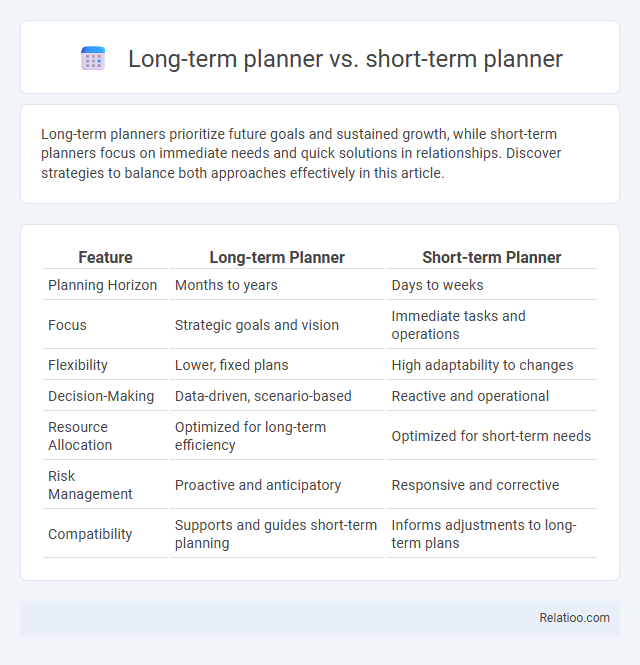

Long-term planners prioritize future goals and sustained growth, while short-term planners focus on immediate needs and quick solutions in relationships. Discover strategies to balance both approaches effectively in this article.

Table of Comparison

| Feature | Long-term Planner | Short-term Planner |

|---|---|---|

| Planning Horizon | Months to years | Days to weeks |

| Focus | Strategic goals and vision | Immediate tasks and operations |

| Flexibility | Lower, fixed plans | High adaptability to changes |

| Decision-Making | Data-driven, scenario-based | Reactive and operational |

| Resource Allocation | Optimized for long-term efficiency | Optimized for short-term needs |

| Risk Management | Proactive and anticipatory | Responsive and corrective |

| Compatibility | Supports and guides short-term planning | Informs adjustments to long-term plans |

Understanding Long-term vs Short-term Planning

Long-term planning emphasizes setting financial goals and creating strategies for sustained wealth growth over years or decades, while short-term planning focuses on managing immediate expenses and achieving objectives within weeks or months. Financial habits, such as regular saving and budgeting, support both planning types by promoting consistent progress and disciplined money management. Balancing long-term vision with short-term actions ensures overall financial stability and adaptability.

Key Differences Between Long-term and Short-term Planners

Long-term planners prioritize setting and achieving financial goals over several years, emphasizing investments, retirement savings, and wealth growth. Short-term planners focus on immediate expenses, budgeting, and managing cash flow within weeks or months, ensuring daily financial stability. Your financial habit development depends on balancing both approaches, integrating long-term visions with short-term actions for sustainable success.

Advantages of Long-term Planning

Long-term planning enables sustained financial growth by setting clear goals and strategies for wealth accumulation over years or decades, which short-term planning often overlooks due to its focus on immediate needs. This approach leverages compound interest, investment diversification, and risk management to maximize returns and secure financial stability. Developing strong financial habits supports long-term planning by fostering discipline and consistency in savings and investments, ensuring that short-term fluctuations do not derail overall financial objectives.

Benefits of Short-term Planning

Short-term planning offers immediate clarity and actionable steps that help you achieve specific financial goals quickly, such as managing monthly expenses or saving for a small purchase. Unlike long-term planners, short-term plans provide flexibility to adjust for unexpected changes, ensuring your financial habits remain disciplined and responsive. Developing strong short-term financial habits builds a foundation of control and confidence, empowering you to maintain steady progress toward larger objectives.

Challenges Faced by Long-term Planners

Long-term planners often face challenges such as uncertainty in economic conditions and difficulty maintaining motivation over extended periods, which can hinder your ability to consistently meet financial goals. Unlike short-term planners who benefit from immediate feedback and quicker results, long-term planners must navigate fluctuating markets and changing personal circumstances that require ongoing adjustments. Relying solely on financial habits without flexibility may limit success, emphasizing the need for strategic adaptability in long-term financial planning.

Common Issues with Short-term Planners

Short-term planners often struggle with inconsistent budgeting and an inability to foresee financial challenges, leading to frequent cash flow problems and unplanned expenses. Unlike long-term planners who set sustainable savings goals and investment strategies, short-term planners may rely heavily on immediate income without building a financial safety net. Developing strong financial habits, such as regular tracking of expenses and disciplined saving, bridges the gap between short-term impulses and long-term financial stability.

When to Use a Long-term Planner

Use a long-term planner when setting major financial goals such as retirement savings, mortgage payoff, or funding education, as it helps map out extended timelines and investment strategies. Short-term planners are better suited for managing monthly budgets, emergency funds, or short-duration expenses, providing immediate financial control. Developing strong financial habits, like regular saving and expense tracking, supports both long-term and short-term planning by ensuring consistent progress and disciplined money management.

When to Choose a Short-term Planner

Choosing a short-term planner is ideal when you need to manage immediate financial goals such as budgeting for upcoming expenses, tracking daily spending, or saving for a specific purchase within months. Unlike long-term planners that focus on retirement or major investments over years, a short-term planner offers flexibility and detailed monitoring to keep Your finances aligned with quick-changing priorities. Developing strong financial habits complements this approach by reinforcing discipline and ensuring consistent progress toward short-term objectives.

Integrating Both Planning Approaches

Integrating long-term planning and short-term planning with disciplined financial habits creates a robust strategy for achieving financial goals. Your long-term planner sets overarching objectives like retirement savings and wealth accumulation, while your short-term planner manages immediate expenses and monthly budgeting to maintain cash flow. Cultivating consistent financial habits ensures both planners work synergistically, enhancing your ability to adapt to changes and optimize resource allocation.

Choosing the Right Planner for Your Goals

Long-term planners prioritize setting and achieving financial milestones over several years, such as retirement savings or buying a home, while short-term planners focus on immediate objectives like monthly budgeting or emergency funds. Financial habits are the daily actions and routines that support both planning approaches, ensuring consistent progress toward your goals. Choosing the right planner depends on aligning your timeline and objectives with strategies that cultivate sustainable habits for lasting financial success.

Infographic: Long-term planner vs Short-term planner

relatioo.com

relatioo.com