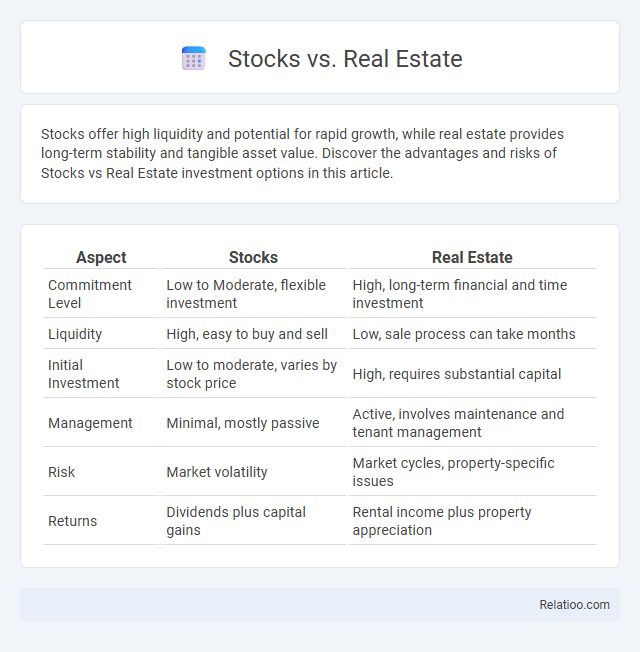

Stocks offer high liquidity and potential for rapid growth, while real estate provides long-term stability and tangible asset value. Discover the advantages and risks of Stocks vs Real Estate investment options in this article.

Table of Comparison

| Aspect | Stocks | Real Estate |

|---|---|---|

| Commitment Level | Low to Moderate, flexible investment | High, long-term financial and time investment |

| Liquidity | High, easy to buy and sell | Low, sale process can take months |

| Initial Investment | Low to moderate, varies by stock price | High, requires substantial capital |

| Management | Minimal, mostly passive | Active, involves maintenance and tenant management |

| Risk | Market volatility | Market cycles, property-specific issues |

| Returns | Dividends plus capital gains | Rental income plus property appreciation |

Introduction to Stocks and Real Estate

Stocks represent ownership in a company and offer liquidity, potential dividends, and market-driven capital gains. Real estate involves purchasing physical properties that can generate rental income and appreciate over time, often providing tax advantages and portfolio diversification. Both investment types carry unique risks and rewards, making them essential components for a balanced investment strategy.

Historical Performance Comparison

Stocks have historically delivered average annual returns of approximately 7-10%, outperforming many other asset classes over the long term. Real estate investments typically yield annual returns around 8-12% when considering property appreciation and rental income, with lower volatility compared to stocks. Diversifying between stocks, real estate, and other investments allows investors to balance growth potential and risk, as historical data shows each asset class responds differently to economic cycles.

Risk and Volatility Analysis

Stocks typically exhibit higher volatility due to market fluctuations and economic sensitivity, leading to greater short-term risk but potential for substantial returns. Real estate investments generally offer lower volatility with more stable cash flow from rental income and appreciation tied to physical assets, though they face liquidity risks and regional market dependencies. Diversifying across stocks, real estate, and other investment vehicles balances risk by leveraging the low correlation between asset classes, enhancing portfolio stability and long-term growth potential.

Liquidity Differences

Stocks offer high liquidity, allowing you to quickly buy or sell shares on the market within seconds, making them ideal for short-term financial needs. Real estate investments have much lower liquidity due to the time required for property sales, often taking weeks or months, which can limit accessibility to your capital. Understanding these liquidity differences is crucial for balancing your portfolio and ensuring your investments align with your cash flow requirements.

Passive vs Active Management

Stocks often provide more passive investment opportunities through index funds and ETFs, requiring minimal active management and offering liquidity and diversification. Real estate typically demands active management, including property maintenance and tenant relations, though passive options exist via REITs. Your choice depends on whether you prefer hands-on control or a more hands-off, passive approach to grow your investment portfolio.

Income Generation Potential

Stocks offer high liquidity and potential for significant dividend income, making them attractive for generating passive cash flow through regular payouts. Real estate provides stable rental income and long-term appreciation, with opportunities for leveraging property to increase your overall income streams. Balancing investments in stocks and real estate can diversify your portfolio and optimize your income generation potential.

Tax Implications and Benefits

Stocks offer favorable tax treatment with long-term capital gains rates typically lower than ordinary income tax rates, allowing you to minimize taxes on profits if held over a year. Real estate provides unique tax benefits including depreciation deductions, mortgage interest deductions, and the potential for 1031 exchanges that defer capital gains taxes. Diversifying your investment portfolio among stocks, real estate, and other assets can optimize tax efficiency and maximize after-tax returns.

Capital Requirements and Accessibility

Stocks typically require lower capital investment and offer high liquidity, allowing you to buy and sell shares with relative ease on various platforms. Real estate demands substantial upfront capital for down payments, closing costs, and maintenance, often restricting accessibility to those with significant funds or credit. Investment vehicles vary in accessibility and capital needs, with mutual funds or ETFs providing entry points that balance affordability and diversification for individual investors.

Diversification Strategies

Diversification strategies in stocks, real estate, and other investments mitigate risk by spreading assets across different sectors and markets to avoid overexposure to any single asset class. Stocks offer liquidity and growth potential, while real estate provides stable cash flow and long-term appreciation, balancing volatility in a portfolio. Combining diverse investments enhances risk-adjusted returns and protects against market fluctuations.

Which Investment Fits Your Goals?

Choosing between stocks, real estate, and other investments depends on your financial goals, risk tolerance, and time horizon. Stocks offer liquidity and potential for high returns but come with market volatility, while real estate provides tangible assets and steady income through rental yields but requires larger capital and maintenance. Understanding how each investment aligns with your long-term objectives helps you build a diversified portfolio tailored to your financial aspirations.

Infographic: Stocks vs Real Estate

relatioo.com

relatioo.com