly monitored. Ownership concentration impacts governance structures by determining control dynamics, with dispersed ownership fostering more external oversight and concentrated ownership enabling quicker decision-making but posing risks of minority shareholder marginalization.

Influence on Company Performance and Decision-Making

Stakeholder ownership involves a broad group including employees, customers, and community members, whose influence drives decisions that prioritize long-term sustainability and social responsibility, often enhancing company reputation and stability. Management ownership aligns executives' interests with company success, fostering proactive decision-making and agility, positively impacting performance through motivated leadership and risk-taking. Pure ownership, typically by external shareholders, emphasizes financial returns and governance control, influencing decisions toward maximizing short-term profitability, which may sometimes conflict with broader stakeholder goals.

Choosing the Right Ownership Structure for Your Organization

Choosing the right ownership structure for your organization involves understanding the distinctions between stakeholder ownership, management ownership, and general ownership. Stakeholder ownership distributes equity among a broad group including employees, customers, and partners, fostering collective investment and long-term commitment. Management ownership centralizes control within executives and managers, aligning decision-making authority closely with day-to-day operations for agility and strategic focus.

Infographic: Stakeholder Ownership vs Management Ownership

relatioo.com

relatioo.com